MoneyLion Results Presentation Deck

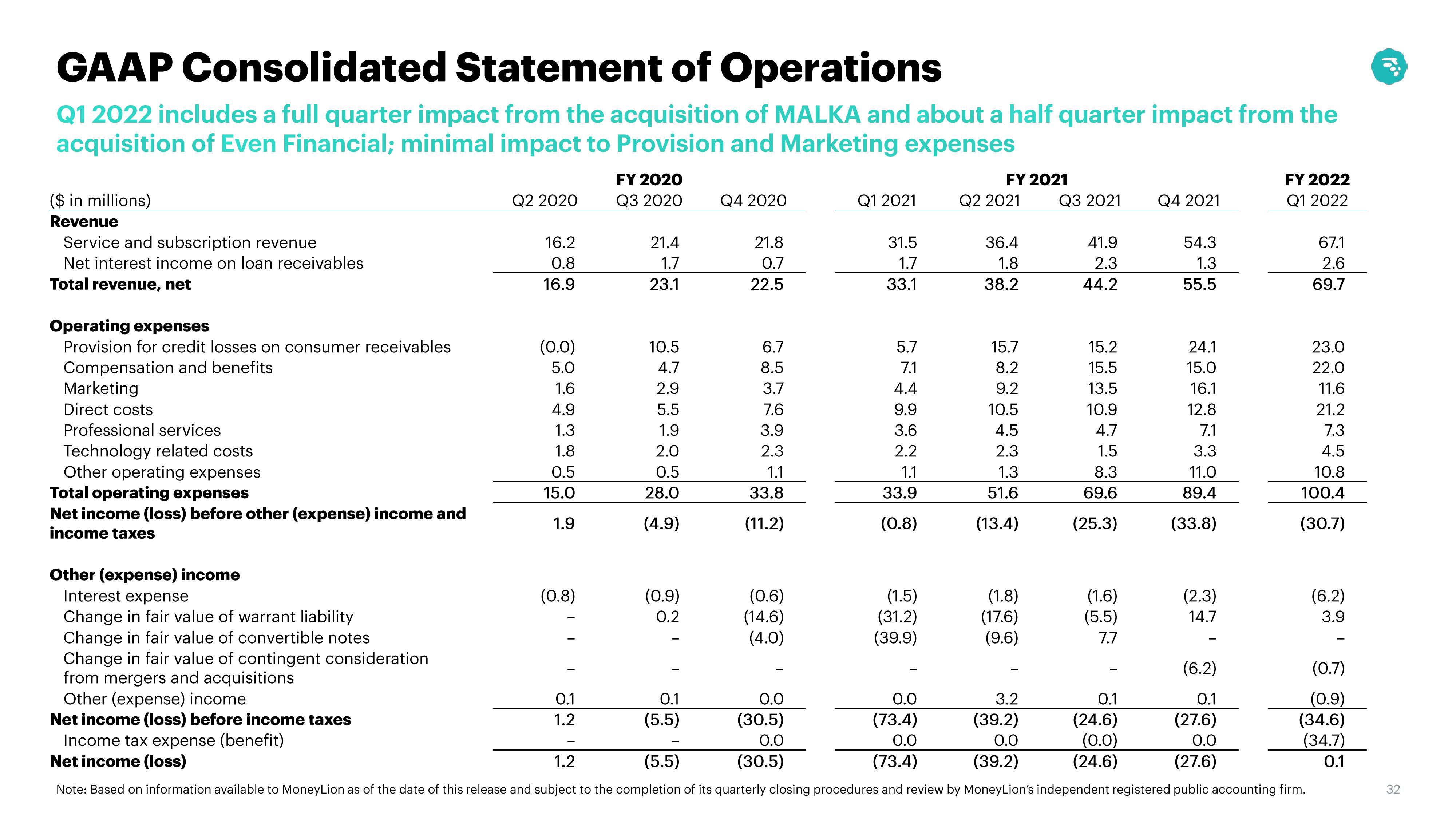

GAAP Consolidated Statement of Operations

Q1 2022 includes a full quarter impact from the acquisition of MALKA and about a half quarter impact from the

acquisition of Even Financial; minimal impact to Provision and Marketing expenses

($ in millions)

Revenue

Service and subscription revenue

Net interest income on loan receivables

Total revenue, net

Operating expenses

Provision for credit losses on consumer receivables

Compensation and benefits

Marketing

Direct costs

Professional services

Technology related costs

Other operating expenses

Total operating expenses

Net income (loss) before other (expense) income and

income taxes

Other (expense) income

Interest expense

Change in fair value of warrant liability

Change in fair value of convertible notes

Change in fair value of contingent consideration

from mergers and acquisitions

Q2 2020

16.2

0.8

16.9

(0.0)

5.0

1.6

4.9

1.3

1.8

0.5

15.0

1.9

(0.8)

FY 2020

Q3 2020

0.1

1.2

21.4

1.7

23.1

10.5

4.7

2.9

5.5

1.9

2.0

0.5

28.0

(4.9)

(0.9)

0.2

Q4 2020

0.1

(5.5)

21.8

0.7

22.5

6.7

8.5

3.7

7.6

3.9

2.3

1.1

33.8

(11.2)

(0.6)

(14.6)

(4.0)

Q1 2021

0.0

(30.5)

0.0

(30.5)

31.5

1.7

33.1

5.7

7.1

4.4

9.9

3.6

2.2

1.1

33.9

(0.8)

(1.5)

(31.2)

(39.9)

FY 2021

Q2 2021

36.4

1.8

38.2

15.7

8.2

9.2

10.5

4.5

2.3

1.3

51.6

(13.4)

(1.8)

(17.6)

(9.6)

Q3 2021

41.9

2.3

44.2

15.2

15.5

13.5

10.9

4.7

1.5

8.3

69.6

(25.3)

(1.6)

(5.5)

7.7

Q4 2021

0.1

(24.6)

(0.0)

(24.6)

54.3

1.3

55.5

24.1

15.0

16.1

12.8

7.1

3.3

11.0

89.4

(33.8)

(6.2)

Other (expense) income

0.0

3.2

0.1

(27.6)

Net income (loss) before income taxes

(73.4)

(39.2)

0.0

0.0

0.0

Income tax expense (benefit)

Net income (loss)

Note: Based on information available to MoneyLion as of the date of this release and subject to the completion of its quarterly closing procedures and review by MoneyLion's independent registered public accounting firm.

1.2

(5.5)

(73.4)

(39.2)

(27.6)

(2.3)

14.7

FY 2022

Q1 2022

67.1

2.6

69.7

23.0

22.0

11.6

21.2

7.3

4.5

10.8

100.4

(30.7)

(6.2)

3.9

(0.7)

(0.9)

(34.6)

(34.7)

0.1

10⁰

32View entire presentation