Baird Investment Banking Pitch Book

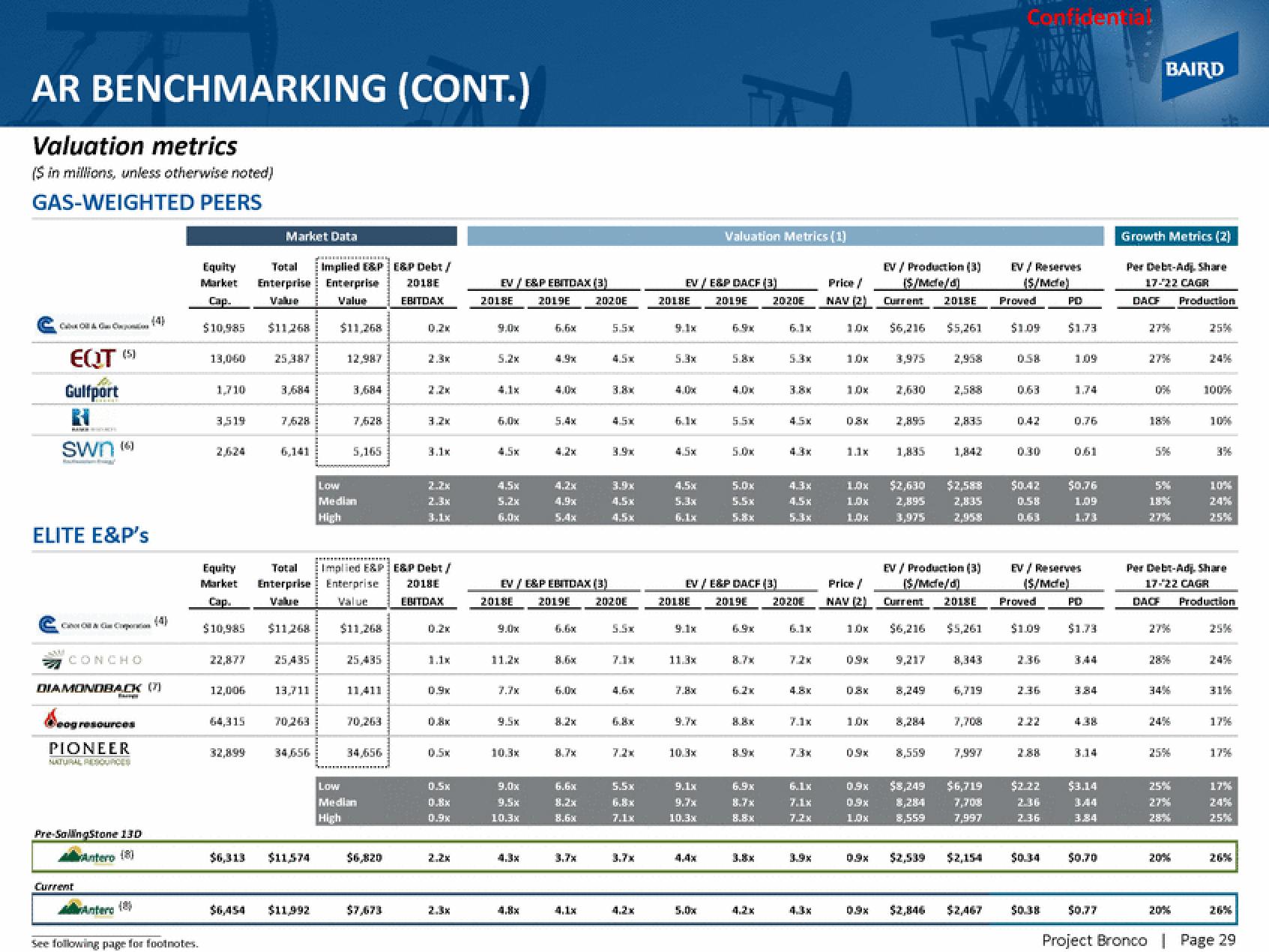

AR BENCHMARKING (CONT.)

Valuation metrics

($ in millions, unless otherwise noted)

GAS-WEIGHTED PEERS

EQT (5)

Gulfport

swn (6)

ELITE E&P's

& Co

CONCHO

Current

DIAMONDBACK (7)

Beogresources

PIONEER

NATURAL RESOURCES

Pre-SallingStone 130

Antero (8)

Bay

Antero

(4)

(4)

See following page for footnotes.

Equity

Market

Cap.

$10,985

13,060

1,710

3,519

Equity

Market

Cap.

$10,985

22,877

12,006

64,315

32,899

Market Data

Total

Enterprise

Value

$11,268

25,387

3,684

7,628

$11,268

25,435

13.711

70,263

34,656

$6,313 $11,574

Anny

Implied E&P E&P Debt /

2018E

EBITDAX

$6,454 $11,992

Enterprise

Value

$11,268

12,987

Total Implied E&P E&P Debt /

Enterprise : Enterprise

2018E

Value

Value

EBITDAX

3,684

5,165

Low

Median

High

$11,268

25,435

11,411

70,263

34,656

Low

Median

High

$6,820

3.2x

$7,673

3.1x

2.2x

1.1x

0.9x

0.5x

0.5x

0.8x

0.9x

EV/E&P EBITDAX (3)

2018E 2019E 2020E

4.1x

6.0x

4.5x

4.5x

5.2x

2018E

9.0x

11.2x

3.7x

10.3x

6.6x

EV / E&P EBITDAX (3)

2019E

9.0x

9.5x

10.3x

49x

4,0x

5.4x

4.2x

4.2x

4.9x

5.4x

6.6x

8.6x

6.0x

8.2x

6.6x

8.2x

8.6x

3.7x

4.1x

5.5x

4.5x

4.5x

3.9x

3.9x

4.5x

4.5x

2020E

5.5x

7.1x

6.8x

7.2x

5.5x

6.8x

7.1x

3.7x

EV/E&P DACF (3)

2019E

2018E

9.1x

4,0x

6.1x

4.5x

4.5x

6.1x

2018E

9.1x

11.3x

7.8x

9.7x

Valuation Metrics (1)

10.3x

9.1x

9.7x

10.3x

6.9x

EV / E&P DACF (3)

2019E

5.8x

4.0x

5.5x

5.0x

5.0x

5.5x

6.9x

6.2x

8.8x

6.9x

8.7x

8.8x

2020E

4,2x

6.1x

4.5x

4.3x

4.5x

5.3x

2020E

7.2x

7.1x

7.3x

6.1x

7.1x

7.2x

3.9x

4.3x

Price /

NAV (2)

1.0x

10x

10x

0.8x

1.1x

Price /

NAV (2)

1.0x

08x

09x

EV / Production (3)

(S/Mcle/d

Current

0.9x

$6,216

09x

3,975

2,895

1,835

1.0x $2,630 $2,588

10x

1.0x

2,895 2,835

3,975

09x 9,217

0.9x $8,249

0.9%

10x

2018E

8,559

$5,261

2,958

EV / Production (3)

(S/Mcle/d)

8,284

8,559

2.588

Current 2018E

$2,846

2,83.5

$6,216 $5,261

1,842

6,719

7,997

$6,719

7,997

Confidential

$2,467

EV/ Reserves

(S/Mcfe)

Proved

$1.09

0.63

0.30

Proved

$0.42 $0.76

0.58

1.09

0.63

$1.09

EV/ Reserves

(S/Mce)

2.36

2.36

$2.22

2.36

$2,154 $0.34

PD

$1.73

50.38

1.74

PD

$1.73

3.84

$3.14

3.84

$0.70

$0.77

BAIRD

Growth Metrics (2)

Per Debt-Adj. Share

17-22 CAGR

DACF Production

27%

0%

5%

18%

27%

34%

Per Debt-Adj. Share

17-22 CAGR

DACH Production

25%

27%

28%

20%

100%

20%

3%

10%

24%

25%

25%

24%

31%

17%

17%

17%

24%

25%

26%

Project Bronco | Page 29View entire presentation