flyExclusive SPAC

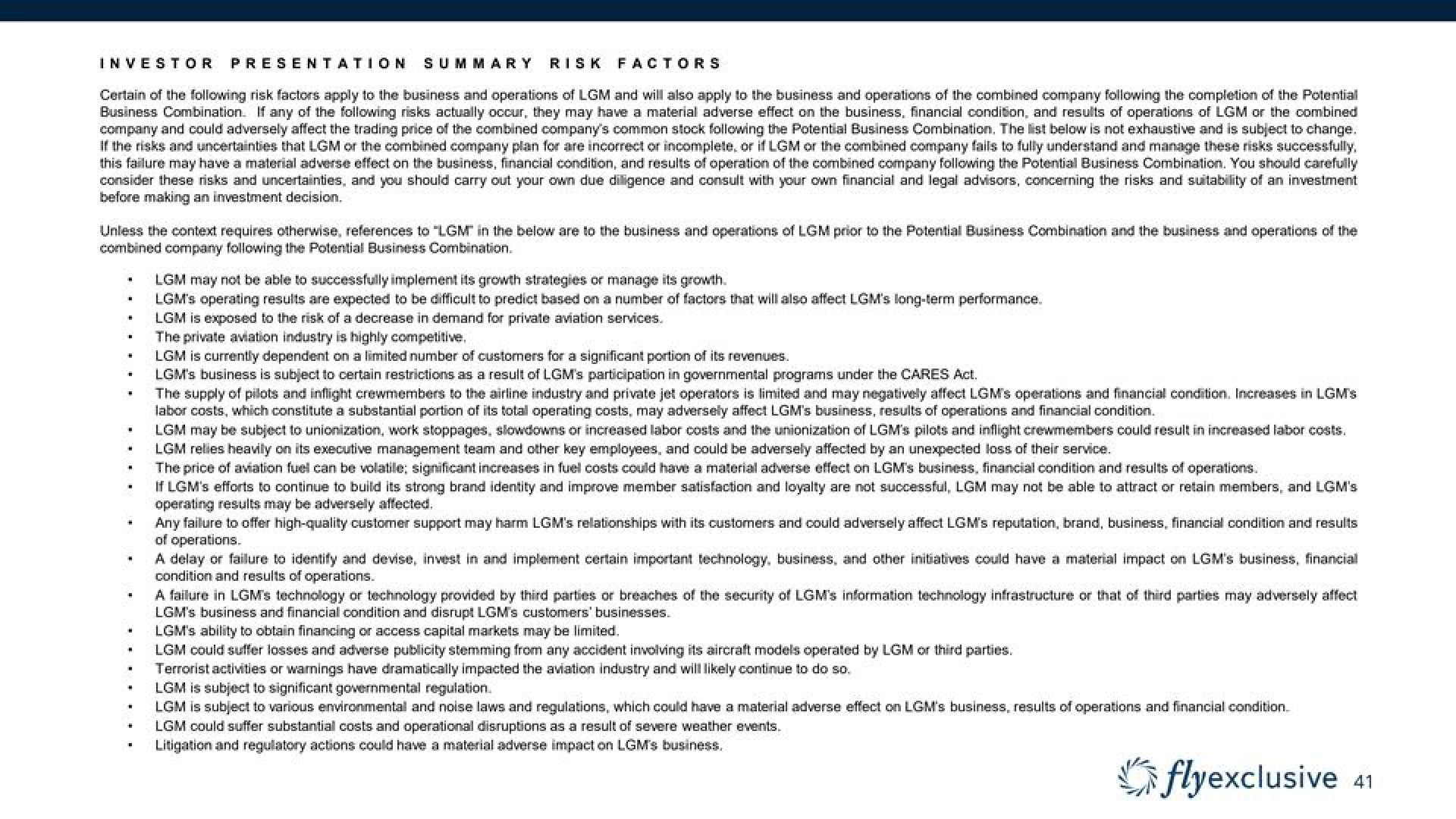

INVESTOR PRESENTATION SUMMARY RISK FACTORS

Certain of the following risk factors apply to the business and operations of LGM and will also apply to the business and operations of the combined company following the completion of the Potential

Business Combination. If any of the following risks actually occur, they may have a material adverse effect on the business, financial condition, and results of operations of LGM or the combined

company and could adversely affect the trading price of the combined company's common stock following the Potential Business Combination. The list below is not exhaustive and is subject to change.

If the risks and uncertainties that LGM or the combined company plan for are incorrect or incomplete, or if LGM or the combined company fails to fully understand and manage these risks successfully,

this failure may have a material adverse effect on the business, financial condition, and results of operation of the combined company following the Potential Business Combination. You should carefully

consider these risks and uncertainties, and you should carry out your own due diligence and consult with your own financial and legal advisors, concerning the risks and suitability of an investment

before making an investment decision.

Unless the context requires otherwise, references to "LGM in the below are to the business and operations of LGM prior to the Potential Business Combination and the business and operations of the

combined company following the Potential Business Combination.

●

·

▪

■

▪

▪

-

■

♥

.

..

LGM may not be able to successfully implement its growth strategies or manage its growth.

LGM's operating results are expected to be difficult to predict based on a number of factors that will also affect LGM's long-term performance.

LGM is exposed to the risk of a decrease in demand for private aviation services.

The private aviation industry is highly competitive.

LGM is currently dependent on a limited number of customers for a significant portion of its revenues.

LGM's business is subject to certain restrictions as a result of LGM's participation in governmental programs under the CARES Act.

The supply of pilots and inflight crewmembers to the airline industry and private jet operators is limited and may negatively affect LGM's operations and financial condition. Increases in LGM's

labor costs, which constitute a substantial portion of its total operating costs, may adversely affect LGM's business, results of operations and financial condition.

LGM may be subject to unionization, work stoppages, slowdowns or increased labor costs and the unionization of LGM's pilots and inflight crewmembers could result in increased labor costs.

LGM relies heavily on its executive management team and other key employees, and could be adversely affected by an unexpected loss of their service.

The price of aviation fuel can be volatile; significant increases in fuel costs could have a material adverse effect on LGM's business, financial condition and results of operations.

If LGM's efforts to continue to build its strong brand identity and improve member satisfaction and loyalty are not successful, LGM may not be able to attract or retain members, and LGM's

operating results may be adversely affected.

Any failure to offer high-quality customer support may harm LGM's relationships with its customers and could adversely affect LGM's reputation, brand, business, financial condition and results

of operations.

A delay or failure to identify and devise, invest in and implement certain important technology, business, and other initiatives could have a material impact on LGM's business, financial

condition and results of operations.

A failure in LGM's technology or technology provided by third parties or breaches of the security of LGM's information technology infrastructure or that of third parties may adversely affect

LGM's business and financial condition and disrupt LGM's customers' businesses.

LGM's ability to obtain financing or access capital markets may be limited.

LGM could suffer losses and adverse publicity stemming from any accident involving its aircraft models operated by LGM or third parties.

Terrorist activities or warnings have dramatically impacted the aviation industry and will likely continue to do so.

LGM is subject to significant governmental regulation.

LGM is subject to various environmental and noise laws and regulations, which could have a material adverse effect on LGM's business, results of operations and financial condition.

LGM could suffer substantial costs and operational disruptions as a result of severe weather events.

Litigation and regulatory actions could have a material adverse impact on LGM's business.

flyexclusiveView entire presentation