Baird Investment Banking Pitch Book

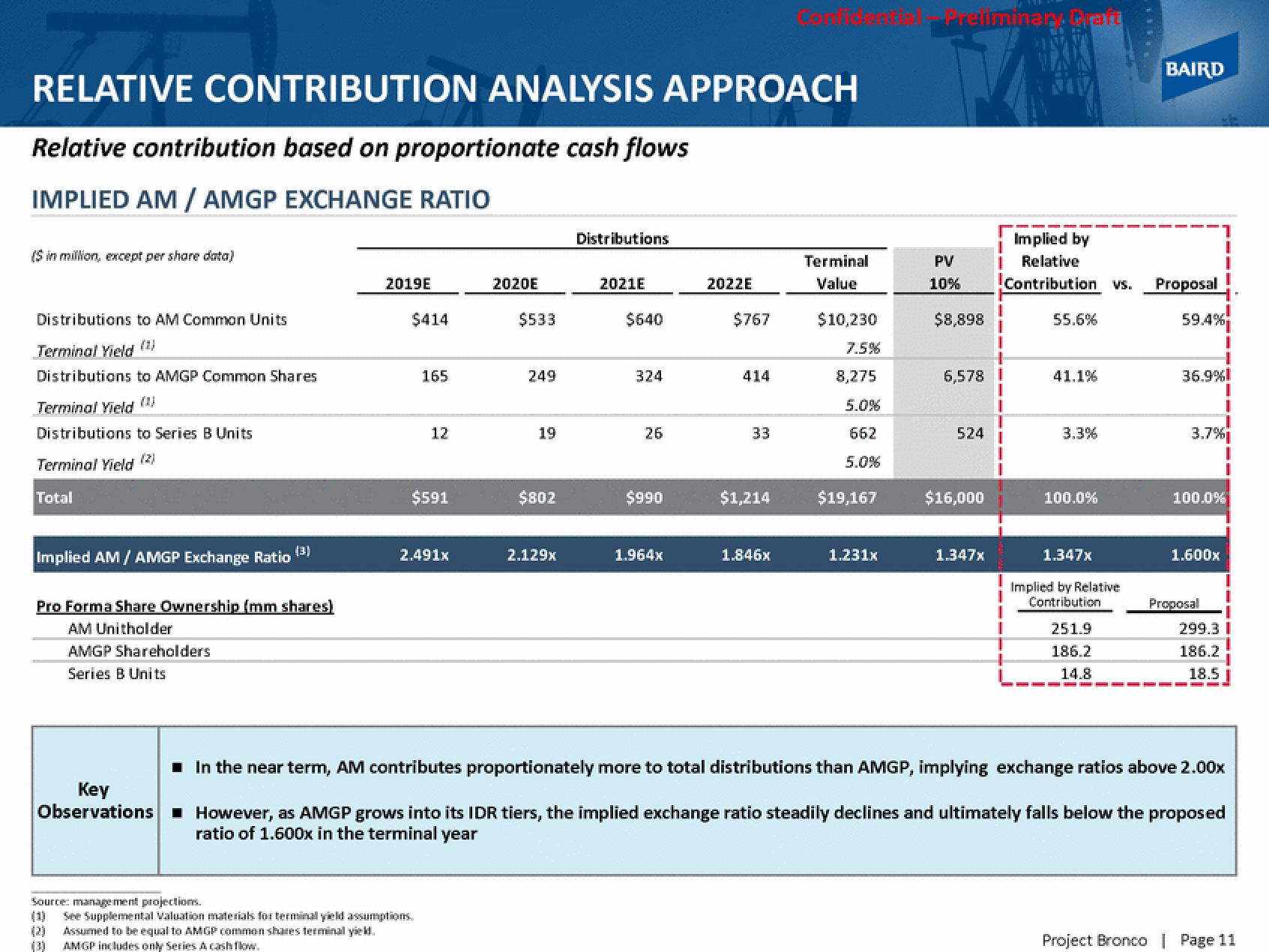

RELATIVE CONTRIBUTION ANALYSIS APPROACH

Relative contribution based on proportionate cash flows

IMPLIED AM / AMGP EXCHANGE RATIO

(S in million, except per share data)

Distributions to AM Common Units

Terminal Yield (2)

Distributions to AMGP Common Shares

Terminal Yield (1)

Distributions to Series B Units

Terminal Yield (2)

Total

Implied AM/ AMGP Exchange Ratio

(3)

Pro Forma Share Ownership (mm shares)

AM Unitholder

AMGP Shareholders

Series B Units

Key

Observations

2019E

$414

165

12

$591

2.491x

Source: management projections.

(1) See Supplemental Valuation materials for terminal yield assumptions.

(2) Assumed to be equal to AMGP common shares terminal yield.

AMGP includes only Series A cash flow.

2020E

$533

249

19

$802

2.129x

Distributions

2021E

$640

324

26

$990

1.964x

2022E

$767

414

33

$1,214

1.846x

Terminal

Value

$10,230

7.5%

8,275

5.0%

662

5.0%

$19,167

1.231x

Preliminary Graft

PV

10%

$8,898

6,578 I

524

$16,000

1.347x

I Relative

Contribution vs.

Implied by

1

I

55.6%

41.1%

3.3%

100.0%

1.347x

Implied by Relative

Contribution

251.9

186.2

14.8

BAIRD

Proposal

59.4%

I

36.9%1

I

3.7%

100.0%

1.600x

1

Proposal

299.3 I

186.2

18.5 I

■ In the near term, AM contributes proportionately more to total distributions than AMGP, implying exchange ratios above 2.00x

However, as AMGP grows into its IDR tiers, the implied exchange ratio steadily declines and ultimately falls below the proposed

ratio of 1.600x in the terminal year

Project Bronco | Page 11View entire presentation