Credit Suisse Results Presentation Deck

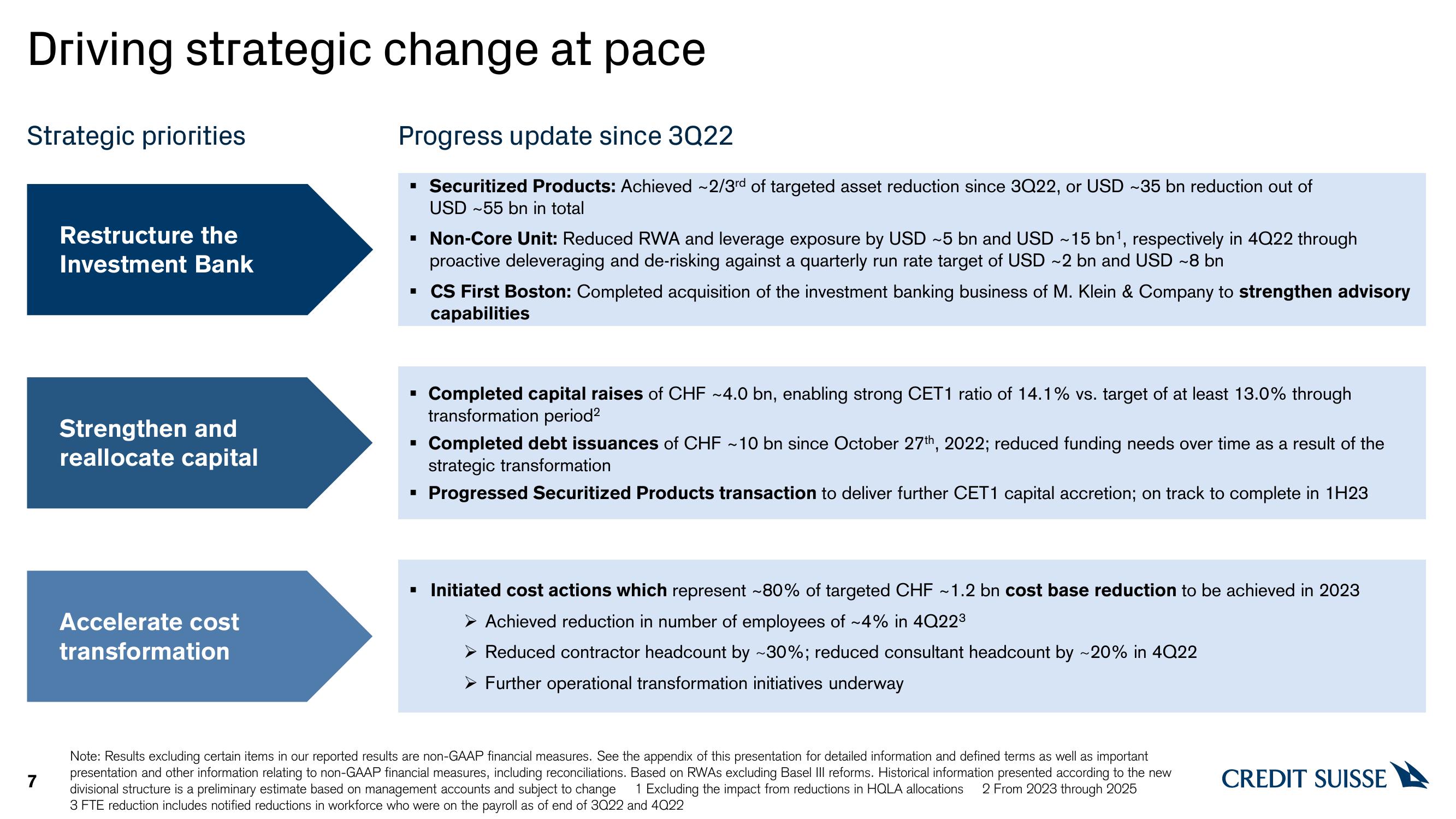

Driving strategic change at pace

Strategic priorities

7

Restructure the

Investment Bank

Strengthen and

reallocate capital

Accelerate cost

transformation

Progress update since 3Q22

▪ Securitized Products: Achieved ~2/3rd of targeted asset reduction since 3Q22, or USD ~35 bn reduction out of

USD ~55 bn in total

▪ Non-Core Unit: Reduced RWA and leverage exposure by USD ~5 bn and USD ~15 bn¹, respectively in 4Q22 through

proactive deleveraging and de-risking against a quarterly run rate target of USD ~2 bn and USD ~8 bn

▪ CS First Boston: Completed acquisition of the investment banking business of M. Klein & Company to strengthen advisory

capabilities

■

I

Completed capital raises of CHF ~4.0 bn, enabling strong CET1 ratio of 14.1% vs. target of at least 13.0% through

transformation period²

Completed debt issuances of CHF ~10 bn since October 27th, 2022; reduced funding needs over time as a result of the

strategic transformation

Progressed Securitized Products transaction to deliver further CET1 capital accretion; on track to complete in 1H23

▪ Initiated cost actions which represent ~80% of targeted CHF ~1.2 bn cost base reduction to be achieved in 2023

> Achieved reduction in number of employees of ~4% in 4Q22³

➤ Reduced contractor headcount by ~30%; reduced consultant headcount by ~20% in 4Q22

➤ Further operational transformation initiatives underway

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. Based on RWAs excluding Basel III reforms. Historical information presented according to the new

divisional structure is a preliminary estimate based on management accounts and subject to change 1 Excluding the impact from reductions in HQLA allocations 2 From 2023 through 2025

3 FTE reduction includes notified reductions in workforce who were on the payroll as of end of 3022 and 4Q22

CREDIT SUISSEView entire presentation