HSBC Investor Day Presentation Deck

Outbound²

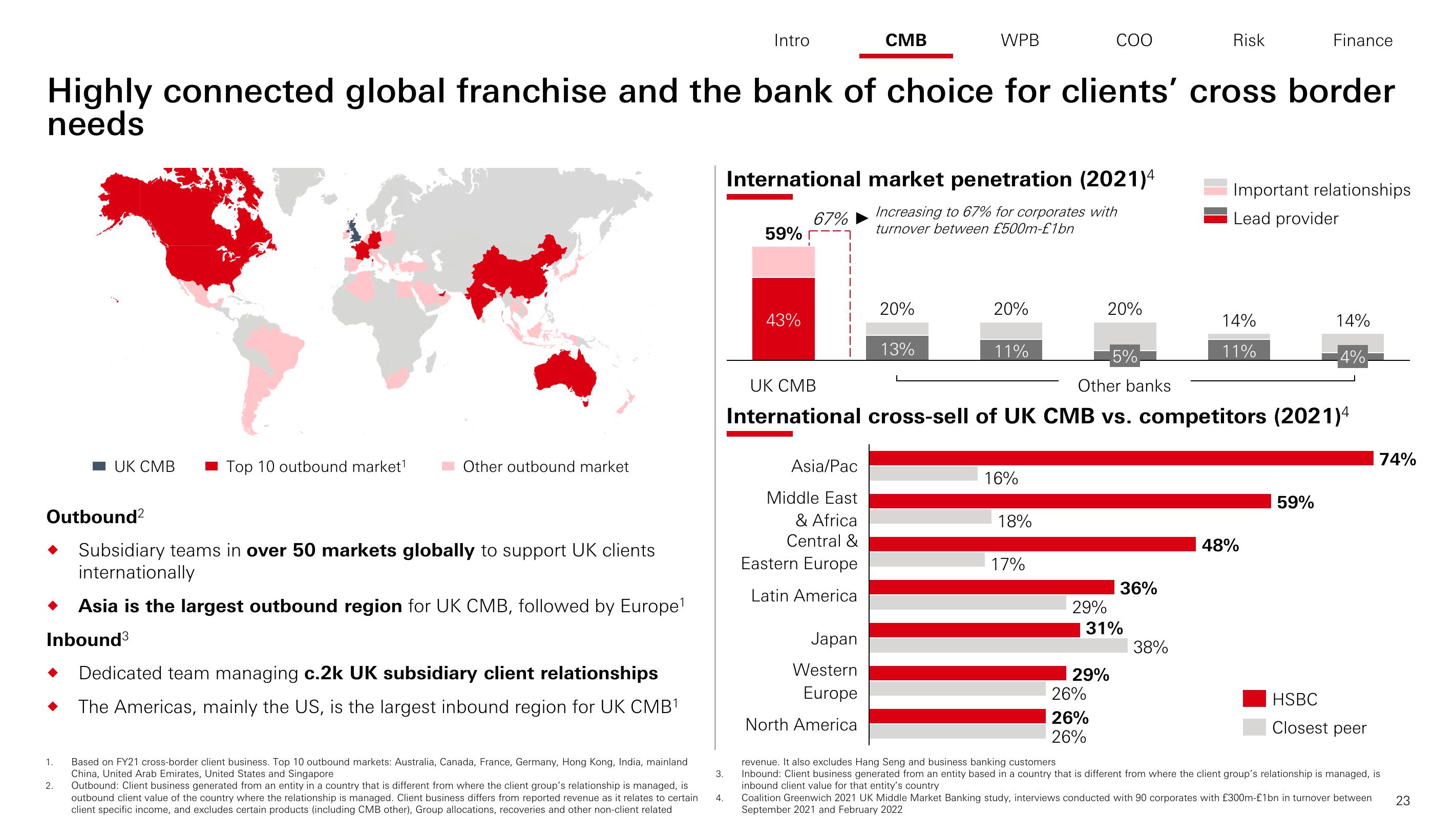

UK CMB

1.

2.

Top 10 outbound market¹

Subsidiary teams in over 50 markets globally to support UK clients

internationally

Asia is the largest outbound region for UK CMB, followed by Europe¹

Inbound³

Highly connected global franchise and the bank of choice for clients' cross border

needs

Other outbound market

Dedicated team managing c.2k UK subsidiary client relationships

The Americas, mainly the US, is the largest inbound region for UK CMB¹

Based on FY21 cross-border client business. Top 10 outbound markets: Australia, Canada, France, Germany, Hong Kong, India, mainland

China, United Arab Emirates, United States and Singapore

Outbound: Client business generated from an entity in a country that is different from where the client group's relationship is managed, is

outbound client value of the country where the relationship is managed. Client business differs from reported revenue as it relates to certain

client specific income, and excludes certain products (including CMB other), Group allocations, recoveries and other non-client related

3.

Intro

4.

59%

43%

International market penetration (2021)4

Increasing to 67% for corporates with

turnover between £500m-£1bn

67%

CMB

Asia/Pac

Middle East

& Africa

Central &

Eastern Europe

Latin America

Japan

Western

Europe

North America

WPB

20%

13%

20%

11%

16%

18%

17%

COO

29%

20%

UK CMB

Other banks

International cross-sell of UK CMB vs. competitors (2021)4

29%

26%

26%

26%

5%

31%

36%

Risk

38%

Important relationships

Lead provider

14%

11%

Finance

48%

59%

14%

4%

HSBC

Closest peer

74%

revenue. It also excludes Hang Seng and business banking customers

Inbound: Client business generated from an entity based in a country that is different from where the client group's relationship is managed, is

inbound client value for that entity's country

Coalition Greenwich 2021 UK Middle Market Banking study, interviews conducted with 90 corporates with £300m-£1bn in turnover between

September 2021 and February 2022

23View entire presentation