Bed Bath & Beyond Results Presentation Deck

Q3 PERFORMANCE HIGHLIGHTS & TRANSFORMATION UPDATE

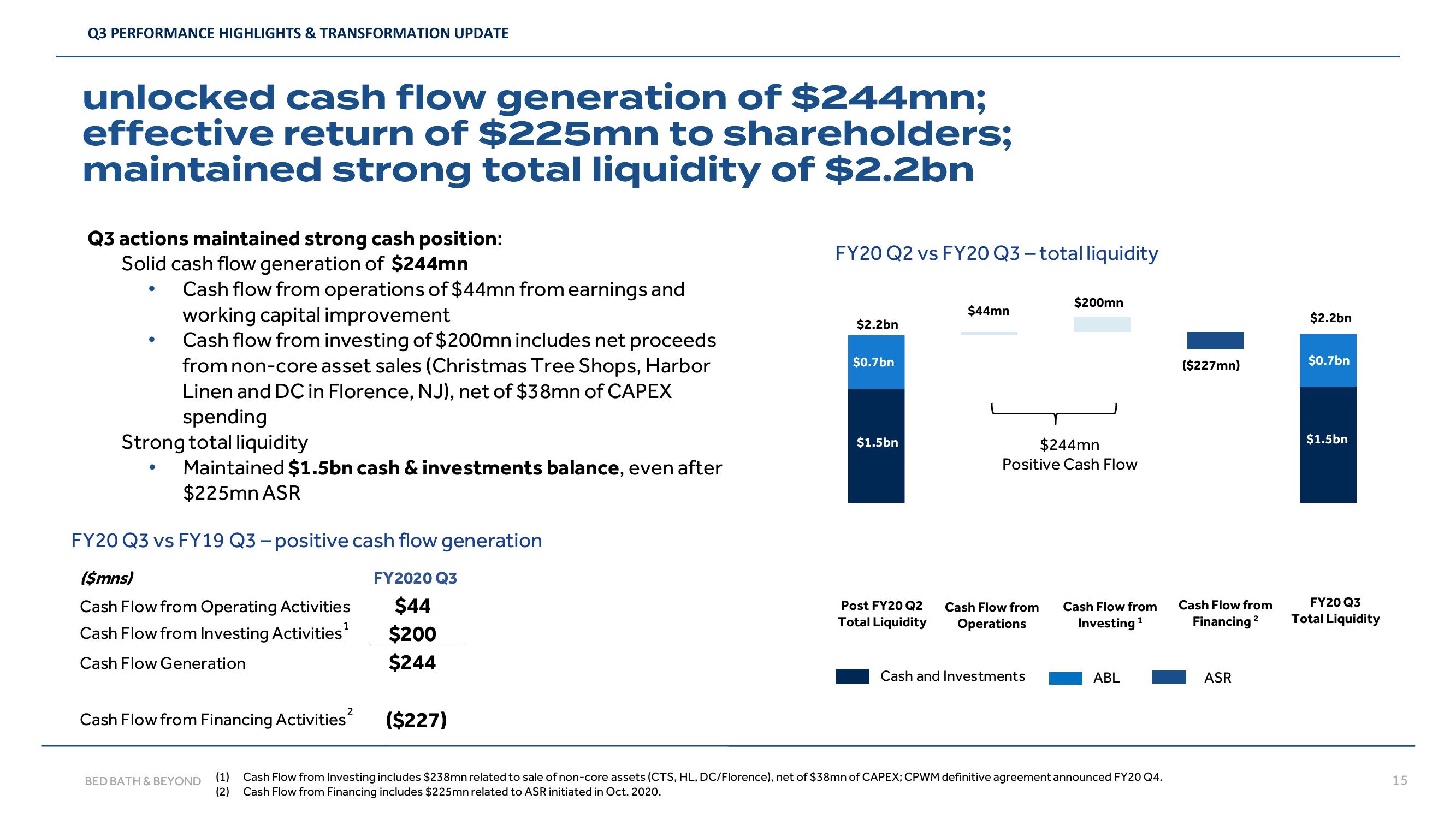

unlocked cash flow generation of $244mn;

effective return of $225mn to shareholders;

maintained strong total liquidity of $2.2bn

Q3 actions maintained strong cash position:

Solid cash flow generation of $244mn

●

●

Cash flow from operations of $44mn from earnings and

working capital improvement

Cash flow from investing of $200mn includes net proceeds

from non-core asset sales (Christmas Tree Shops, Harbor

Linen and DC in Florence, NJ), net of $38mn of CAPEX

spending

Strong total liquidity

Maintained $1.5bn cash & investments balance, even after

$225mn ASR

FY20 Q3 vs FY19 Q3-positive cash flow generation

($mns)

FY2020 Q3

Cash Flow from Operating Activities

$44

1

Cash Flow from Investing Activities ¹

$200

Cash Flow Generation

$244

Cash Flow from Financing Activities ²

BED BATH & BEYOND

($227)

FY20 Q2 vs FY20 Q3 - total liquidity

$2.2bn

$0.7bn

$1.5bn

Post FY20 Q2

Total Liquidity

$44mn

$244mn

Positive Cash Flow

Cash Flow from

Operations

$200mn

Cash and Investments

Cash Flow from

Investing ¹

ABL

(1) Cash Flow from Investing includes $238mn related to sale of non-core assets (CTS, HL, DC/Florence), net of $38mn of CAPEX; CPWM definitive agreement announced FY20 Q4.

(2) Cash Flow from Financing includes $225mn related to ASR initiated in Oct. 2020.

($227mn)

Cash Flow from

Financing ²

2

ASR

$2.2bn

$0.7bn

$1.5bn

FY20 Q3

Total Liquidity

15View entire presentation