FY 2023 Second Quarter Earnings Call

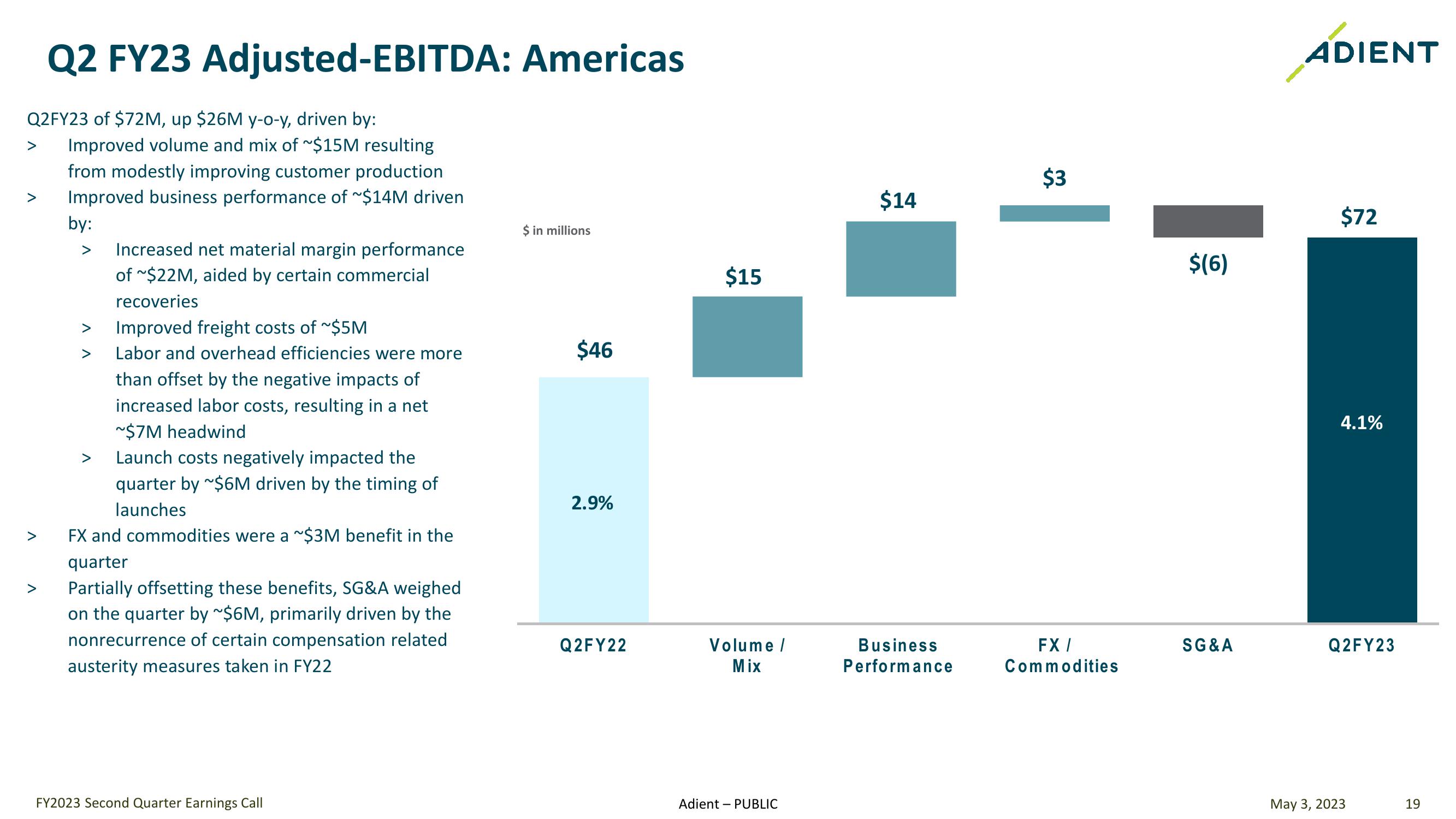

Q2 FY23 Adjusted-EBITDA: Americas

Q2FY23 of $72M, up $26M y-o-y, driven by:

>

>

Improved volume and mix of ~$15M resulting

from modestly improving customer production

Improved business performance of ~$14M driven

by:

>

Increased net material margin performance

of ~$22M, aided by certain commercial

recoveries

Improved freight costs of ~$5M

$ in millions

>

>

>

>

Labor and overhead efficiencies were more

$46

than offset by the negative impacts of

increased labor costs, resulting in a net

~$7M headwind

>

Launch costs negatively impacted the

quarter by ~$6M driven by the timing of

launches

2.9%

FX and commodities were a ~$3M benefit in the

quarter

Partially offsetting these benefits, SG&A weighed

on the quarter by ~$6M, primarily driven by the

nonrecurrence of certain compensation related

austerity measures taken in FY22

FY2023 Second Quarter Earnings Call

$15

$14

$3

ADIENT

$(6)

$72

4.1%

Q2FY22

Volume /

Mix

Business

Performance

FX/

Commodities

SG&A

Q2FY23

Adient - PUBLIC

May 3, 2023

19View entire presentation