HSBC Results Presentation Deck

Net interest income sensitivity -

sensitivity - main drivers and assumptions

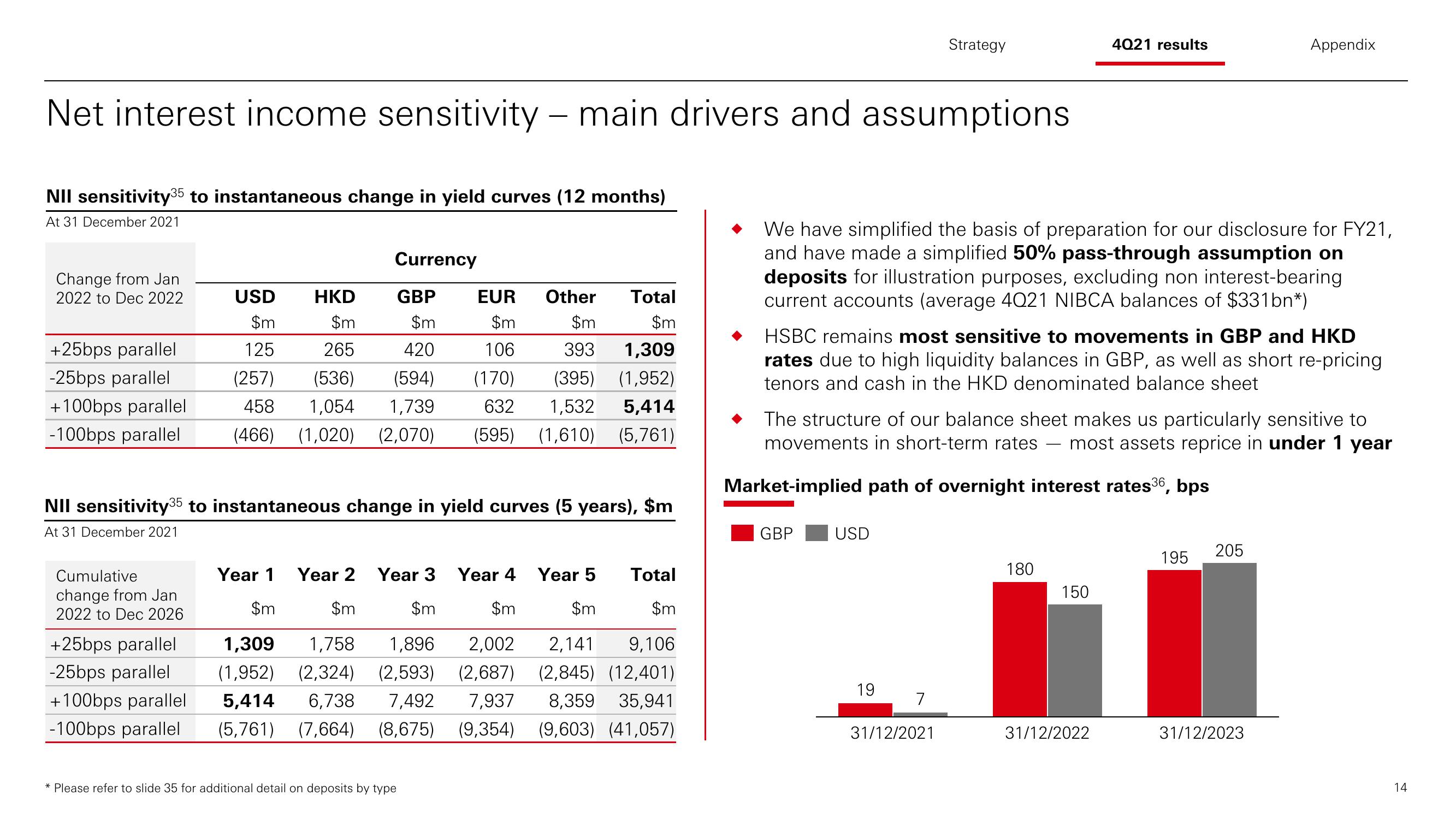

NII sensitivity³5 to instantaneous change in yield curves (12 months)

At 31 December 2021

Change from Jan

2022 to Dec 2022

+25bps parallel

-25bps parallel

+100bps parallel

-100bps parallel

NII sensitivity³5 to instantaneous change in yield curves (5 years), $m

At 31 December 2021

Cumulative

change from Jan

2022 to Dec 2026

Currency

USD

HKD

$m

$m

125

265

GBP EUR Other Total

$m $m $m $m

420 106 393 1,309

(257) (536) (594) (170) (395) (1,952)

458 1,054 1,739 632 1,532 5,414

(466) (1,020) (2,070) (595) (1,610) (5,761)

+25bps parallel

-25bps parallel

+100bps parallel

-100bps parallel

Year 2 Year 3 Year 4 Year 5 Total

$m

$m

1,309

(1,952)

$m $m $m

1,758 1,896 2,002 2,141 9,106

(2,324) (2,593) (2,687) (2,845) (12,401)

5,414 6,738 7,492 7,937 8,359 35,941

(5,761) (7,664) (8,675)

(9,354) (9,603) (41,057)

Year 1

$m

* Please refer to slide 35 for additional detail on deposits by type

We have simplified the basis of preparation for our disclosure for FY21,

and have made a simplified 50% pass-through assumption on

deposits for illustration purposes, excluding non interest-bearing

current accounts (average 4021 NIBCA balances of $331bn*)

GBP

Strategy

HSBC remains most sensitive to movements in GBP and HKD

rates due to high liquidity balances in GBP, as well as short re-pricing

tenors and cash in the HKD denominated balance sheet

USD

The structure of our balance sheet makes us particularly sensitive to

movements in short-term rates most assets reprice in under 1 year

Market-implied path of overnight interest rates³6, bps

19

7

31/12/2021

4021 results

180

150

31/12/2022

Appendix

195

205

31/12/2023

14View entire presentation