Silicon Valley Bank Results Presentation Deck

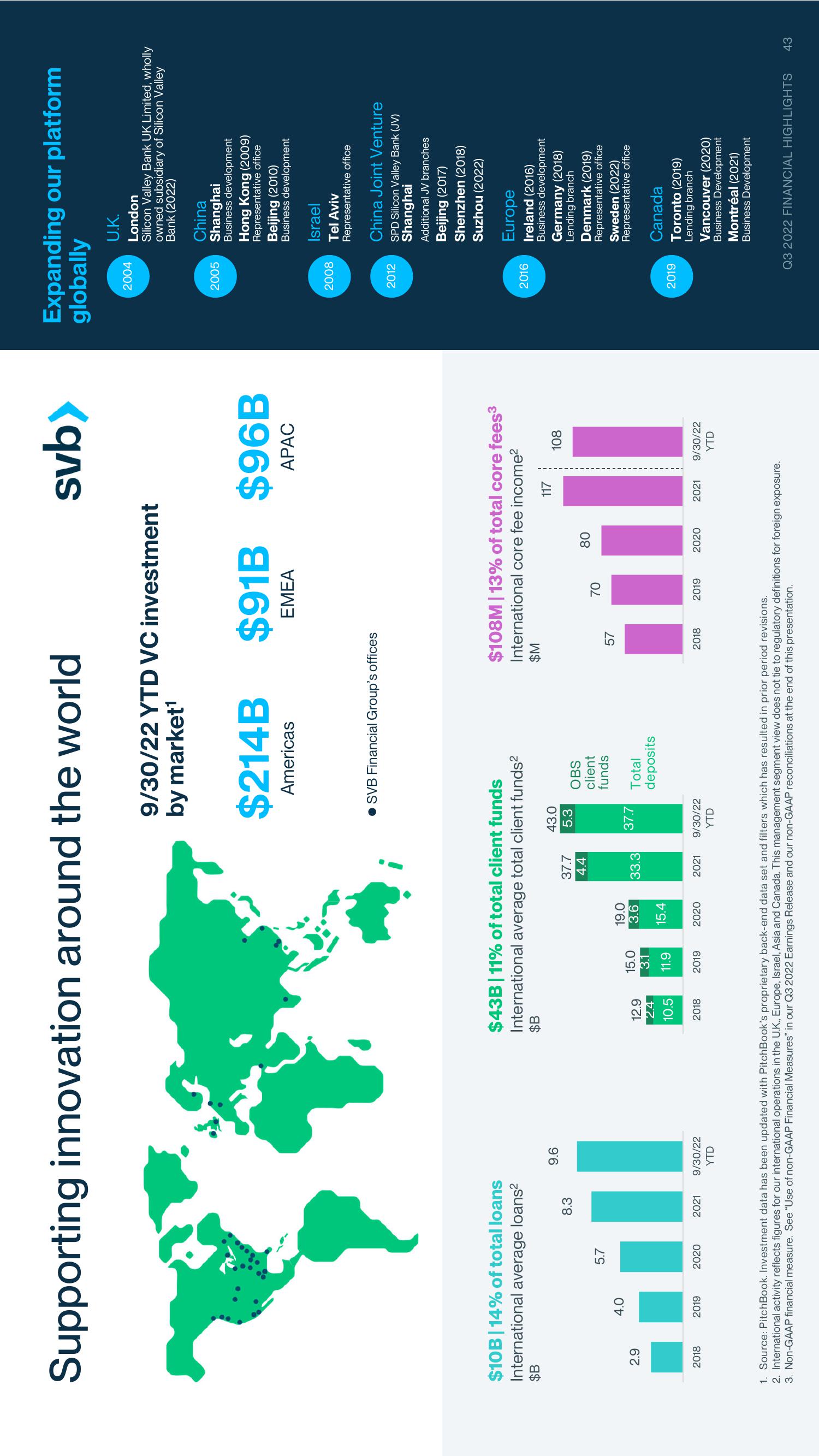

Supporting innovation around the world

$10B | 14% of total loans

International average loans²

$B

2.9

2018

4.0

2019

5.7

2020

8.3

2021

9.6

9/30/22

YTD

$B

12.9

2.4

10.5

$43B | 11% of total client funds

International average total client funds²

2018

15.0

3.1

11.9

2019

19.0

3.6

15.4

2020

9/30/22 YTD VC investment

by market¹

33.3

$214B

Americas

43.0

37.7 5.3

4.4

2021

37.7

SVB Financial Group's offices

9/30/22

YTD

OBS

client

funds

Total

deposits

$91B $96B

EMEA

APAC

$108M | 13% of total core fees³

International core fee income²

$M

57

2018

70

svb>

2019

117

108

80

ill

2020

2021

9/30/22

YTD

1. Source: PitchBook. Investment data has been updated with PitchBook's proprietary back-end data set and filters which has resulted in prior period revisions.

2. International activity reflects figures for our international operations in the U.K., Europe, Israel, Asia and Canada. This management segment view does not tie to regulatory definitions for foreign exposure.

3. Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q3 2022 Earnings Release and our non-GAAP reconciliations at the end of this presentation.

Expanding our platform

globally

2004

2005

2008

2012

2016

2019

U.K.

London

Silicon Valley Bank UK Limited, wholly

owned subsidiary of Silicon Valley

Bank (2022)

China

Shanghai

Business development

Hong Kong (2009)

Representative office

Beijing (2010)

Business development

Israel

Tel Aviv

Representative office

China Joint Venture

SPD Silicon Valley Bank (JV)

Shanghai

Additional JV branches

Beijing (2017)

Shenzhen (2018)

Suzhou (2022)

Europe

Ireland (2016)

Business development

Germany (2018)

Lending branch

Denmark (2019)

Representative office

Sweden (2022)

Representative office

Canada

Toronto (2019)

Lending branch

Vancouver (2020)

Business Development

Montréal (2021)

Business Development

Q3 2022 FINANCIAL HIGHLIGHTS 43View entire presentation