J.P.Morgan Investment Banking Pitch Book

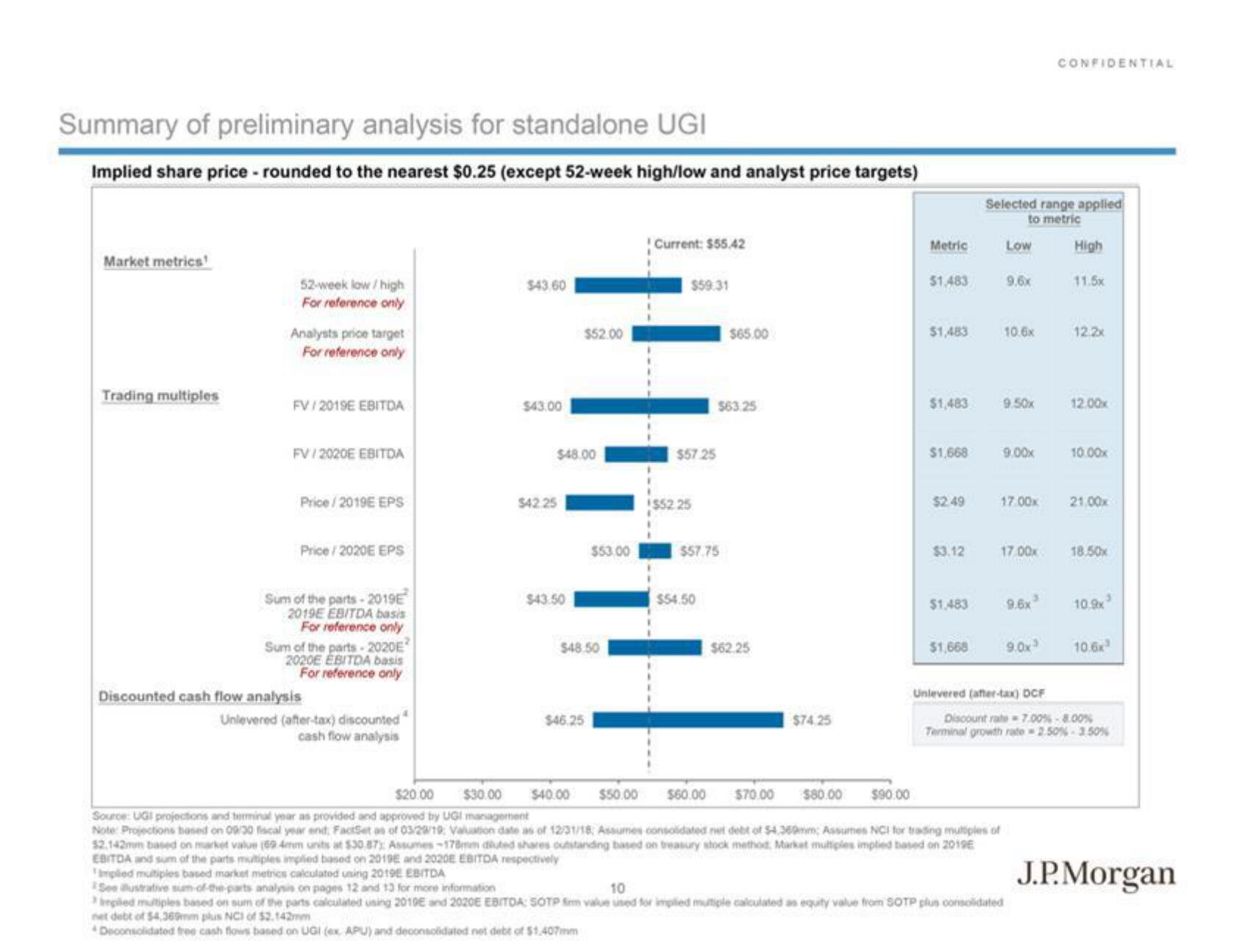

Summary of preliminary analysis for standalone UGI

Implied share price - rounded to the nearest $0.25 (except 52-week high/low and analyst price targets)

Market metrics

Trading multiples

52-week low/high

For reference only

Analysts price target

For reference only

FV/2019E EBITDA

FV/2020E EBITDA

Price / 2019E EPS

Price / 2020E EPS

Sum of the parts - 2019E

2019E EBITDA basis

For reference only

Sum of the parts-2020E²

2020E EBITDA basis

For reference only

Discounted cash flow analysis

Unlevered (after-tax) discounted

cash flow analysis

$43.60

$43.00

$48.00

$42.25

$43.50

$52.00

$46.25

$53.00

$48.50

Current: $55.42

$59.31

$57.25

$52 25

$57.75

$54.50

$65.00

$63.25

$62.25

$74.25

Metric

$1,483

$1,483

$1,483

$1,668

$2.49

$3.12

$1,483

$1,668

Selected range applied

to metric

Low

9.6x

10.6x

9.50x

9.00x

17.00x

17.00x

9.6x³

$20.00 $30.00 $40.00

$50.00 $60.00 $70.00 $80.00

$90.00

Source: UGI projections and terminal year as provided and approved by UĢI management

Note: Projections based on 09:30 fiscal year end FactSet as of 03/29/19, Valuation date as of 12/31/18, Assumes consolidated net debt of $4.369mm; Assumes NCI for trading multiples of

$2,142mm based on market value (69 4mm units at $30,87% Assumes-178mm diluted shares outstanding based on treasury stock method, Market multiples implied based on 2019E

EBITDA and sum of the parts multiples implied based on 2019 and 2020E EBITDA respectively

Implied multiples based market metrics calculated using 2019E EBITDA

See ilustrative sum of the parts analysis on pages 12 and 13 for more information

10

implied multiples based on sum of the parts calculated using 2010 and 2020E EBITDA: SOTP Sim value used for implied multiple calculated as equity value from SOTP plus consolidated

net debt of $4,369mm plus NC1 of $2.142mm

Deconsolidated free cash flows based on UGI (ex APU) and deconsolidated not debt of $1.407mm

9.0x²

Unlevered (after-tax) DCF

CONFIDENTIAL

High

1151

12.2x

12.00x

10.00x

21,00x

18.50x

10.9x

10.6x²

Discount rate=7.00% -8.00%

Terminal growth rate=2.50%-350%

J.P. MorganView entire presentation