Main Street Capital Investor Day Presentation Deck

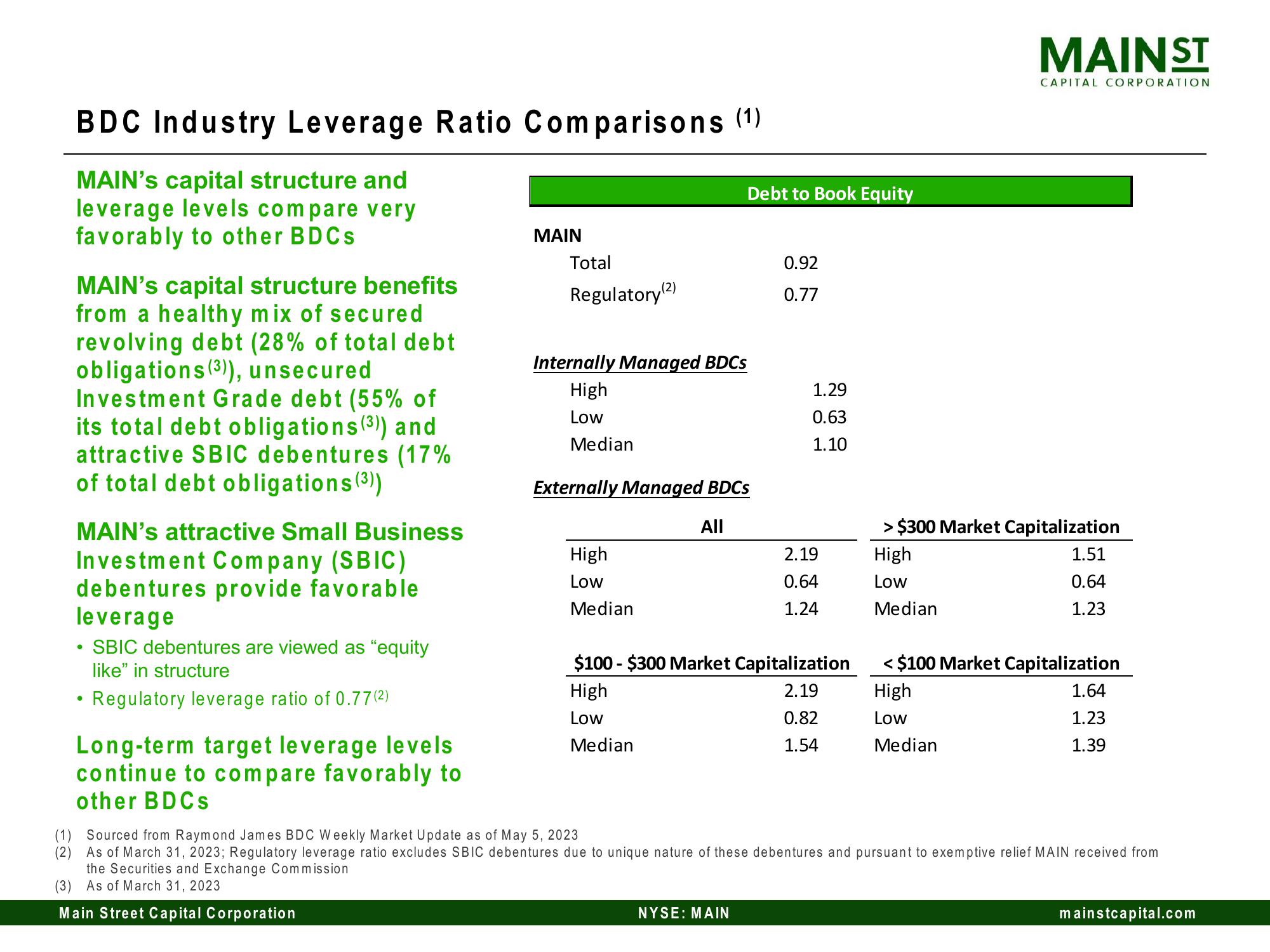

BDC Industry Leverage Ratio Comparisons (1)

MAIN's capital structure and

leverage levels compare very

favorably to other BDCS

MAIN's capital structure benefits

from a healthy mix of secured

revolving debt (28% of total debt

obligations (3)), unsecured

Investment Grade debt (55% of

its total debt obligations (3)) and

attractive SBIC debentures (17%

of total debt obligations (3))

MAIN's attractive Small Business

Investment Company (SBIC)

debentures provide favorable

leverage

SBIC debentures are viewed as "equity

like" in structure

• Regulatory leverage ratio of 0.77 (2)

Long-term target leverage levels.

continue to compare favorably to

other BDCs

MAIN

Total

Regulatory (2)

Internally Managed BDCS

High

Low

Median

Debt to Book Equity

Externally Managed BDCs

All

High

Low

Median

0.92

0.77

NYSE: MAIN

1.29

0.63

1.10

2.19

0.64

1.24

$100-$300 Market Capitalization

High

Low

2.19

0.82

Median

1.54

MAINST

CAPITAL CORPORATION

> $300 Market Capitalization

High

Low

Median

1.51

0.64

1.23

<$100 Market Capitalization

High

Low

Median

1.64

1.23

1.39

(1) Sourced from Raymond James BDC Weekly Market Update as of May 5, 2023

(2) As of March 31, 2023; Regulatory leverage ratio excludes SBIC debentures due to unique nature of these debentures and pursuant to exemptive relief MAIN received from

the Securities and Exchange Commission

(3) As of March 31, 2023

Main Street Capital Corporation

mainstcapital.comView entire presentation