Ares US Real Estate Opportunity Fund III

Real Estate Market Overview

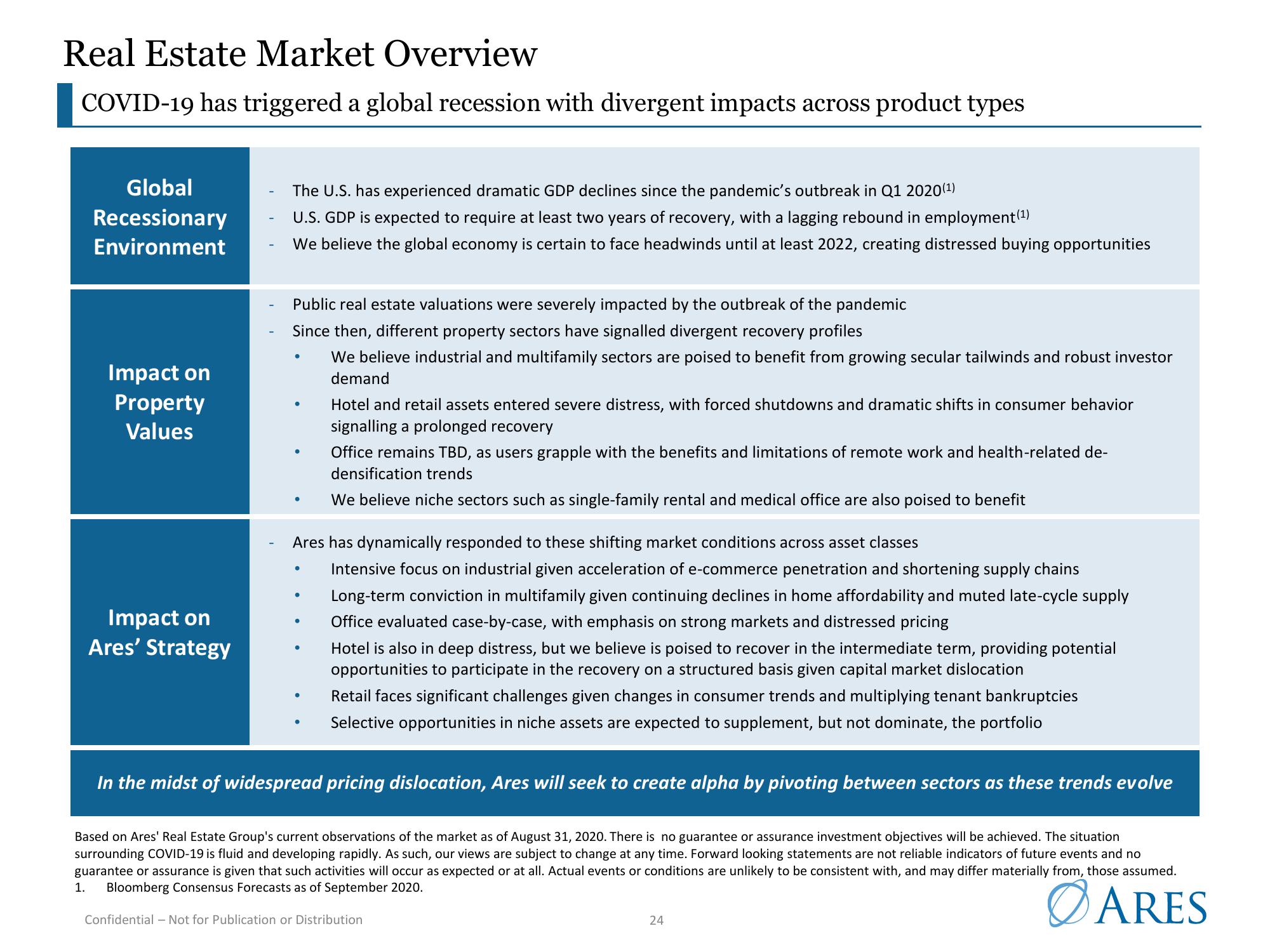

COVID-19 has triggered a global recession with divergent impacts across product types

Global

Recessionary

Environment

Impact on

Property

Values

Impact on

Ares' Strategy

The U.S. has experienced dramatic GDP declines since the pandemic's outbreak in Q1 2020(¹)

U.S. GDP is expected to require at least two years of recovery, with a lagging rebound in employment (¹)

We believe the global economy is certain to face headwinds until at least 2022, creating distressed buying opportunities

Public real estate valuations were severely impacted by the outbreak of the pandemic

Since then, different property sectors have signalled divergent recovery profiles

We believe industrial and multifamily sectors are poised to benefit from growing secular tailwinds and robust investor

demand

●

Hotel and retail assets entered severe distress, with forced shutdowns and dramatic shifts in consumer behavior

signalling a prolonged recovery

Ares has dynamically responded to these shifting market conditions across asset classes

Intensive focus on industrial given acceleration of e-commerce penetration and shortening supply chains

Long-term conviction in multifamily given continuing declines in home affordability and muted late-cycle supply

Office evaluated case-by-case, with emphasis on strong markets and distressed pricing

Hotel is also in deep distress, but we believe is poised to recover in the intermediate term, providing potential

opportunities to participate in the recovery on a structured basis given capital market dislocation

●

Office remains TBD, as users grapple with the benefits and limitations of remote work and health-related de-

densification trends

We believe niche sectors such as single-family rental and medical office are also poised to benefit

Retail faces significant challenges given changes in consumer trends and multiplying tenant bankruptcies

Selective opportunities in niche assets are expected to supplement, but not dominate, the portfolio

In the midst of widespread pricing dislocation, Ares will seek to create alpha by pivoting between sectors as these trends evolve

Based on Ares' Real Estate Group's current observations of the market as of August 31, 2020. There is no guarantee or assurance investment objectives will be achieved. The situation

surrounding COVID-19 is fluid and developing rapidly. As such, our views are subject to change at any time. Forward looking statements are not reliable indicators of future events and no

guarantee or assurance is given that such activities will occur as expected or at all. Actual events or conditions are unlikely to be consistent with, and may differ materially from, those assumed.

1. Bloomberg Consensus Forecasts as of September 2020.

ARES

Confidential - Not for Publication or Distribution

24View entire presentation