Bank of America Investment Banking Pitch Book

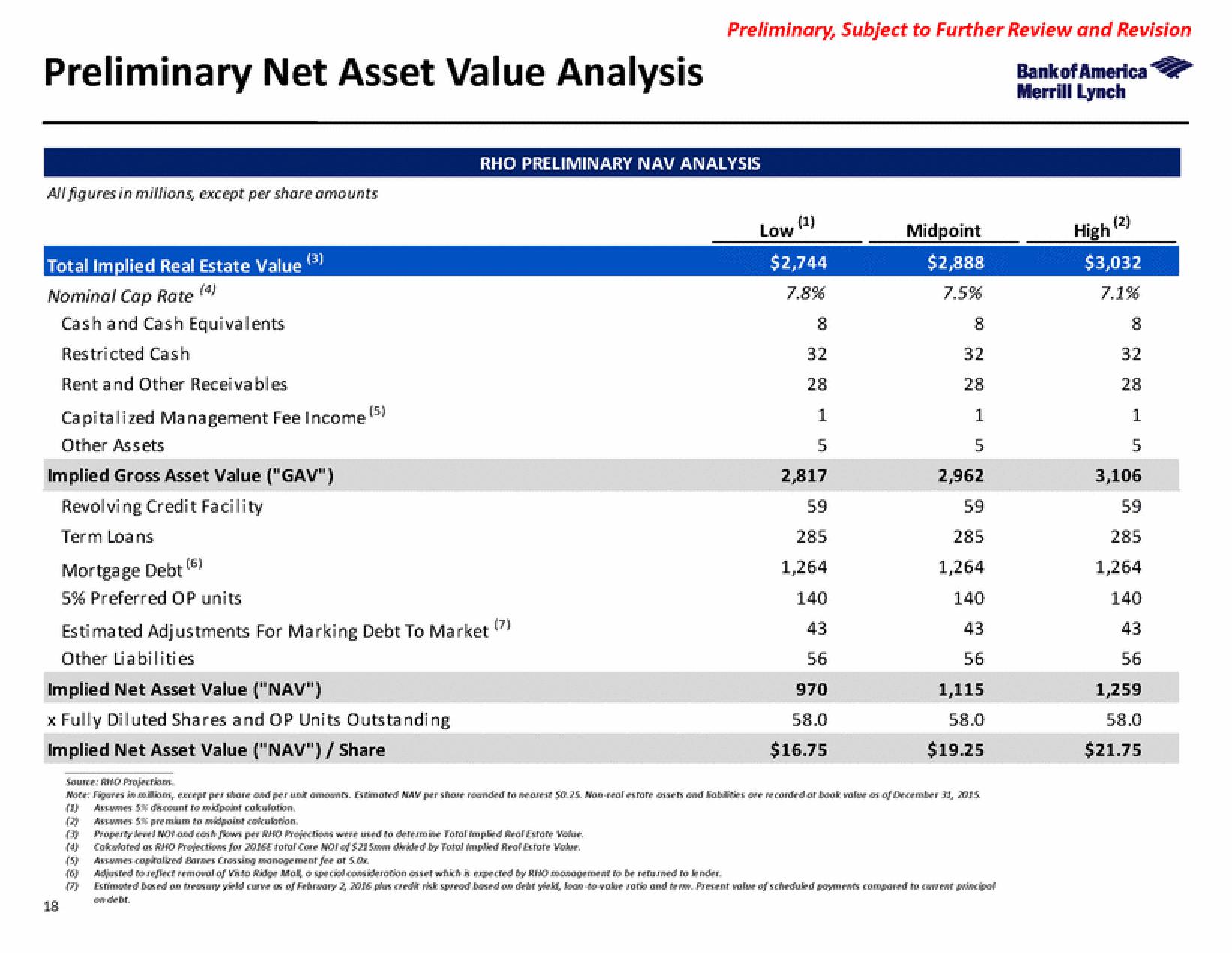

Preliminary Net Asset Value Analysis

All figures in millions, except per share amounts

Total Implied Real Estate Value

Nominal Cap Rate

Cash and Cash Equivalents

Restricted Cash

Rent and Other Receivables

Capitalized Management Fee Income (5)

Other Assets

Implied Gross Asset Value ("GAV")

Revolving Credit Facility

Term Loans

18

(6)

Mortgage Debt

5% Preferred OP units

Estimated Adjustments For Marking Debt To Market

Other Liabilities.

Implied Net Asset Value ("NAV")

x Fully Diluted Shares and OP Units Outstanding

Implied Net Asset Value ("NAV") / Share

(5)

(6)

(7)

RHO PRELIMINARY NAV ANALYSIS

Preliminary, Subject to Further Review and Revision

Bank of America

Merrill Lynch

(7)

(1)

Low

$2,744

7.8%

8

32

28

1

5

2,817

59

285

1,264

140

43

56

970

58.0

$16.75

Midpoint

$2,888

7.5%

8

32

28

1

5

2,962

59

285

1,264

140

43

56

1,115

58.0

$19.25

Source: RIO Projections

Note: Figures in million, except per share and per unit amounts. Estimated NAV per shore rounded to nearest 50.25. Non-real estate ossets and liabilities are recorded of book value os of December 31, 2015

Assumes 5% discount to midpoint calculation.

(2) Assumes 5% premium to midpoint calculation.

(3)

Property level NOT and cash flows per RHO Projections were used to determine Total implied Real Estate Volur.

Calculated as RHO Projections for 2016E total Care NOT of $215mm divided by Total Implied Real Estate Volur.

Assumes capitalized Barnes Crossing management fee of 5.0x

Adjusted to reflect removal of Visto Ridge Mallo special consideration asset which is expected by Rito management to be returned to lender.

Estimated based on treasury yield curve as of February 2, 2016 plas credit risk spread based on debt yield, lean-to-value ratio and tem. Present value of scheduled payments compared to corrent principal

on debt.

High

(2)

$3,032

7.1%

8

32

28

1

5

3,106

59

285

1,264

140

43

56

1,259

58.0

$21.75View entire presentation