Investor Presentation

ENERGY EVOLUTION

NATURAL RESOURCES

INTRO

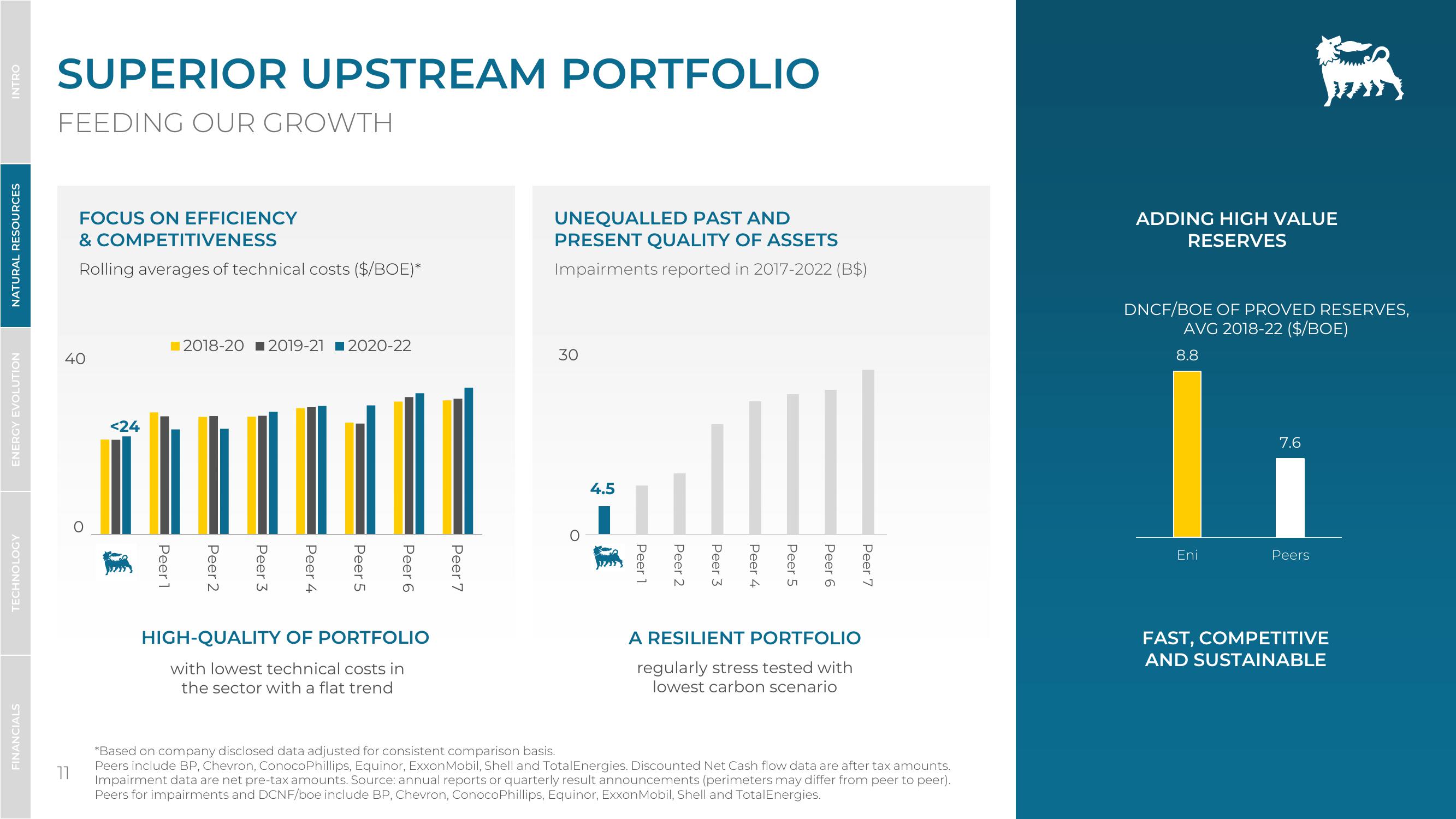

SUPERIOR UPSTREAM PORTFOLIO

FEEDING OUR GROWTH

FOCUS ON EFFICIENCY

& COMPETITIVENESS

Rolling averages of technical costs ($/BOE)*

40

2018-20 2019-21 2020-22

UNEQUALLED PAST AND

PRESENT QUALITY OF ASSETS

Impairments reported in 2017-2022 (B$)

30

50

ADDING HIGH VALUE

RESERVES

DNCF/BOE OF PROVED RESERVES,

AVG 2018-22 ($/BOE)

8.8

FINANCIALS

TECHNOLOGY

11

<24

HIGH-QUALITY OF PORTFOLIO

with lowest technical costs in

the sector with a flat trend

Peer 7

4.5

Peer 6

Peer 5

Peer 4

Peer 3

Peer 2

Peer 1

Peer 7

A RESILIENT PORTFOLIO

regularly stress tested with

lowest carbon scenario

*Based on company disclosed data adjusted for consistent comparison basis.

Peers include BP, Chevron, ConocoPhillips, Equinor, Exxon Mobil, Shell and Total Energies. Discounted Net Cash flow data are after tax amounts.

Impairment data are net pre-tax amounts. Source: annual reports or quarterly result announcements (perimeters may differ from peer to peer).

Peers for impairments and DCNF/boe include BP, Chevron, ConocoPhillips, Equinor, ExxonMobil, Shell and TotalEnergies.

7.6

Eni

Peers

FAST, COMPETITIVE

AND SUSTAINABLEView entire presentation