J.P.Morgan Shareholder Engagement Presentation Deck

D Climate

We are committed to our climate strategy and realizing the sizable economic

opportunities that the transition presents for our Firm and our clients

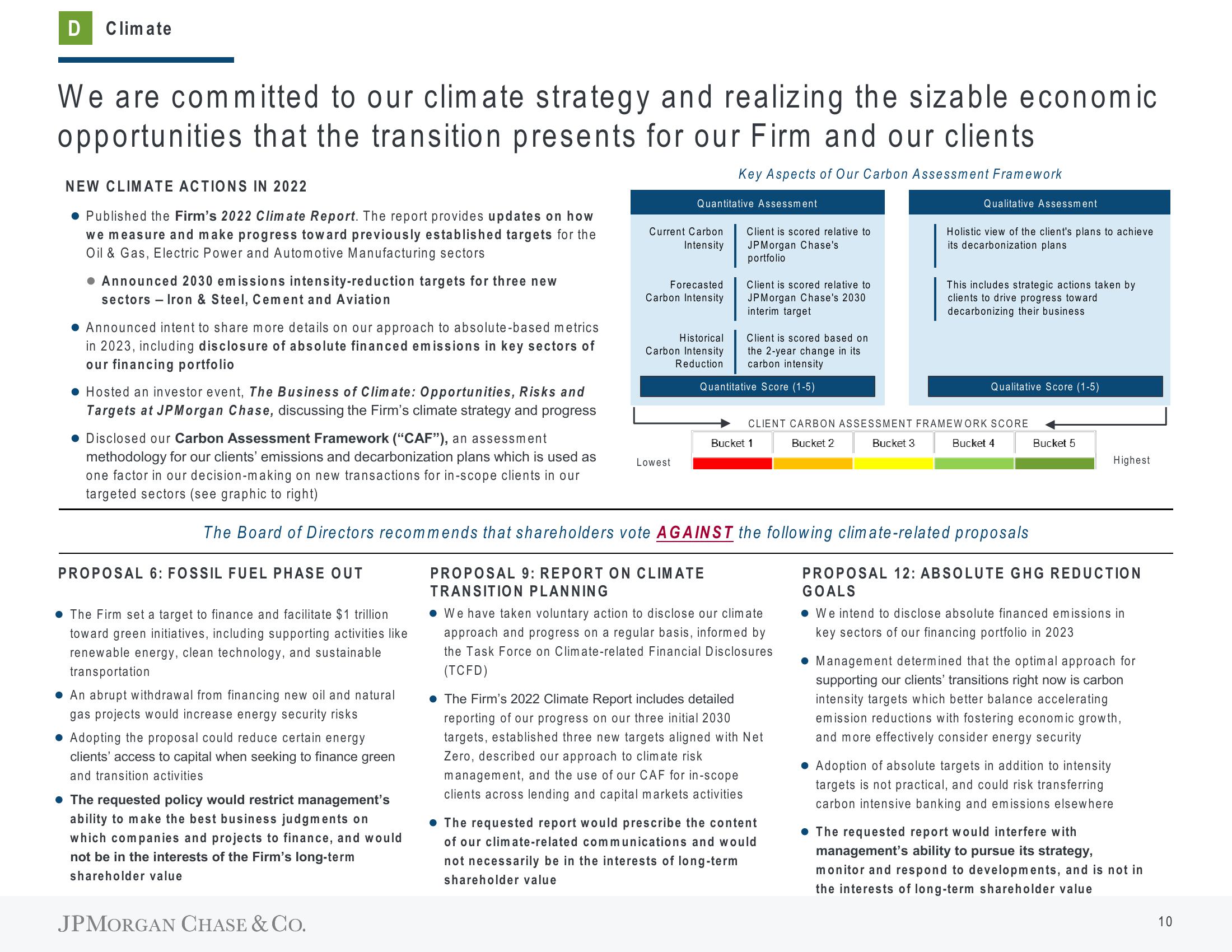

Key Aspects of Our Carbon Assessment Framework

NEW CLIMATE ACTIONS IN 2022

Published the Firm's 2022 Climate Report. The report provides updates on how

we measure and make progress toward previously established targets for the

Oil & Gas, Electric Power and Automotive Manufacturing sectors

• Announced 2030 emissions intensity-reduction targets for three new

sectors - Iron & Steel, Cement and Aviation

● Announced intent to share more details on our approach to absolute-based metrics

in 2023, including disclosure of absolute financed emissions in key sectors of

our financing portfolio

• Hosted an investor event, The Business of Climate: Opportunities, Risks and

Targets at JPMorgan Chase, discussing the Firm's climate strategy and progress

• Disclosed our Carbon Assessment Framework ("CAF"), an assessment

methodology for our clients' emissions and decarbonization plans which is used as

one factor in our decision-making on new transactions for in-scope clients in our

targeted sectors (see graphic to right)

PROPOSAL 6: FOSSIL FUEL PHASE OUT

● The Firm set a target to finance and facilitate $1 trillion

toward green initiatives, including supporting activities like

renewable energy, clean technology, and sustainable

transportation

An abrupt withdrawal from financing new oil and natural

gas projects would increase energy security risks

Adopting the proposal could reduce certain energy

clients' access to capital when seeking to finance green

and transition activities

• The requested policy would restrict management's

ability to make the best business judgments on

which companies and projects to finance, and would

not be in the interests of the Firm's long-term

shareholder value

JPMORGAN CHASE & CO.

Quantitative Assessment

Current Carbon

Intensity

Forecasted

Carbon Intensity

Historical

Carbon Intensity

Reduction

Lowest

Client is scored relative to

JPMorgan Chase's

portfolio

Client is scored relative to

JPMorgan Chase's 2030.

interim target

Client is scored based on

the 2-year change in its

carbon intensity

Quantitative Score (1-5)

Bucket 1

The Board of Directors recommends that shareholders vote AGAINST the following climate-related proposals

PROPOSAL 9: REPORT ON CLIMATE

TRANSITION PLANNING

. We have taken voluntary action to disclose our climate

approach and progress on a regular basis, informed by

the Task Force on Climate-related Financial Disclosures

(TCFD)

Qualitative Assessment

CLIENT CARBON ASSESSMENT FRAMEWORK SCORE

Bucket 2

Bucket 3

Bucket 4

The Firm's 2022 Climate Report includes detailed

reporting of our prog on our three initial 2030

targets, established three new targets aligned with Net

Zero, described our approach to climate risk

management, and the use of our CAF for in-scope

clients across lending and capital markets activities

Holistic view of the client's plans to achieve.

its decarbonization plans

• The requested report would prescribe the content

of our climate-related communications and would

not necessarily be in the interests of long-term

shareholder value

This includes strategic actions taken by

clients to drive progress toward

decarbonizing their business

Qualitative Score (1-5)

Bucket 5

Highest

PROPOSAL 12: ABSOLUTE GHG REDUCTION

GOALS

We intend to disclose absolute financed emissions in

key sectors of our financing portfolio in 2023

Management determined that the optimal approach for

supporting our clients' transitions right now is carbon

intensity targets which better balance accelerating

emission reductions with fostering economic growth,

and more effectively consider energy security

Adoption of absolute targets in addition to intensity

targets is not practical, and could risk transferring

carbon intensive banking and emissions elsewhere

The requested report would interfere with

management's ability to pursue its strategy,

monitor and respond to developments, and is not in

the interests of long-term shareholder value

10View entire presentation