Ocado Investor Day Presentation Deck

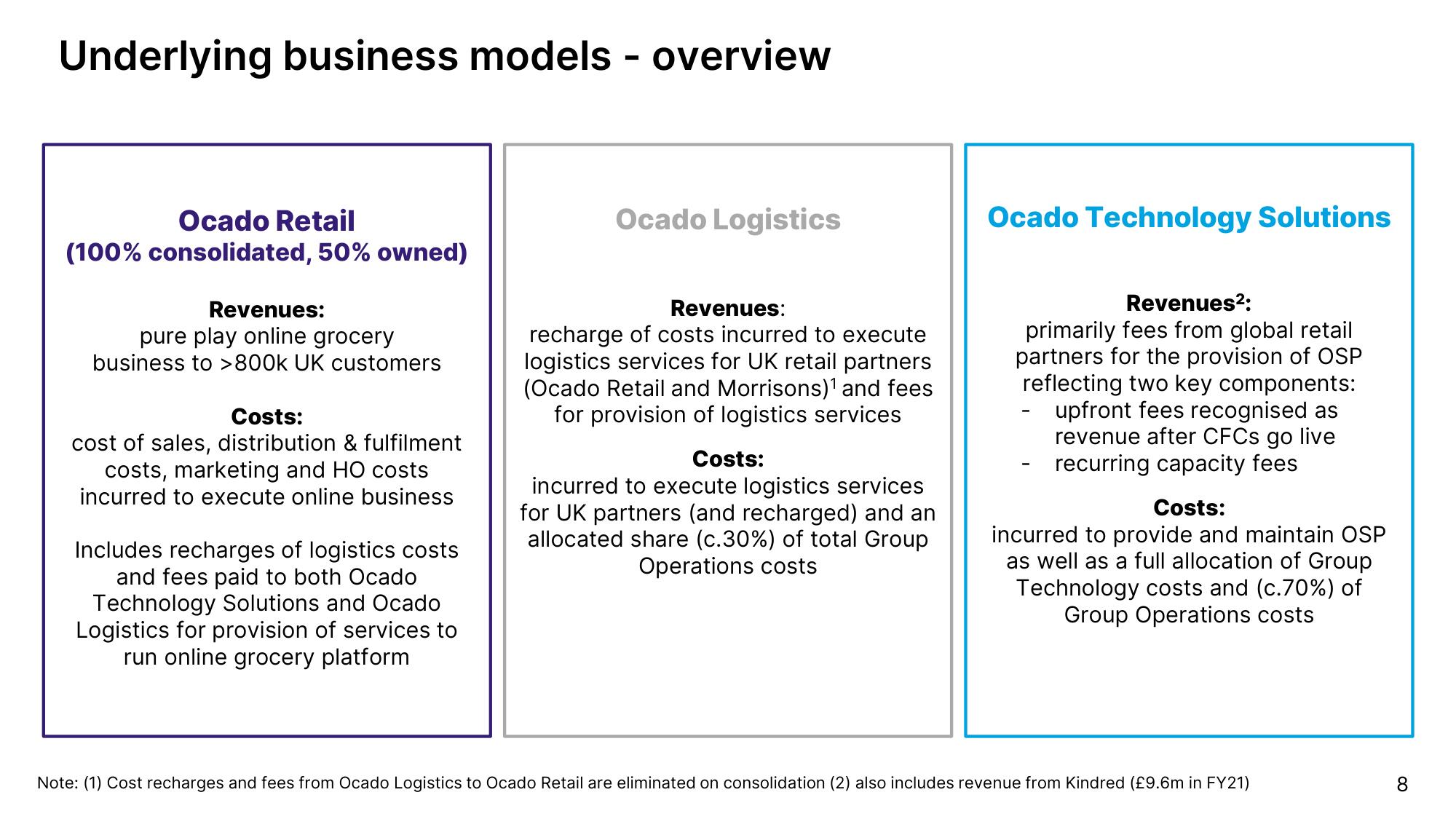

Underlying business models - overview

Ocado Retail

(100% consolidated, 50% owned)

Revenues:

pure play online grocery

business to >800k UK customers

Costs:

cost of sales, distribution & fulfilment

costs, marketing and HO costs

incurred to execute online business

Includes recharges of logistics costs

and fees paid to both Ocado

Technology Solutions and Ocado

Logistics for provision of services to

run online grocery platform

Ocado Logistics

Revenues:

rech ge of costs incurred to execute

logistics services for UK retail partners

(Ocado Retail and Morrisons)¹ and fees

for provision of logistics services

Costs:

incurred to execute logistics services

for UK partners (and recharged) and an

allocated share (c.30%) of total Group

Operations costs

Ocado Technology Solutions

Revenues²:

primarily fees from global retail

partners for the provision of OSP

reflecting two key components:

upfront fees recognised as

revenue after CFCs go live

recurring capacity fees

Costs:

incurred to provide and maintain OSP

as well as a full allocation of Group

Technology costs and (c.70%) of

Group Operations costs

Note: (1) Cost recharges and fees from Ocado Logistics to Ocado Retail are eliminated on consolidation (2) also includes revenue from Kindred (£9.6m in FY21)

8View entire presentation