Investor Presentation

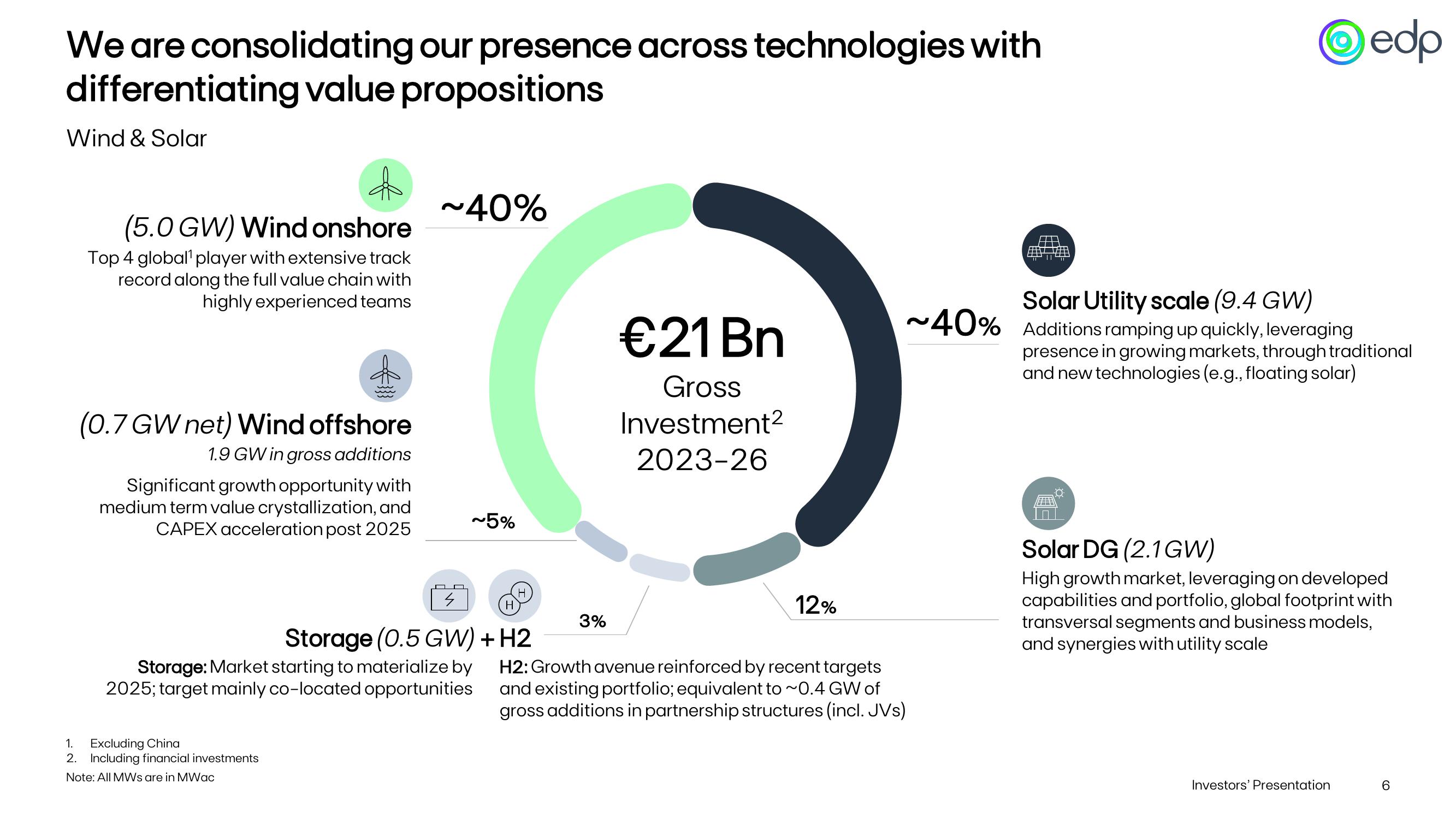

We are consolidating our presence across technologies with

differentiating value propositions

Wind & Solar

Oedp

(5.0 GW) Wind onshore

Top 4 global player with extensive track

record along the full value chain with

highly experienced teams

~40%

(0.7 GW net) Wind offshore

1.9 GW in gross additions

Significant growth opportunity with

medium term value crystallization, and

CAPEX acceleration post 2025

~5%

H

3%

€21 Bn

Gross

Investment2

2023-26

12%

Storage (0.5 GW) + H2

Storage: Market starting to materialize by

2025; target mainly co-located opportunities

H2: Growth avenue reinforced by recent targets

and existing portfolio; equivalent to ~0.4 GW of

gross additions in partnership structures (incl. JVs)

1.

Excluding China

2. Including financial investments

Note: All MWs are in MWac

Solar Utility scale (9.4 GW)

~40% Additions ramping up quickly, leveraging

presence in growing markets, through traditional

and new technologies (e.g., floating solar)

Solar DG (2.1 GW)

High growth market, leveraging on developed

capabilities and portfolio, global footprint with

transversal segments and business models,

and synergies with utility scale

Investors' Presentation

6View entire presentation