Bed Bath & Beyond Results Presentation Deck

APPENDIX

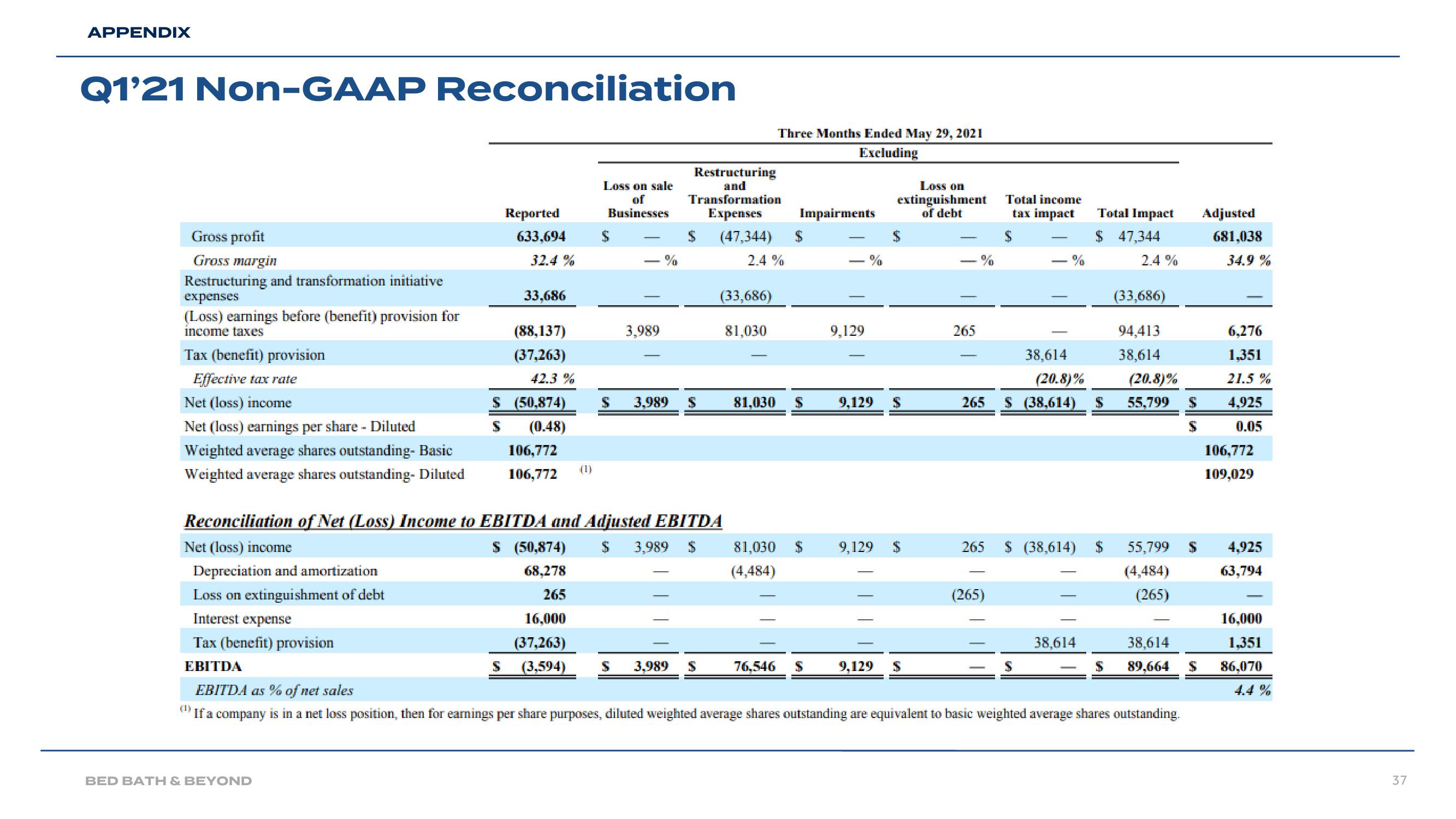

Q1'21 Non-GAAP Reconciliation

Gross profit

Gross margin

Restructuring and transformation initiative

expenses

(Loss) earnings before (benefit) provision for

income taxes

Tax (benefit) provision

Effective tax rate

Net (loss) income

Net (loss) earnings per share - Diluted

Weighted average shares outstanding- Basic

Weighted average shares outstanding- Diluted

Reported

BED BATH & BEYOND

633,694

32.4%

33,686

S

(88,137)

(37,263)

42.3 %

$ (50,874)

(0.48)

106,772

106,772

Loss on sale

of

Businesses

$ (50,874)

68,278

265

16,000

(37,263)

(3,594)

3,989

S 3,989

Reconciliation of Net (Loss) Income to EBITDA and Adjusted EBITDA

3,989 $

Restructuring

and

Transformation

Expenses

(47,344)

2.4 %

(33,686)

81,030

3,989 S

Three Months Ended May 29, 2021

Excluding

Impairments

81,030 S

81,030

(4,484)

9,129

76,546 S

9,129

9,129

Loss on

extinguishment

of debt

S

265

9,129 S

265

Net (loss) income

Depreciation and amortization

Loss on extinguishment of debt

Interest expense

Tax (benefit) provision

EBITDA

EBITDA as % of net sales

If a company is in a net loss position, then for earnings per share purposes, diluted weighted average shares outstanding are equivalent to basic weighted average shares outstanding.

(1)

265

Total income

tax impact

(265)

38,614

(20.8)%

S (38,614)

$ (38,614)

Total Impact

$ 47,344

2.4%

38,614

S

(33,686)

94,413

38,614

(20.8)%

55,799

55,799

(4,484)

(265)

38,614

$ 89,664

$

Adjusted

681,038

34.9 %

6,276

1,351

21.5 %

4,925

0.05

106,772

109,029

4,925

63,794

16,000

1,351

86,070

70

37View entire presentation