Hostess SPAC Presentation Deck

PAGE

12

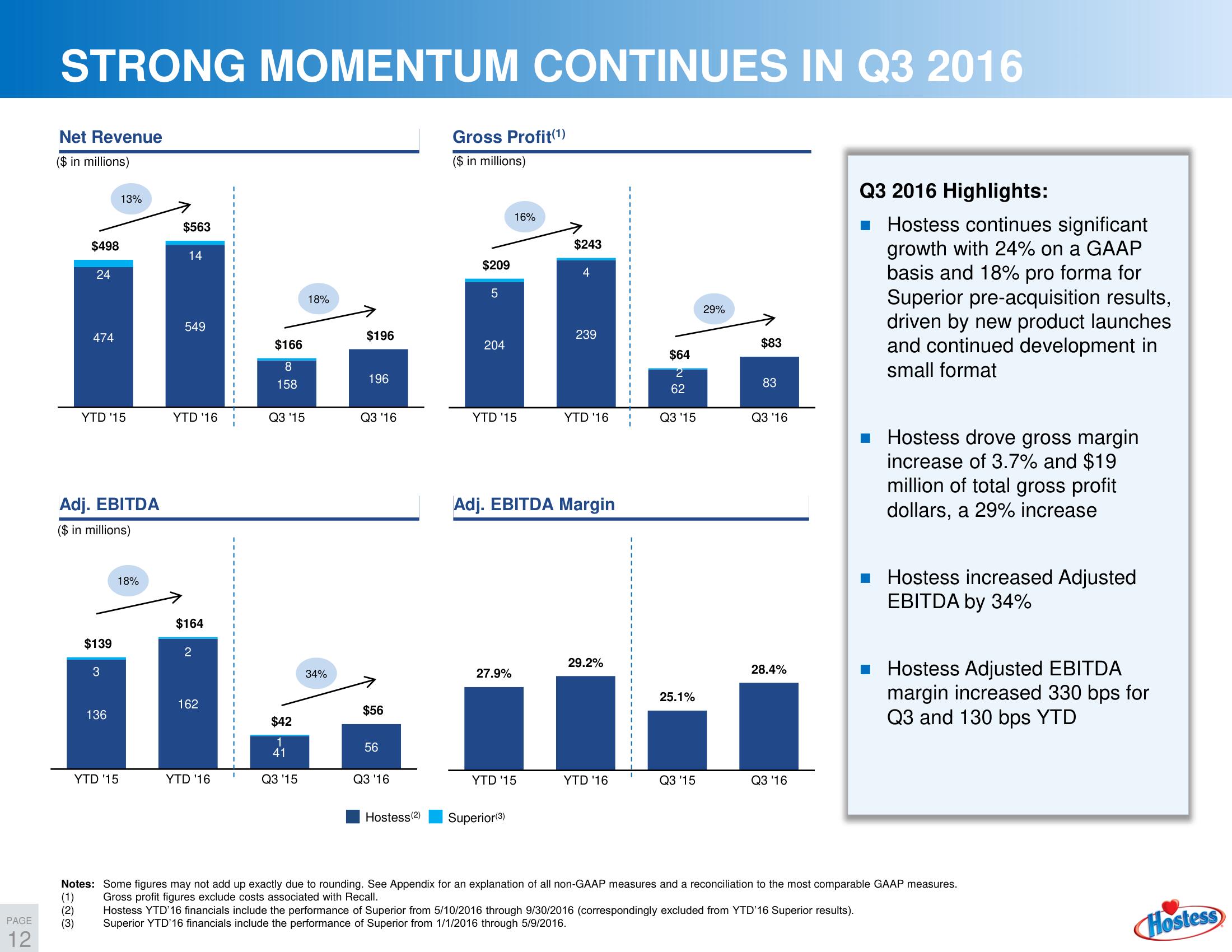

STRONG MOMENTUM CONTINUES IN Q3 2016

Net Revenue

($ in millions)

$498

24

474

YTD '15

Adj. EBITDA

($ in millions)

$139

3

13%

136

18%

YTD '15

$563

14

549

YTD '16

$164

2

162

YTD '16

I

$166

8

158

Q3 '15

$42

1

41

Q3 '15

18%

34%

$196

196

Q3 '16

$56

56

Q3 '16

Hostess (2)

Gross Profit(1)

($ in millions)

$209

5

204

YTD '15

16%

27.9%

YTD '15

Superior (3)

$243

4

Adj. EBITDA Margin

239

YTD '16

29.2%

YTD '16

$64

2

62

Q3 '15

25.1%

Q3 '15

29%

$83

83

Q3 '16

28.4%

Q3 '16

Q3 2016 Highlights:

Hostess continues significant

growth with 24% on a GAAP

basis and 18% pro forma for

Superior pre-acquisition results,

driven by new product launches

and continued development in

small format

Hostess drove gross margin

increase of 3.7% and $19

million of total gross profit

dollars, a 29% increase

Hostess increased Adjusted

EBITDA by 34%

Hostess Adjusted EBITDA

margin increased 330 bps for

Q3 and 130 bps YTD

Notes: Some figures may not add up exactly due to rounding. See Appendix for an explanation of all non-GAAP measures and a reconciliation to the most comparable GAAP measures.

(1) Gross profit figures exclude costs associated with Recall.

(2)

Hostess YTD'16 financials include the performance of Superior from 5/10/2016 through 9/30/2016 (correspondingly excluded from YTD'16 Superior results).

Superior YTD 16 financials include the performance of Superior from 1/1/2016 through 5/9/2016.

(3)

HostessView entire presentation