Pershing Square Activist Presentation Deck

Appendix

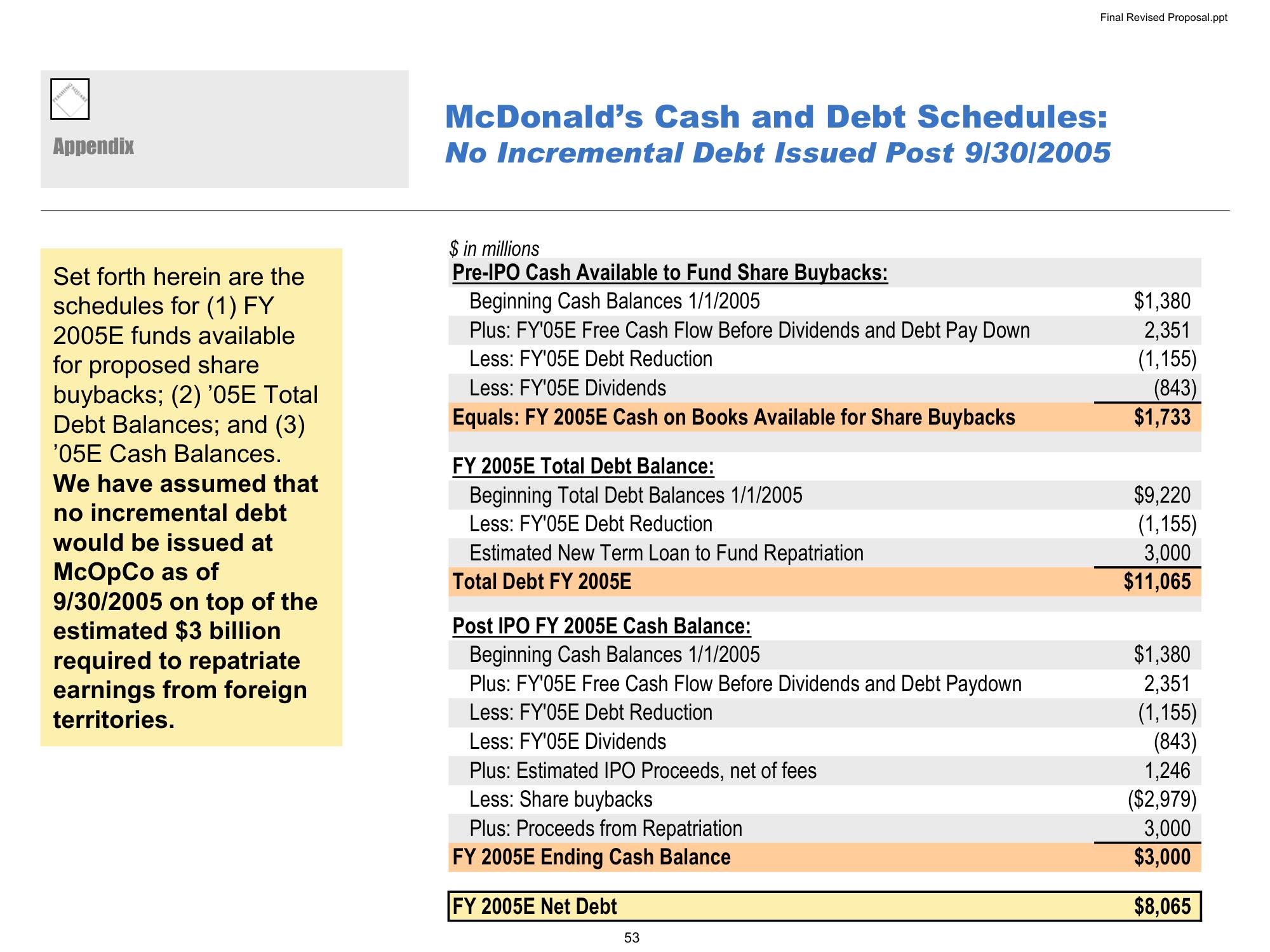

Set forth herein are the

schedules for (1) FY

2005E funds available

for proposed share

buybacks; (2) '05E Total

Debt Balances; and (3)

'05E Cash Balances.

We have assumed that

no incremental debt

would be issued at

McOpCo as of

9/30/2005 on top of the

estimated $3 billion

required to repatriate

earnings from foreign

territories.

McDonald's Cash and Debt Schedules:

No Incremental Debt Issued Post 9/30/2005

$ in millions

Pre-IPO Cash Available to Fund Share Buybacks:

Beginning Cash Balances 1/1/2005

Plus: FY'05E Free Cash Flow Before Dividends and Debt Pay Down

Less: FY'05E Debt Reduction

Less: FY'05E Dividends

Equals: FY 2005E Cash on Books Available for Share Buybacks

FY 2005E Total Debt Balance:

Beginning Total Debt Balances 1/1/2005

Less: FY'05E Debt Reduction

Estimated New Term Loan to Fund Repatriation

Total Debt FY 2005E

Post IPO FY 2005E Cash Balance:

Beginning Cash Balances 1/1/2005

Plus: FY'05E Free Cash Flow Before Dividends and Debt Paydown

Less: FY'05E Debt Reduction

Less: FY'05E Dividends

Plus: Estimated IPO Proceeds, net of fees

Less: Share buybacks

Plus: Proceeds from Repatriation

FY 2005E Ending Cash Balance

FY 2005E Net Debt

Final Revised Proposal.ppt

53

$1,380

2,351

(1,155)

(843)

$1,733

$9,220

(1,155)

3,000

$11,065

$1,380

2,351

(1,155)

(843)

1,246

($2,979)

3,000

$3,000

$8,065View entire presentation