Bakkt SPAC Presentation Deck

Transaction Summary

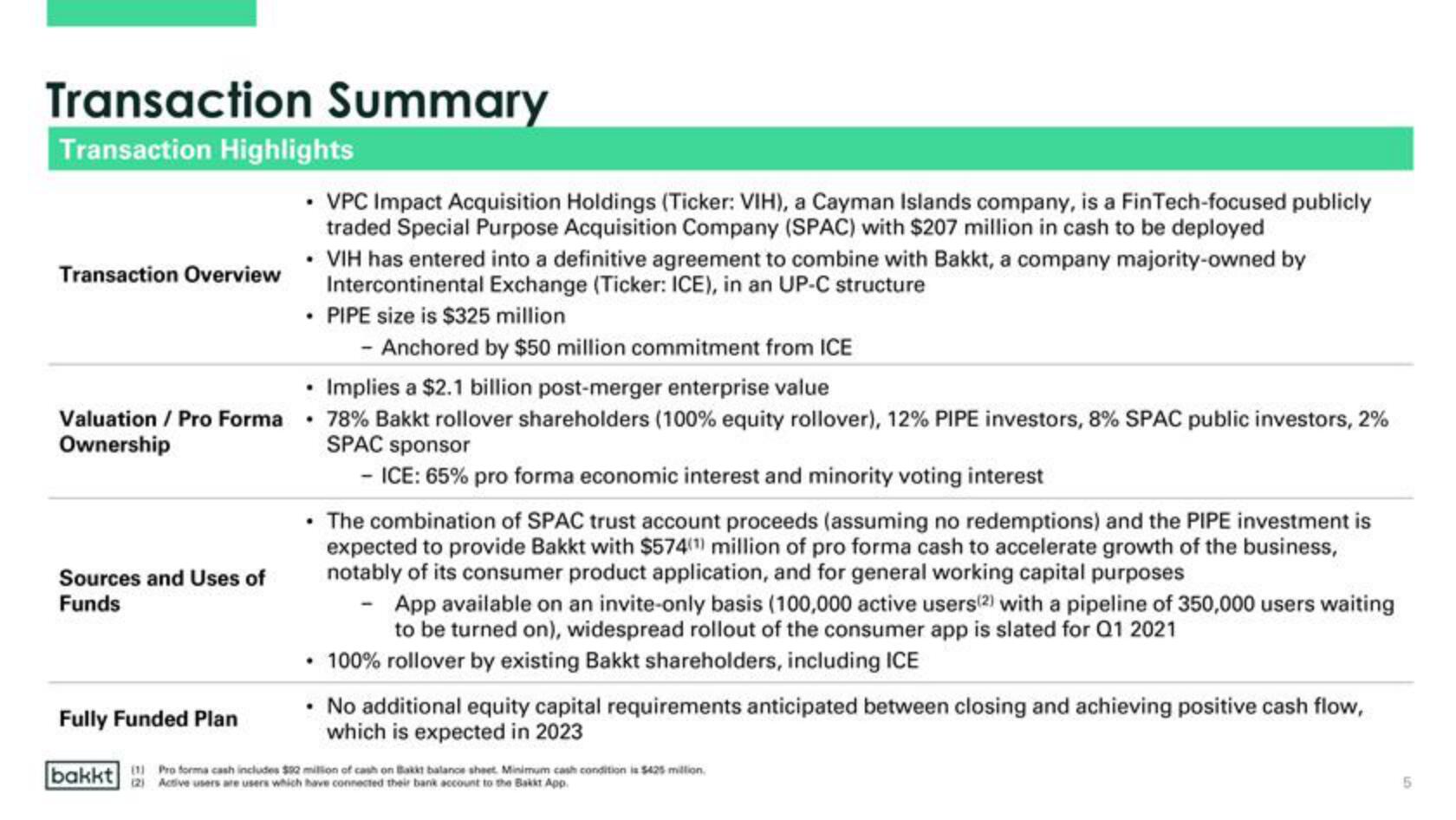

Transaction Highlights

Transaction Overview

Valuation / Pro Forma

Ownership

Sources and Uses of

Funds

Fully Funded Plan

bakkt

• VPC Impact Acquisition Holdings (Ticker: VIH), a Cayman Islands company, is a FinTech-focused publicly

traded Special Purpose Acquisition Company (SPAC) with $207 million in cash to be deployed

• VIH has entered into a definitive agreement to combine with Bakkt, a company majority-owned by

Intercontinental Exchange (Ticker: ICE), in an UP-C structure

• PIPE size is $325 million

.

- Anchored by $50 million commitment from ICE

Implies a $2.1 billion post-merger enterprise value

• 78% Bakkt rollover shareholders (100% equity rollover), 12% PIPE investors, 8% SPAC public investors, 2%

SPAC sponsor

- ICE: 65% pro forma economic interest and minority voting interest

The combination of SPAC trust account proceeds (assuming no redemptions) and the PIPE investment is

expected to provide Bakkt with $57401) million of pro forma cash to accelerate growth of the business,

notably of its consumer product application, and for general working capital purposes

App available on an invite-only basis (100,000 active users(2) with a pipeline of 350,000 users waiting

to be turned on), widespread rollout of the consumer app is slated for Q1 2021

• 100% rollover by existing Bakkt shareholders, including ICE

• No additional equity capital requirements anticipated between closing and achieving positive cash flow,

which is expected in 2023

(1) Pro forma cash includes $02 million of cash on Bakkt balance sheet. Minimum cash condition is $425 million.

(2) Active users are users which have connected their bank account to the Bakkt App.View entire presentation