EVE SPAC Presentation Deck

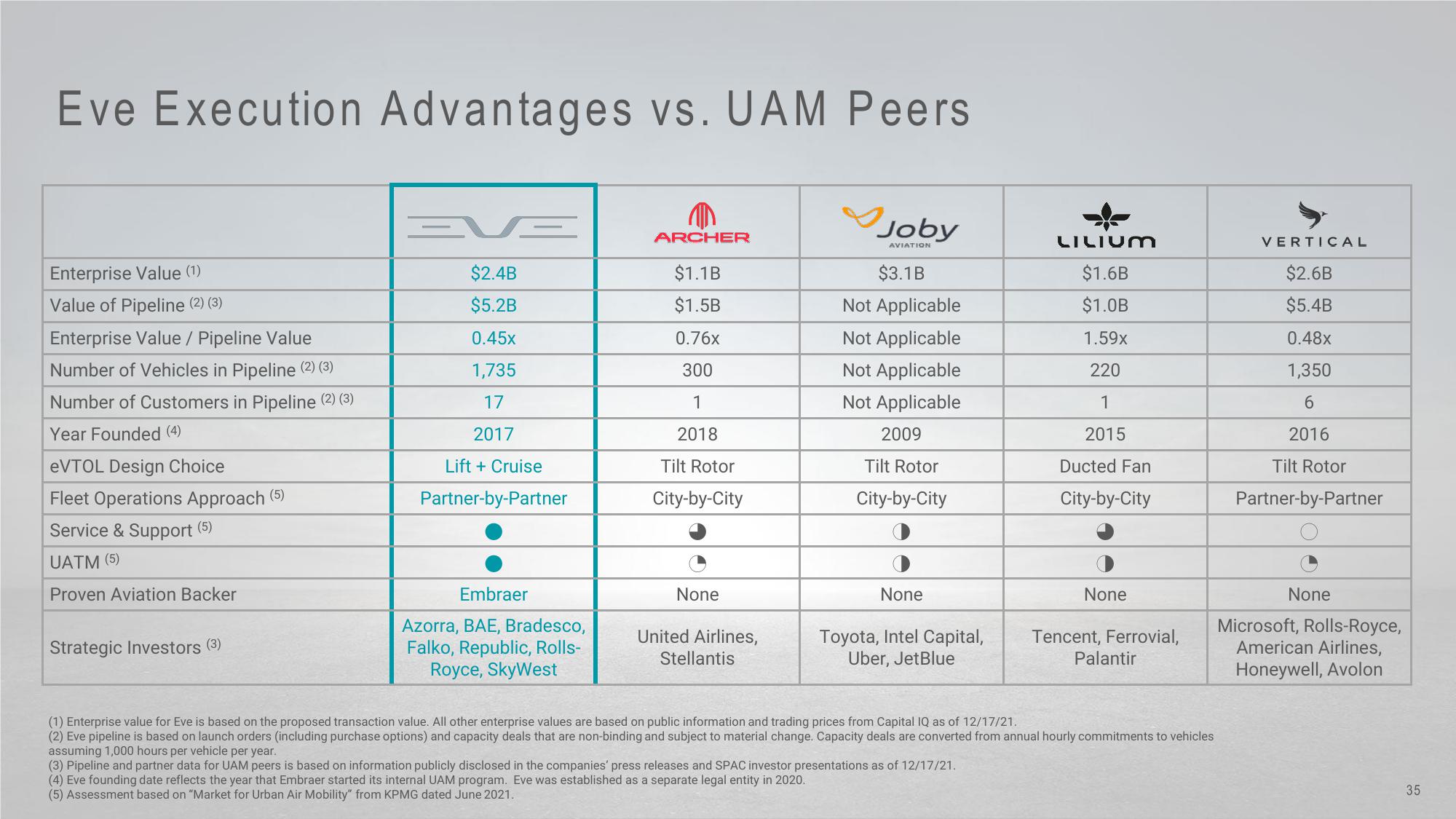

Eve Execution Advantages vs. UAM Peers

Enterprise Value (1)

Value of Pipeline (2) (3)

Enterprise Value / Pipeline Value

Number of Vehicles in Pipeline (2) (3)

Number of Customers in Pipeline (2) (3)

Year Founded (4)

eVTOL Design Choice

Fleet Operations Approach (5)

Service & Support (5)

UATM (5)

Proven Aviation Backer

Strategic Investors (3)

EVE

$2.4B

$5.2B

0.45x

1,735

17

2017

Lift + Cruise

Partner-by-Partner

Embraer

Azorra, BAE, Bradesco,

Falko, Republic, Rolls-

Royce, SkyWest

ARCHER

$1.1B

$1.5B

0.76x

300

1

2018

Tilt Rotor

City-by-City

None

United Airlines,

Stellantis

Joby

AVIATION

$3.1B

Not Applicable

Not Applicable

Not Applicable

Not Applicable

2009

Tilt Rotor

City-by-City

None

Toyota, Intel Capital,

Uber, JetBlue

LILIUM

$1.6B

$1.0B

1.59x

220

1

2015

Ducted Fan

City-by-City

None

Tencent, Ferrovial,

Palantir

(1) Enterprise value for Eve is based on the proposed transaction value. All other enterprise values are based on public information and trading prices from Capital IQ as of 12/17/21.

(2) Eve pipeline is based on launch orders (including purchase options) and capacity deals that are non-binding and subject to material change. Capacity deals are converted from annual hourly commitments to vehicles

assuming 1,000 hours per vehicle per year.

(3) Pipeline and partner data for UAM peers is based on information publicly disclosed in the companies' press releases and SPAC investor presentations as of 12/17/21.

(4) Eve founding date reflects the year that Embraer started its internal UAM program. Eve was established as a separate legal entity in 2020.

(5) Assessment based on "Market for Urban Air Mobility" from KPMG dated June 2021.

VERTICAL

$2.6B

$5.4B

0.48x

1,350

6

2016

Tilt Rotor

Partner-by-Partner

None

Microsoft, Rolls-Royce,

American Airlines,

Honeywell, Avolon

35View entire presentation