Meyer Burger Investor Presentation

FINANCIAL OUTLOOK

MEYER BURGER

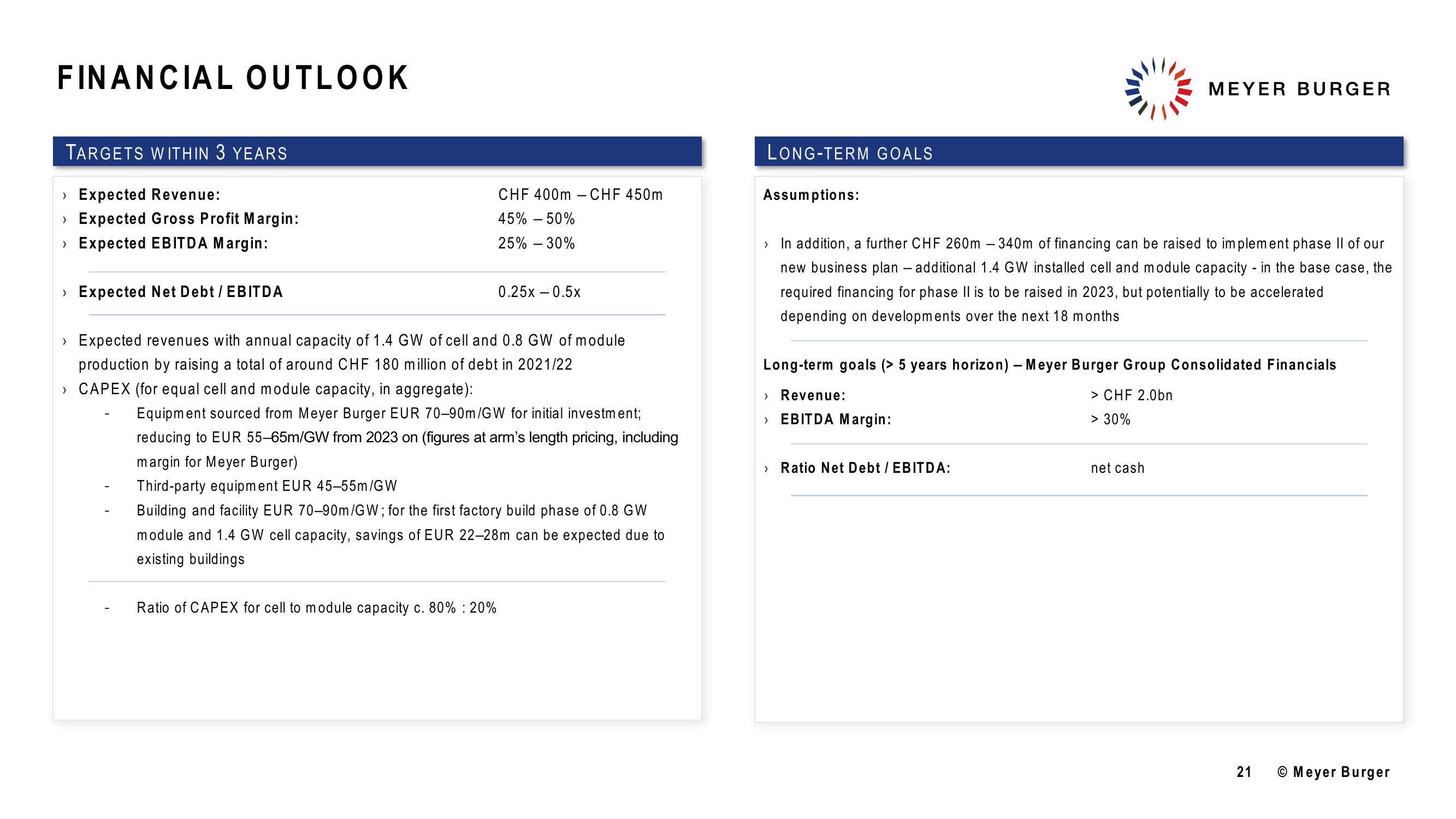

TARGETS WITHIN 3 YEARS

› Expected Revenue:

› Expected Gross Profit Margin:

› Expected EBITDA Margin:

› Expected Net Debt/EBITDA

CHF 400m CHF 450m

45% -50%

25% - 30%

0.25x -0.5x

› Expected revenues with annual capacity of 1.4 GW of cell and 0.8 GW of module

production by raising a total of around CHF 180 million of debt in 2021/22

› CAPEX (for equal cell and module capacity, in aggregate):

Equipment sourced from Meyer Burger EUR 70-90m/GW for initial investment;

reducing to EUR 55-65m/GW from 2023 on (figures at arm's length pricing, including

margin for Meyer Burger)

Third-party equipment EUR 45-55m/GW

Building and facility EUR 70-90m/GW; for the first factory build phase of 0.8 GW

module and 1.4 GW cell capacity, savings of EUR 22-28m can be expected due to

existing buildings

Ratio of CAPEX for cell to module capacity c. 80% : 20%

LONG-TERM GOALS

Assumptions:

>

In addition, a further CHF 260m - 340m of financing can be raised to implement phase II of our

new business plan - additional 1.4 GW installed cell and module capacity - in the base case, the

required financing for phase II is to be raised in 2023, but potentially to be accelerated

depending on developments over the next 18 months

Long-term goals (> 5 years horizon) - Meyer Burger Group Consolidated Financials

> Revenue:

> EBITDA Margin:

> Ratio Net Debt / EBITDA:

> CHF 2.0bn

> 30%

net cash

21

O Meyer BurgerView entire presentation