Accelerating Value Creation for Shareholders

Proposal for integration with UFJ Group

Outline

Basic Concepts of the Integration

Integration with spirit of

equals

Smooth and speedy

integration

Emphasis on economic

rationales

Equal and fair

human resources policy

Reinforcement of

the focused

business areas

Establishment of tripolar

franchise in Tokyo, Tokai,

Osaka metropolitan districts

Collaboration with a top

tier trust bank*

Integration ratio, Capital enhancement

■Integration ratio UFJ SMFG = 1 share 1 share

¥200bn average annual pre-tax benefit from rationalization

■Capital enhancement to UFJ by 04/9

- Willing to provide capital even if capital requirement reaches ¥700bn

Able to maintain adequate capital ratio without capital raising

Assuming that the trust business of UFJ Trust Bank be integrated to Sumitomo Trust & Banking

SMFG

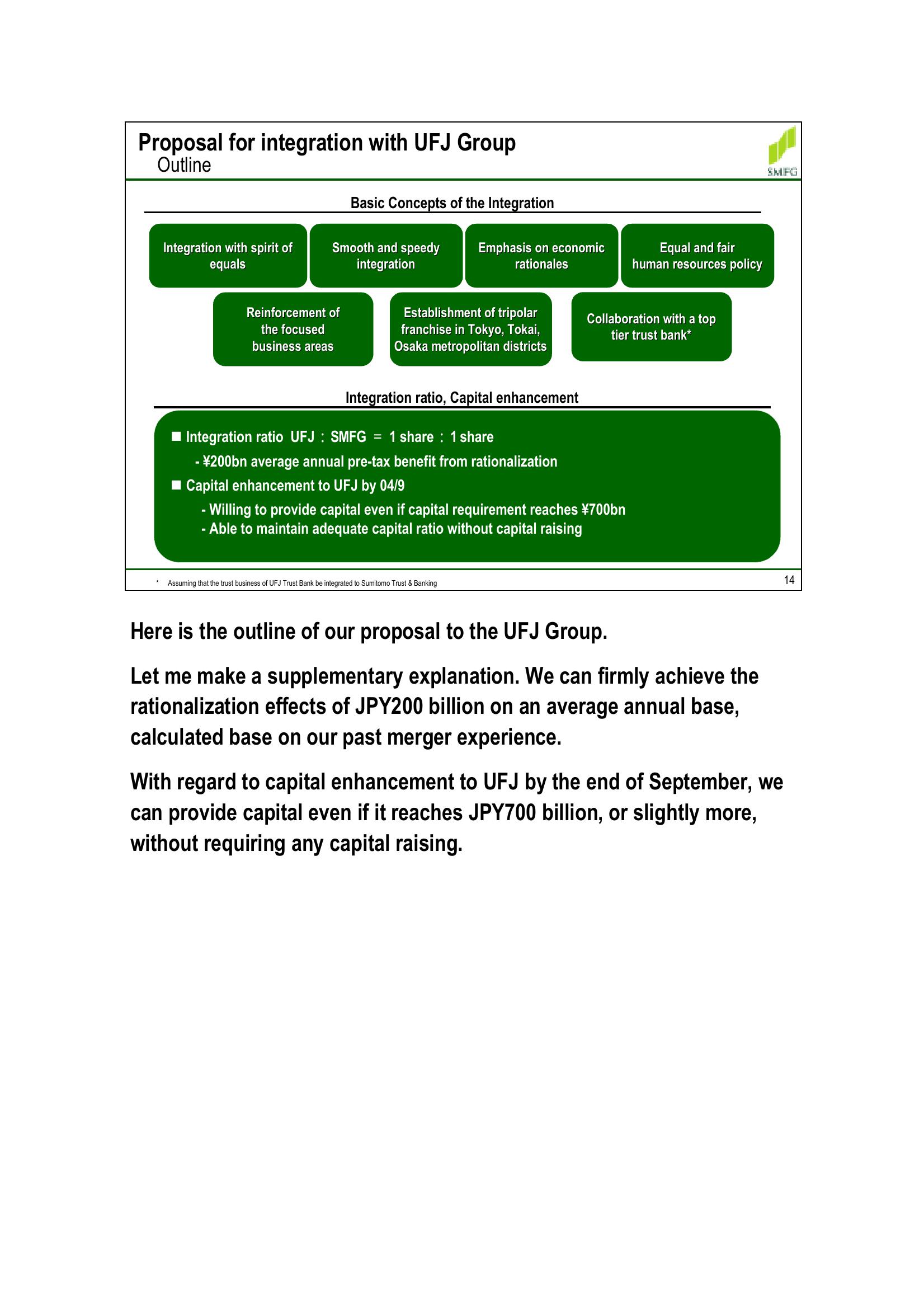

Here is the outline of our proposal to the UFJ Group.

Let me make a supplementary explanation. We can firmly achieve the

rationalization effects of JPY200 billion on an average annual base,

calculated base on our past merger experience.

With regard to capital enhancement to UFJ by the end of September, we

can provide capital even if it reaches JPY700 billion, or slightly more,

without requiring any capital raising.

14View entire presentation