Kinnevik Results Presentation Deck

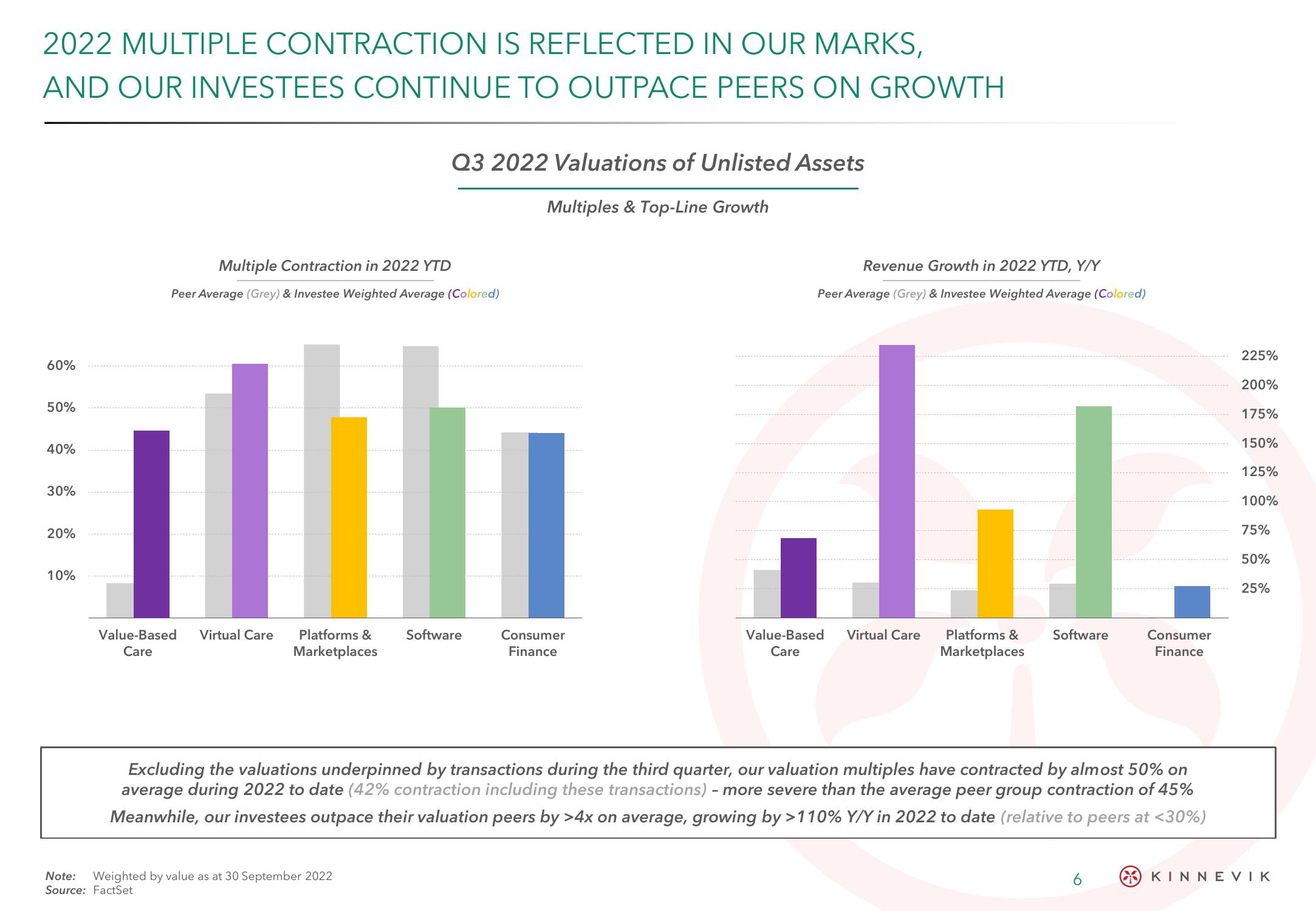

2022 MULTIPLE CONTRACTION IS REFLECTED IN OUR MARKS,

AND OUR INVESTEES CONTINUE TO OUTPACE PEERS ON GROWTH

60%

50%

40%

30%

20%

10%

Multiple Contraction in 2022 YTD

Peer Average (Grey) & Investee Weighted Average (Colored)

Value-Based Virtual Care

Care

Platforms &

Marketplaces

Q3 2022 Valuations of Unlisted Assets

Multiples & Top-Line Growth

Note: Weighted by value as at 30 September 2022

Source: FactSet

Software

Consumer

Finance

Revenue Growth in 2022 YTD, Y/Y

Peer Average (Grey) & Investee Weighted Average (Colored)

...

Platforms &

Marketplaces

Value-Based

Care

Virtual Care

Software

Excluding the valuations underpinned by transactions during the third quarter, our valuation multiples have contracted by almost 50% on

average during 2022 to date (42% contraction including these transactions) - more severe than the average peer group contraction of 45%

Meanwhile, our investees outpace their valuation peers by >4x on average, growing by >110% Y/Y in 2022 to date (relative to peers at <30%)

Consumer

Finance

6

225%

200%

175%

150%

125%

100%

75%

50%

25%

KINNEVIKView entire presentation