Third Point Management Activist Presentation Deck

RETURN ON INVESTED CAPITAL

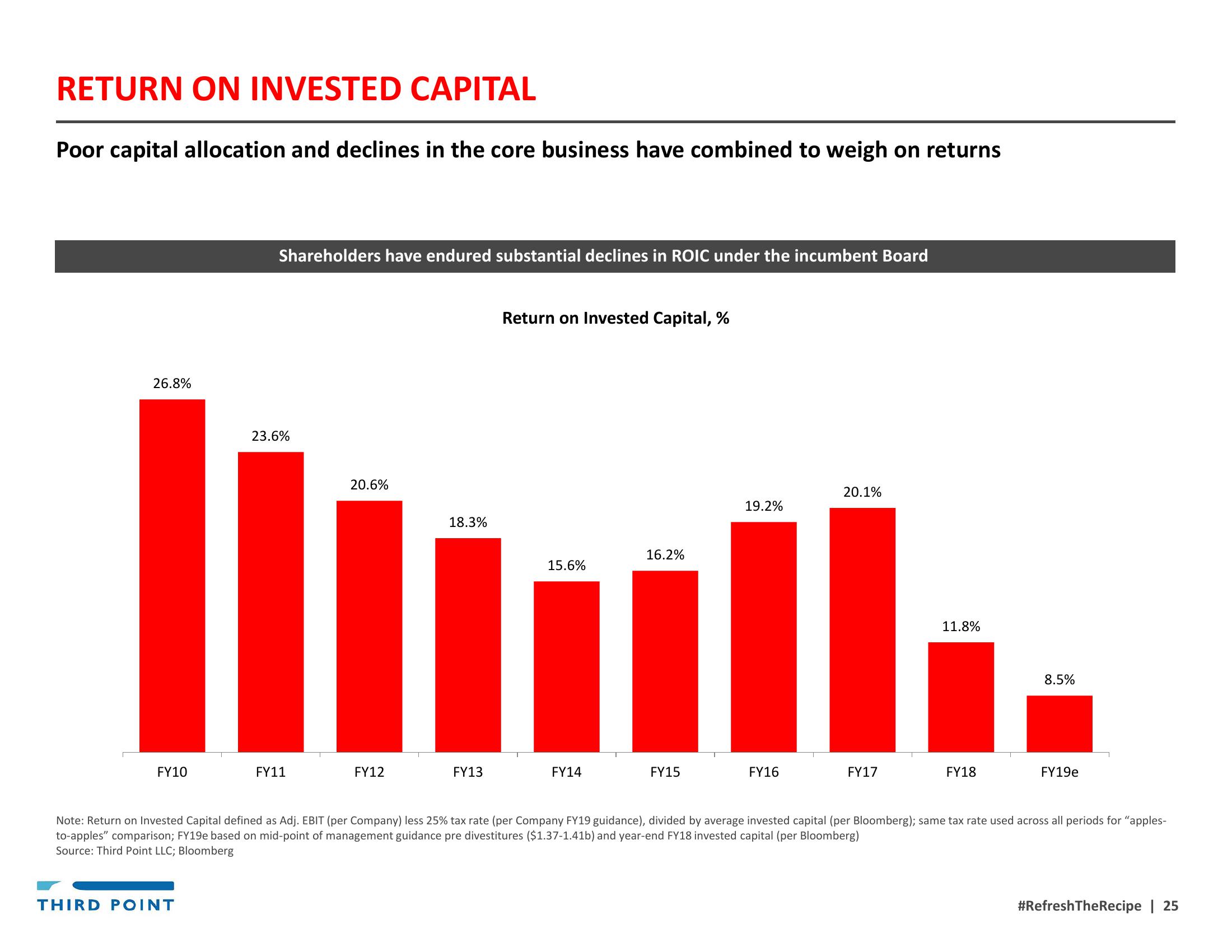

Poor capital allocation and declines in the core business have combined to weigh on returns

26.8%

FY10

Shareholders have endured substantial declines in ROIC under the incumbent Board

THIRD POINT

23.6%

FY11

20.6%

FY12

18.3%

FY13

Return on Invested Capital, %

20.1%

19.2%

.....

11.8%

FY16

FY17

15.6%

FY14

16.2%

FY15

FY18

8.5%

FY19e

Note: Return on Invested Capital defined as Adj. EBIT (per Company) less 25% tax rate (per Company FY19 guidance), divided by average invested capital (per Bloomberg); same tax rate used across all periods for "apples-

to-apples" comparison; FY19e based on mid-point of management guidance pre divestitures ($1.37-1.41b) and year-end FY18 invested capital (per Bloomberg)

Source: Third Point LLC; Bloomberg

#RefreshTheRecipe | 25View entire presentation