Presentation to Vermont Pension Investment Committee

Designing Investments for Stressful Times

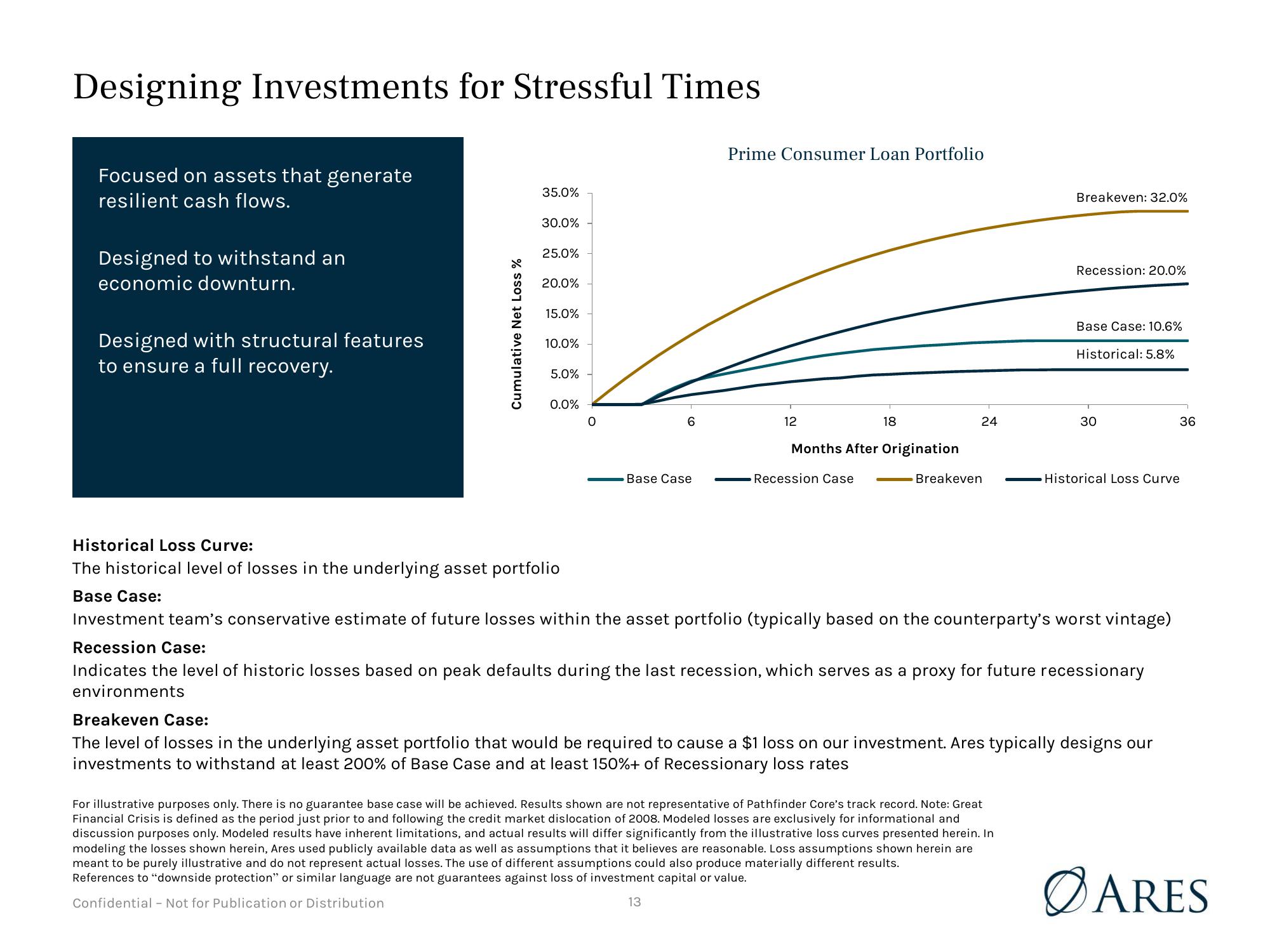

Focused on assets that generate

resilient cash flows.

Designed to withstand an

economic downturn.

Designed with structural features

to ensure a full recovery.

Cumulative Net Loss %

35.0%

30.0%

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

Historical Loss Curve:

The historical level of losses in the underlying asset portfolio

Base Case:

0

6

Base Case

Prime Consumer Loan Portfolio

12

18

Months After Origination

Recession Case

24

Breakeven

Breakeven: 32.0%

Recession: 20.0%

For illustrative purposes only. There is no guarantee base case will be achieved. Results shown are not representative of Pathfinder Core's track record. Note: Great

Financial Crisis is defined as the period just prior to and following the credit market dislocation of 2008. Modeled losses are exclusively for informational and

discussion purposes only. Modeled results have inherent limitations, and actual results will differ significantly from the illustrative loss curves presented herein. In

modeling the losses shown herein, Ares used publicly available data as well as assumptions that it believes are reasonable. Loss assumptions shown herein are

meant to be purely illustrative and do not represent actual losses. The use of different assumptions could also produce materially different results.

References to "downside protection" or similar language are not guarantees against loss of investment capital or value.

Confidential - Not for Publication or Distribution

13

Base Case: 10.6%

Historical: 5.8%

30

Historical Loss Curve

Investment team's conservative estimate of future losses within the asset portfolio (typically based on the counterparty's worst vintage)

Recession Case:

Indicates the level of historic losses based on peak defaults during the last recession, which serves as a proxy for future recessionary

environments

Breakeven Case:

The level of losses in the underlying asset portfolio that would be required to cause a $1 loss on our investment. Ares typically designs our

investments to withstand at least 200% of Base Case and at least 150%+ of Recessionary loss rates

36

ØARESView entire presentation