Dutch Bros Results Presentation Deck

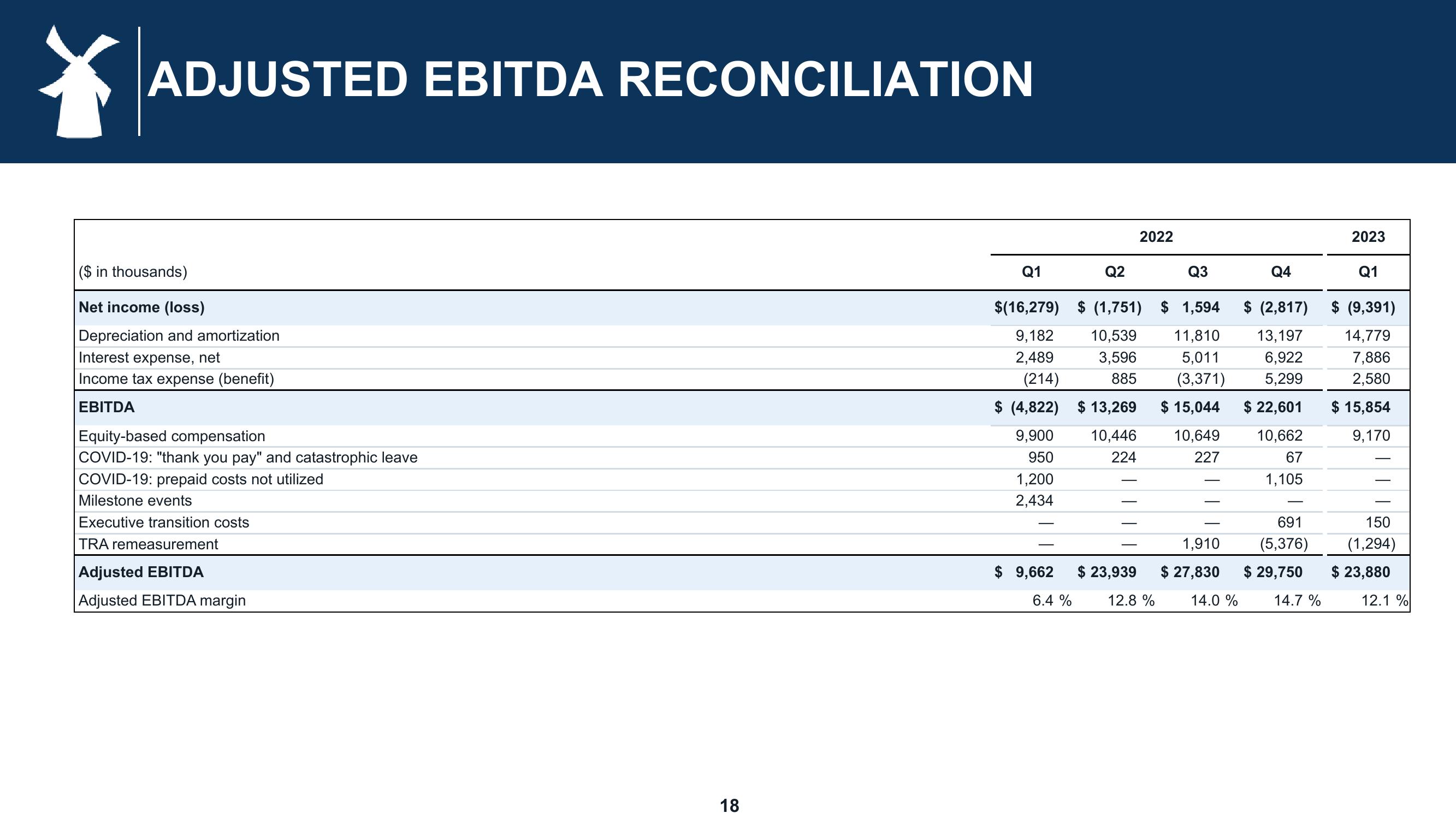

ADJUSTED EBITDA RECONCILIATION

($ in thousands)

Net income (loss)

Depreciation and amortization

Interest expense, net

Income tax expense (benefit)

EBITDA

Equity-based compensation

COVID-19: "thank you pay" and catastrophic leave

COVID-19: prepaid costs not utilized

Milestone events

Executive transition costs

TRA remeasurement

Adjusted EBITDA

Adjusted EBITDA margin

18

Q1

$(16,279)

9,182

2,489

(214)

$ (4,822) $13,269

10,446

224

9,900

950

1,200

2,434

-

$ 9,662

Q2

6.4 %

Q3

$ (2,817)

$ (1,751) $ 1,594

10,539 11,810 13,197

3,596 5,011

6,922

885 (3,371) 5,299

$ 22,601

10,662

67

1,105

$ 15,044

10,649

227

2022

Q4

$ 23,939

12.8 %

691

(5,376)

1,910

$ 27,830 $ 29,750

14.0 % 14.7%

2023

Q1

$ (9,391)

14,779

7,886

2,580

$ 15,854

9,170

150

(1,294)

$ 23,880

12.1 %View entire presentation