AngloAmerican Results Presentation Deck

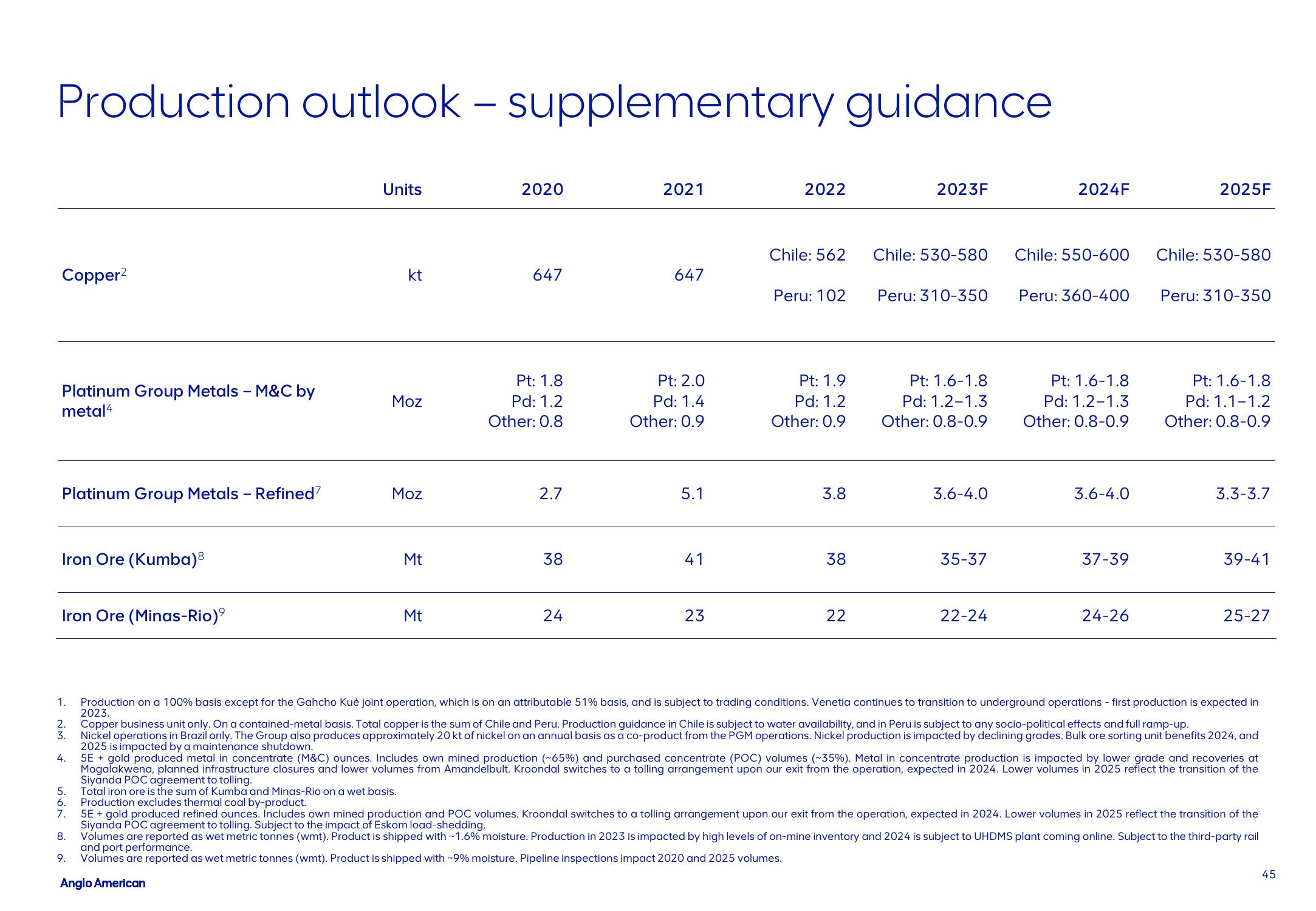

Production outlook - supplementary guidance

Copper²

Platinum Group Metals - M&C by

metal4

Platinum Group Metals - Refined?

Iron Ore (Kumba)8

Iron Ore (Minas-Rio)⁹

NM

2.

3.

4.

Units

5.

6.

7.

8.

kt

Moz

Moz

Mt

Mt

2020

647

Pt: 1.8

Pd: 1.2

Other: 0.8

2.7

38

24

2021

647

Pt: 2.0

Pd: 1.4

Other: 0.9

5.1

41

23

2022

Chile: 562

Peru: 102

Pt: 1.9

Pd: 1.2

Other: 0.9

3.8

38

22

2023F

Chile: 530-580

Peru: 310-350

Pt: 1.6-1.8

Pd: 1.2-1.3

Other: 0.8-0.9

3.6-4.0

35-37

22-24

2024F

Chile: 550-600

Peru: 360-400

Pt: 1.6-1.8

Pd: 1.2-1.3

Other: 0.8-0.9

3.6-4.0

37-39

24-26

2025F

Chile: 530-580

Peru: 310-350

1. Production on a 100% basis except for the Gahcho Kué joint operation, which is on an attributable 51% basis, and is subject to trading conditions. Venetia continues to transition to underground operations - first production is expected in

2023.

Copper business unit only. On a contained-metal basis. Total copper is the sum of Chile and Peru. Production guidance in Chile is subject to water availability, and in Peru is subject to any socio-political effects and full ramp-up.

Nickel operations in Brazil only. The Group also produces approximately 20 kt of nickel on an annual basis as a co-product from the PGM operations. Nickel production is impacted by declining grades. Bulk ore sorting unit benefits 2024, and

2025 is impacted by a maintenance shutdown.

5E + gold produced metal in concentrate (M&C) ounces. Includes own mined production (~65%) and purchased concentrate (POC) volumes (~35%). Metal in concentrate production is impacted by lower grade and recoveries at

Mogalakwena, planned infrastructure closures and lower volumes from Amandelbult. Kroondal switches to a tolling arrangement upon our exit from the operation, expected in 2024. Lower volumes in 2025 reflect the transition of the

Siyanda POC agreement to tolling.

Total iron ore is the sum of Kumba and Minas-Rio on a wet basis.

Production excludes thermal coal by-product.

5E + gold produced refined ounces. Includes own mined production and POC volumes. Kroondal switches to a tolling arrangement upon our exit from the operation, expected in 2024. Lower volumes in 2025 reflect the transition of the

Siyanda POC agreement to tolling. Subject to the impact of Eskom load-shedding.

Volumes are reported as wet metric tonnes (wmt). Product is shipped with ~1.6% moisture. Production in 2023 is impacted by high levels of on-mine inventory and 2024 is subject to UHDMS plant coming online. Subject to the third-party rail

and port performance.

9. Volumes are reported as wet metric tonnes (wmt). Product is shipped with ~9% moisture. Pipeline inspections impact 2020 and 2025 volumes.

Anglo American

Pt: 1.6-1.8

Pd: 1.1-1.2

Other: 0.8-0.9

3.3-3.7

39-41

25-27

45View entire presentation