Crocs Results Presentation Deck

cr

CS

cr

OCS

CI

OC

APPENDIX

NON-GAAP RECONCILIATION (CONT'D)

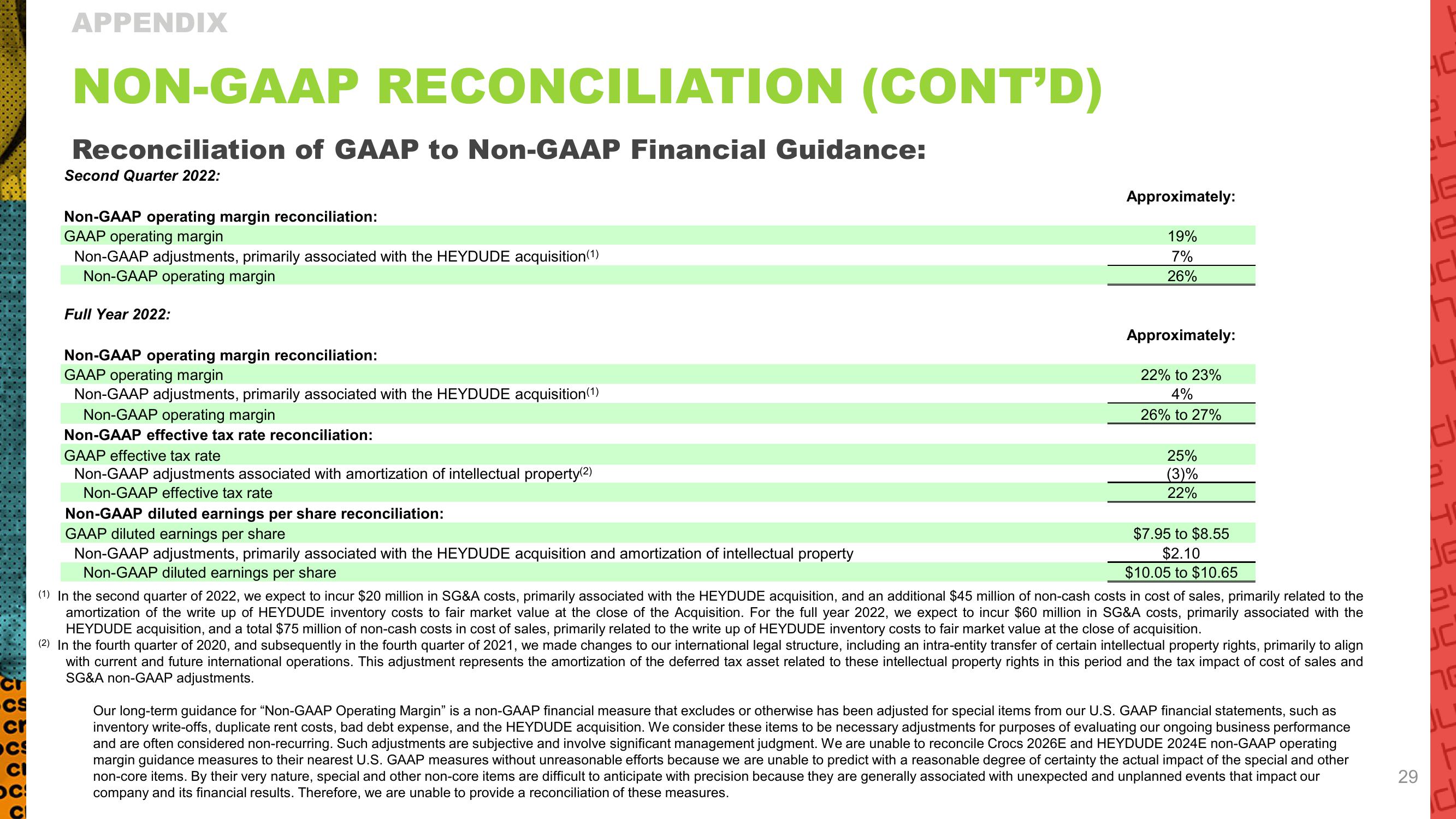

Reconciliation of GAAP to Non-GAAP Financial Guidance:

Second Quarter 2022:

Non-GAAP operating margin reconciliation:

GAAP operating margin

Non-GAAP adjustments, primarily associated with the HEYDUDE acquisition (1)

Non-GAAP operating margin

Full Year 2022:

Non-GAAP operating margin reconciliation:

GAAP operating margin

Non-GAAP adjustments, primarily associated with the HEYDUDE acquisition (1)

Non-GAAP operating margin

Non-GAAP effective tax rate reconciliation:

GAAP effective tax rate

Non-GAAP adjustments associated with amortization of intellectual property(2)

Non-GAAP effective tax rate

Non-GAAP diluted earnings per share reconciliation:

GAAP diluted earnings per share

Non-GAAP adjustments, primarily associated with the HEYDUDE acquisition and amortization of intellectual property

Non-GAAP diluted earnings per share

Approximately:

19%

7%

26%

Approximately:

22% to 23%

4%

26% to 27%

25%

(3)%

22%

$7.95 to $8.55

$2.10

$10.05 to $10.65

(1) In the second quarter of 2022, we expect to incur $20 million in SG&A costs, primarily associated with the HEYDUDE acquisition, and an additional $45 million of non-cash costs in cost of sales, primarily related to the

amortization of the write up of HEYDUDE inventory costs to fair market value at the close of the Acquisition. For the full year 2022, we expect to incur $60 million in SG&A costs, primarily associated with the

HEYDUDE acquisition, and a total $75 million of non-cash costs in cost of sales, primarily related to the write up of HEYDUDE inventory costs to fair market value at the close of acquisition.

(2) In the fourth quarter of 2020, and subsequently in the fourth quarter of 2021, we made changes to our international legal structure, including an intra-entity transfer of certain intellectual property rights, primarily to align

with current and future international operations. This adjustment represents the amortization of the deferred tax asset related to these intellectual property rights in this period and the tax impact of cost of sales and

SG&A non-GAAP adjustments.

Our long-term guidance for "Non-GAAP Operating Margin" is a non-GAAP financial measure that excludes or otherwise has been adjusted for special items from our U.S. GAAP financial statements, such as

inventory write-offs, duplicate rent costs, bad debt expense, and the HEYDUDE acquisition. We consider these items to be necessary adjustments for purposes of evaluating our ongoing business performance

and are often considered non-recurring. Such adjustments are subjective and involve significant management judgment. We are unable to reconcile Crocs 2026E and HEYDUDE 2024E non-GAAP operating

margin guidance measures to their nearest U.S. GAAP measures without unreasonable efforts because we are unable to predict with a reasonable degree of certainty the actual impact of the special and other

non-core items. By their very nature, special and other non-core items are difficult to anticipate with precision because they are generally associated with unexpected and unplanned events that impact our

company and its financial results. Therefore, we are unable to provide a reconciliation of these measures.

29

AC

5

E

12

d

40

JE

24

JC

76View entire presentation