BAT Results Presentation Deck

Adjusted results demonstrate continued delivery

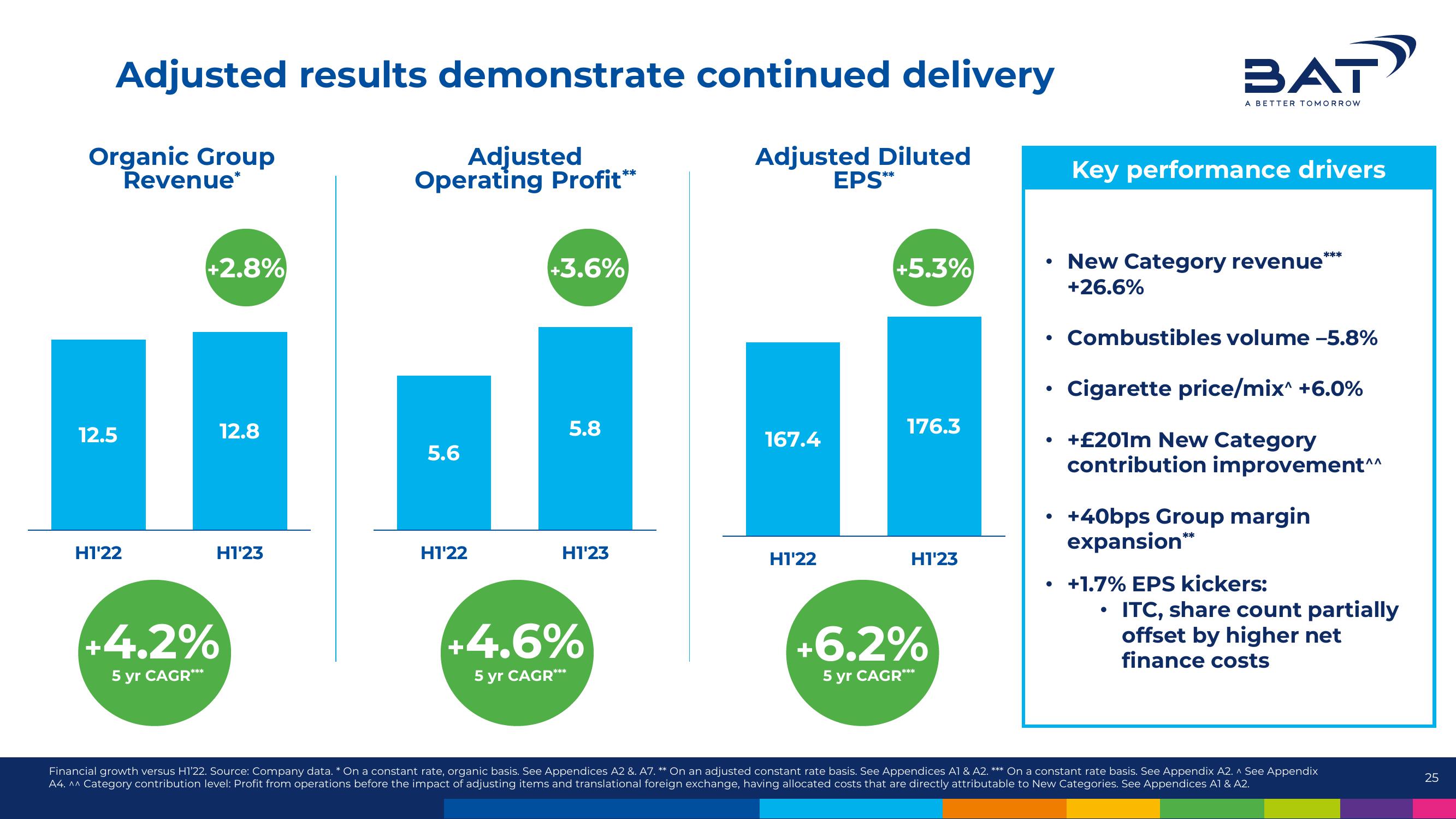

Organic Group

Revenue*

12.5

H122

+2.8%

+4.2%

5 yr CAGR***

12.8

H1'23

Adjusted

Operating Profit**

5.6

H122

+3.6%

5.8

H1'23

+4.6%

5 yr CAGR***

Adjusted Diluted

167.4

H122

EPS**

+5.3%

176.3

H1'23

+6.2%

5 yr CAGR***

●

●

BAT

A BETTER TOMORROW

Key performance drivers

New Category revenue

+26.6%

Combustibles volume -5.8%

Cigarette price/mix^ +6.0%

• + £201m New Category

contribution improvement^^

+40bps Group margin

expansion**

●

+1.7% EPS kickers:

***

ITC, share count partially

offset by higher net

finance costs

Financial growth versus H1'22. Source: Company data. * On a constant rate, organic basis. See Appendices A2 &. A7. ** On an adjusted constant rate basis. See Appendices A1 & A2. *** On a constant rate basis. See Appendix A2. ^ See Appendix

A4. ^^ Category contribution level: Profit from operations before the impact of adjusting items and translational foreign exchange, having allocated costs that are directly attributable to New Categories. See Appendices A1 & A2.

25View entire presentation