Axalta Coating Systems (axta) First Quarter 2021 Financial Results

tailwinds. First quarter Adjusted EBIT excludes the impact of the $94 million operating charges

associated with the Mobility Coatings operational matter.

Q1 Performance Coatings Results

($ in millions)

Refinish

Industrial

Net Sales

Adjusted EBIT

% margin

$648

Q1 2020

Financial Performance

6.2%

2021

2020

368

280

648

79

12.3%

Net Sales Variance

Volume

Sensitivity: Business Internal

Q1

399

308

707

117

16.6%

(1.2)%

Price/Mix

%

Incl. F/X

8.5 %

10.1%

9.2 %

47.6%

4.2%

FX

Excl. F/X

3.7 %

6.7 %

5.0 %

9.2%

$707

Q1 2021

Commentary

Stronger net sales driven by both Refinish and

Industrial volume improvement

■

.

▪

4

YOY volume growth driven by continued Industrial

strength across most global markets, recovery in

Refinish notably in China versus prior year pandemic

effects, partly tempered by U.S. severe weather supply

chain impacts and ongoing pandemic restrictions

Modest price-mix headwinds in select Industrial

businesses and mix in Refinish

FX tailwinds driven by the Euro and Chinese Renminbi,

partly offset by Brazilian Real

Improved Adjusted EBIT and margins

Continued cost productivity benefits and volume

recovery drove impressive 430 bps Adjusted EBIT

margin improvement with solid contribution from both

end-markets

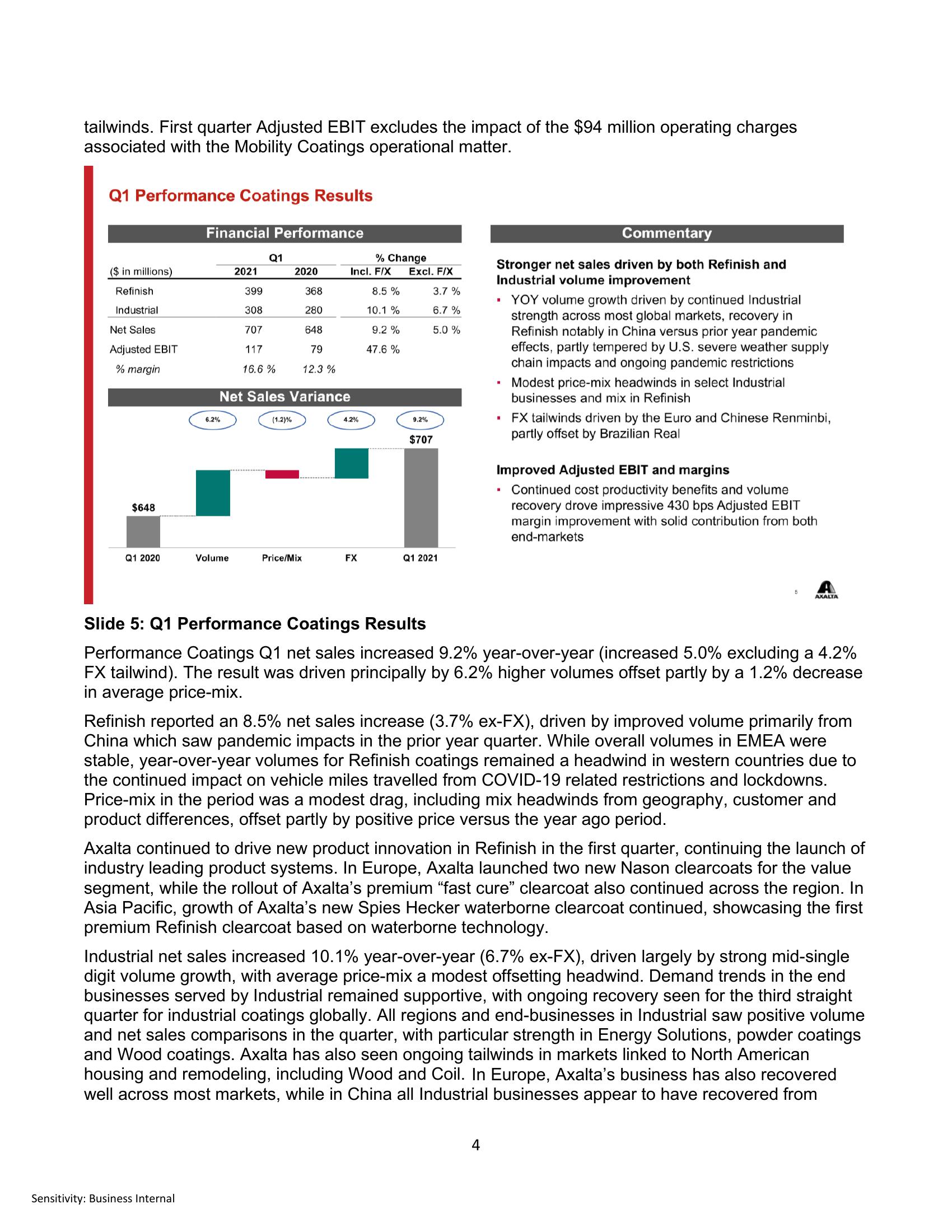

Slide 5: Q1 Performance Coatings Results

Performance Coatings Q1 net sales increased 9.2% year-over-year (increased 5.0% excluding a 4.2%

FX tailwind). The result was driven principally by 6.2% higher volumes offset partly by a 1.2% decrease

in average price-mix.

AXALTA

Refinish reported an 8.5% net sales increase (3.7% ex-FX), driven by improved volume primarily from

China which saw pandemic impacts in the prior year quarter. While overall volumes in EMEA were

stable, year-over-year volumes for Refinish coatings remained a headwind in western countries due to

the continued impact on vehicle miles travelled from COVID-19 related restrictions and lockdowns.

Price-mix in the period was a modest drag, including mix headwinds from geography, customer and

product differences, offset partly by positive price versus the year ago period.

Axalta continued to drive new product innovation in Refinish in the first quarter, continuing the launch of

industry leading product systems. In Europe, Axalta launched two new Nason clearcoats for the value

segment, while the rollout of Axalta's premium "fast cure" clearcoat also continued across the region. In

Asia Pacific, growth of Axalta's new Spies Hecker waterborne clearcoat continued, showcasing the first

premium Refinish clearcoat based on waterborne technology.

Industrial net sales increased 10.1% year-over-year (6.7% ex-FX), driven largely by strong mid-single

digit volume growth, with average price-mix a modest offsetting headwind. Demand trends in the end

businesses served by Industrial remained supportive, with ongoing recovery seen for the third straight

quarter for industrial coatings globally. All regions and end-businesses in Industrial saw positive volume

and net sales comparisons in the quarter, with particular strength in Energy Solutions, powder coatings

and Wood coatings. Axalta has also seen ongoing tailwinds in markets linked to North American

housing and remodeling, including Wood and Coil. In Europe, Axalta's business has also recovered

well across most markets, while in China all Industrial businesses appear to have recovered fromView entire presentation