Presentation to Vermont Pension Investment Committee

Ares' ESG Screening Framework

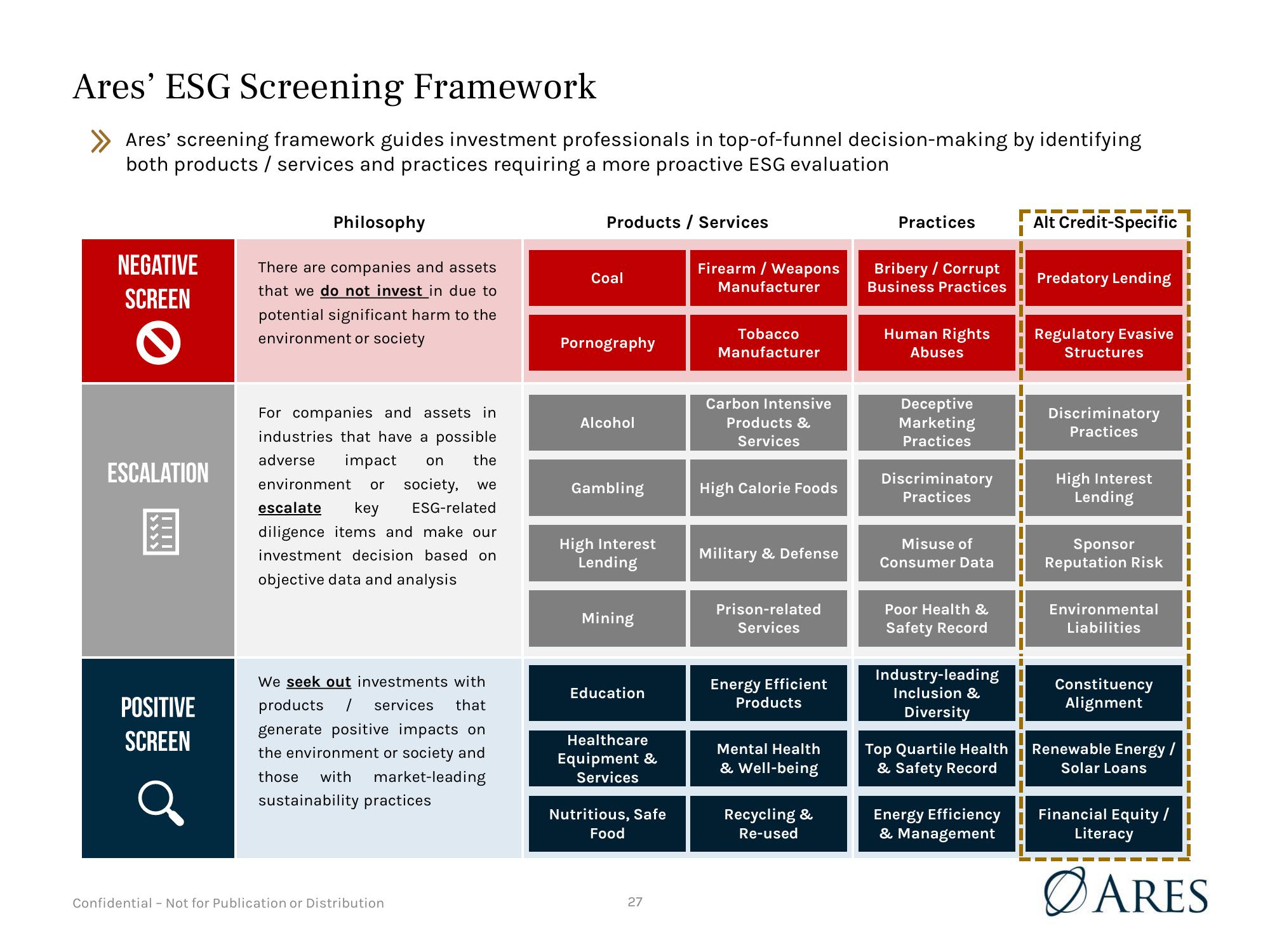

Ares' screening framework guides investment professionals in top-of-funnel decision-making by identifying

both products / services and practices requiring a more proactive ESG evaluation

NEGATIVE

SCREEN

ESCALATION

POSITIVE

SCREEN

а

Philosophy

There are companies and assets

that we do not invest in due to

potential significant harm to the

environment or society

or

we

For companies and assets in

industries that have a possible

adverse impact on the

environment

society,

escalate

key ESG-related

diligence items and make our

investment decision ba

objective data and analysis

on

We seek out investments with

products 1 services that

generate positive impacts on

the environment or society and

those with market-leading

sustainability practices

Confidential - Not for Publication or Distribution

Products / Services

Coal

Pornography

Alcohol

Gambling

High Interest

Lending

Mining

Education

Healthcare

Equipment &

Services

Nutritious, Safe

Food

27

Firearm / Weapons

Manufacturer

Tobacco

Manufacturer

Carbon Intensive

Products &

Services

High Calorie Foods

Military & Defense

Prison-related

Services

Energy Efficient

Products

Mental Health

& Well-being

Recycling &

Re-used

Practices

Bribery / Corrupt

Business Practices

Human Rights

Abuses

Deceptive

Marketing

Practices

Discriminatory

Practices

Misuse of

Consumer Data

Poor Health &

Safety Record

Industry-leading

Inclusion &

Diversity

Top Quartile Health

& Safety Record

Energy Efficiency

& Management

Alt Credit-Specific

Predatory Lending

Regulatory Evasive

Structures

Discriminatory

Practices

High Interest

Lending

Sponsor

Reputation Risk

Environmental

Liabilities

Constituency

Alignment

Renewable Energy /

Solar Loans

Financial Equity /

Literacy

ARESView entire presentation