Credit Suisse Investment Banking Pitch Book

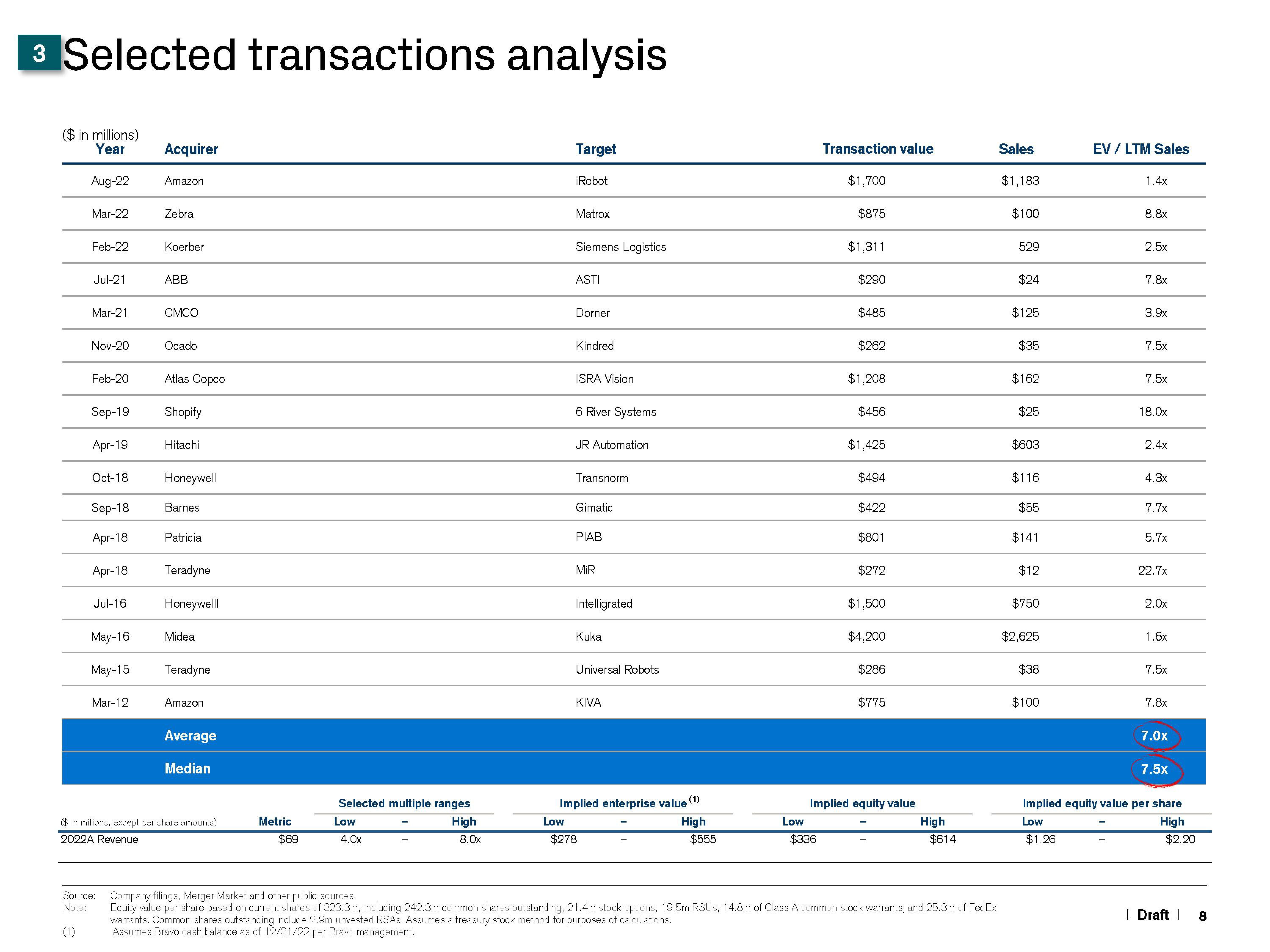

3 Selected transactions analysis

($ in millions)

Year

Aug-22

Mar-22

Feb-22

Jul-21

Mar-21

Nov-20

Feb-20

Sep-19

Apr-19

Oct-18

Jul-16

May-16

May-15

Acquirer

Mar-12

Amazon

Zebra

Koerber

ABB

CMCO

Ocado

Atlas Copco

Shopify

Sep-18

Apr-18

Apr-18 Teradyne

Honeywelll

Hitachi

Honeywell

Barnes

Patricia

Midea

Teradyne

Amazon

Average

Median

($ in millions, except per share amounts)

2022A Revenue

Metric

$69

Selected multiple ranges

High

8.0x

Low

4.0x

Target

iRobot

Matrox

Siemens Logistics

ASTI

Dorner

Kindred

ISRA Vision

6 River Systems

JR Automation

Transnorm

Gimatic

PIAB

MiR

Intelligrated

Kuka

Universal Robots

KIVA

Implied enterprise value (1)

Low

$278

High

$555

Low

Transaction value

$336

$1,700

$875

$1,311

$290

$485

$262

$1,208

$456

$1,425

$494

$422

$801

$272

$1,500

$4,200

$286

$775

Implied equity value

High

$614

Source: Company filings, Merger Market and other public sources.

Note: Equity value per share based on current shares of 323.3m, including 242.3m common shares outstanding, 21.4m stock options, 19.5m RSUS, 14.8m of Class A common stock warrants, and 25.3m of FedEx

warrants. Common shares outstanding include 2.9m unvested RSAs. Assumes a treasury stock method for purposes of calculations.

(1)

Assumes Bravo cash balance as of 12/31/22 per Bravo management.

Sales

$1,183

$100

529

$24

$125

$35

$162

$25

$603

$116

$55

$141

$12

$750

$2,625

$38

$100

EV / LTM Sales

$1.26

1.4x

8.8x

2.5x

7.8x

3.9x

7.5x

7.5x

18.0x

2.4x

4.3x

7.7x

5.7x

22.7x

2.0x

1.6x

7.5x

7.8x

7.0x

7.5x

Implied equity value per share

Low

High

$2.20

| Draft |

8View entire presentation