First Busey Results Presentation Deck

4Q23 Earnings Investor Presentation

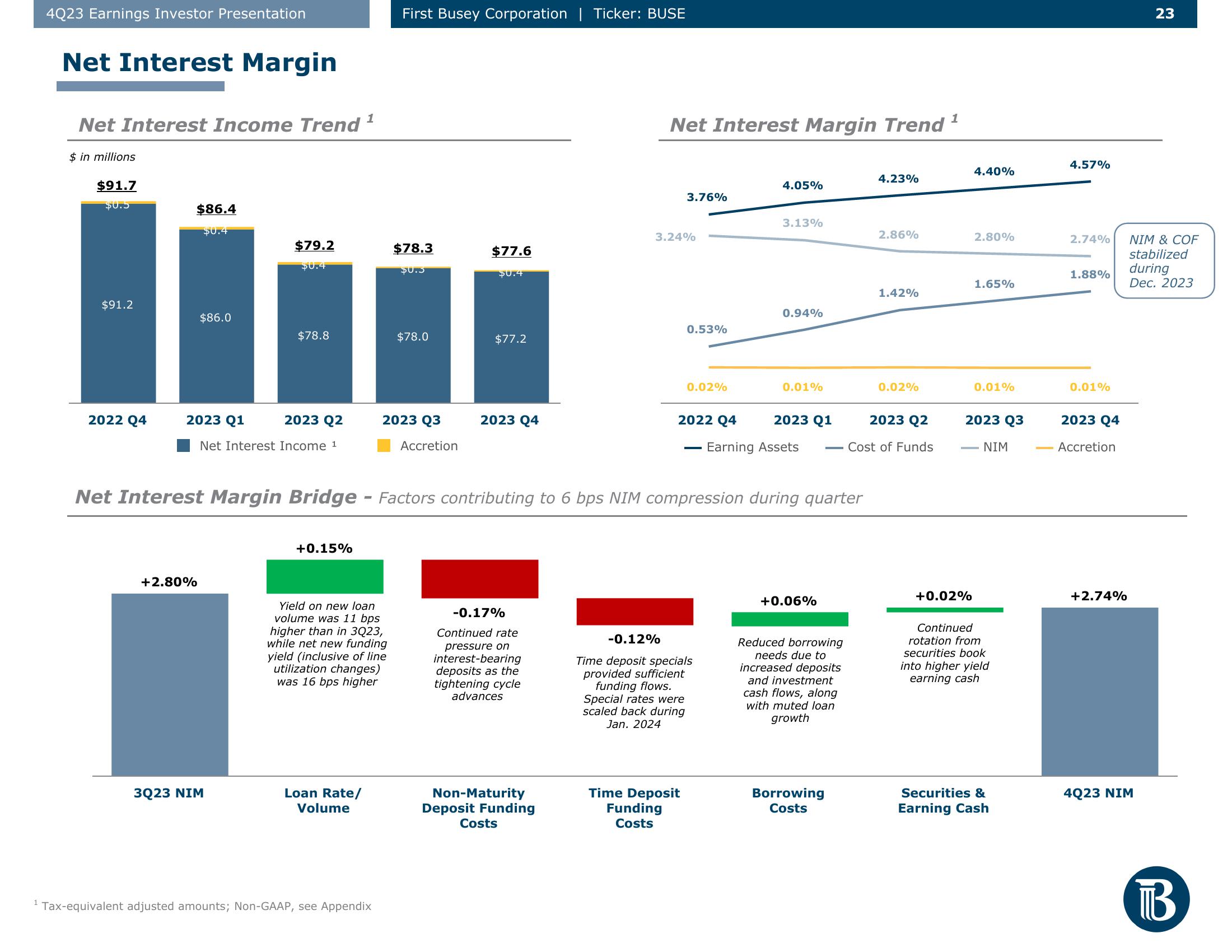

Net Interest Margin

Net Interest Income Trend ¹

$ in millions

$91.7

$0.5

$91.2

2022 Q4

$86.4

$0.4

$86.0

2023 Q1

+2.80%

$79.2

$0.4

2023 Q2

Net Interest Income 1

$78.8

3Q23 NIM

+0.15%

Yield on new loan

volume was 11 bps

higher than in 3Q23,

while net new funding

yield (inclusive of line

utilization changes)

was 16 bps higher

Loan Rate/

Volume

First Busey Corporation | Ticker: BUSE

Tax-equivalent adjusted amounts; Non-GAAP, see Appendix

$78.3

$0.3

$78.0

2023 Q3

Accretion

$77.6

$0.4

$77.2

2023 Q4

-0.17%

Continued rate

pressure on

interest-bearing

deposits as the

tightening cycle

advances

Non-Maturity

Deposit Funding

Costs

Net Interest Margin Trend

3.76%

3.24%

Net Interest Margin Bridge - Factors contributing to 6 bps NIM compression during quarter

0.53%

0.02%

Time Deposit

Funding

Costs

4.05%

-0.12%

Time deposit specials

provided sufficient

funding flows.

Special rates were

scaled back during

Jan. 2024

3.13%

0.94%

2022 Q4 2023 Q1

Earning Assets

0.01%

+0.06%

Reduced borrowing

needs due to

increased deposits

and investment

cash flows, along

with muted loan

growth

Borrowing

Costs

4.23%

2.86%

1.42%

0.02%

2023 Q2

Cost of Funds

1

4.40%

+0.02%

2.80%

1.65%

0.01%

2023 Q3

NIM

Continued

rotation from

securities book

into higher yield

earning cash

Securities &

Earning Cash

4.57%

2.74%

1.88%

0.01%

2023 Q4

Accretion

+2.74%

23

NIM & COF

stabilized

during

Dec. 2023

4Q23 NIM

BView entire presentation