Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

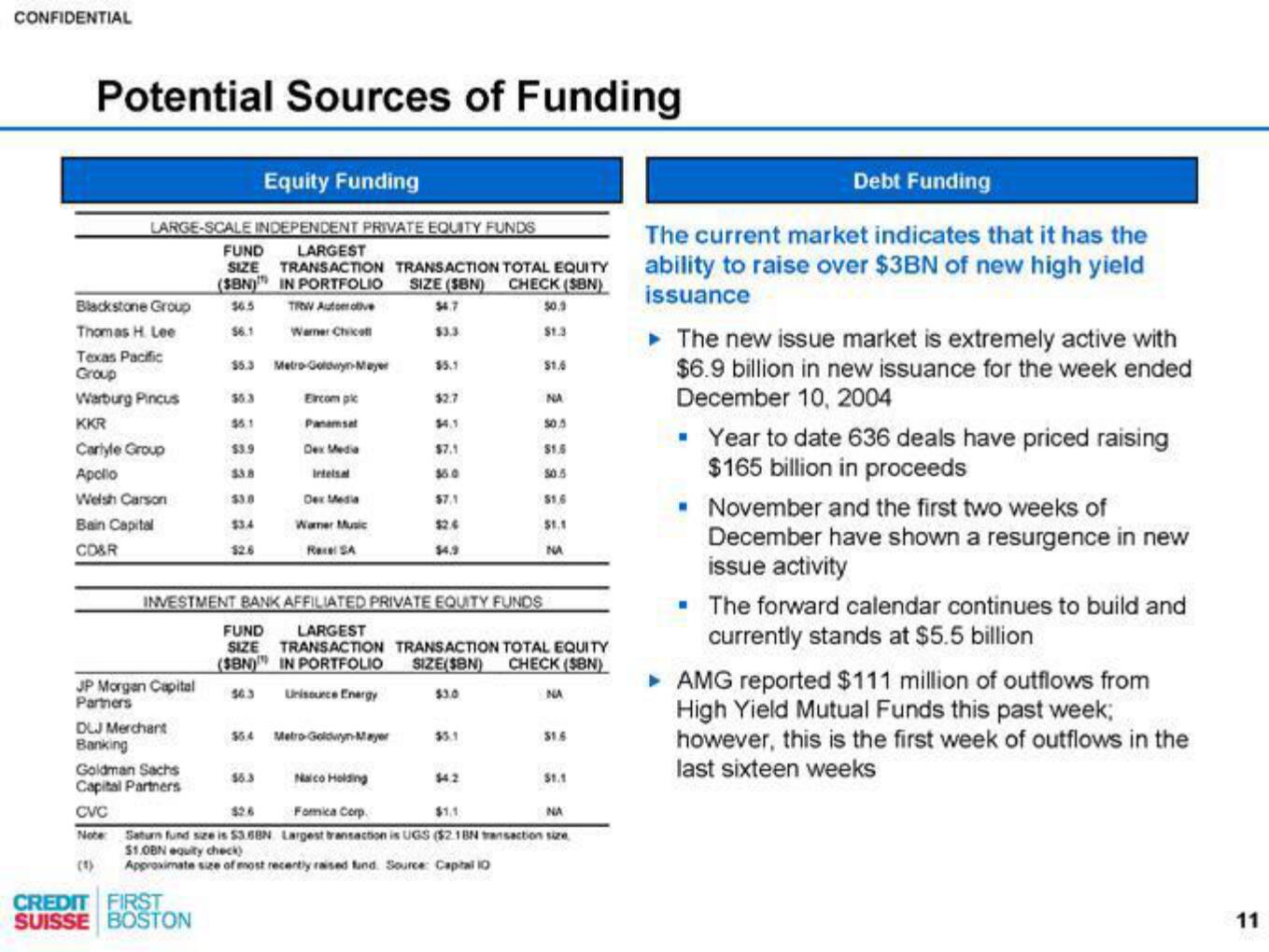

Potential Sources of Funding

LARGE-SCALE INDEPENDENT PRIVATE EQUITY FUNDS

FUND

LARGEST

SIZE TRANSACTION TRANSACTION TOTAL EQUITY

(SBN) IN PORTFOLIO SIZE (SBN) CHECK (SBN)

50.3

TRW Automrotive

Warner Chico

$1.3

Blackstone Group

Thomas H. Lee

Texas Pacific

Group

Warburg Pincus

KKR

Carlyle Group

Apollo

Welsh Carson

Bain Capital

CD&R

JP Morgan Capital

Partners

DLJ Merchant

Banking

Goldman Sachs

Capital Partners

CVC

Note:

56.1

CREDIT FIRST

SUISSE BOSTON

$5,3 Metro-Goldwyn-Mayer

Eircom plc

Panamsat

Dex Media

Intelsal

Dex Media

Warner Music

Race SA

46.1

$3.9

$3.8

$3.0

$3.4

$2.6

Equity Funding

FUND

SIZE

(SBN)

INVESTMENT BANK AFFILIATED PRIVATE EQUITY FUNDS

46.3 Unisource Energy

56.3

$64 Metro-Goldwyn-Mayer

$3.3

$5.1

Naico Holding

$2.7

$4.1

$7.1

$5.0

$7,1

$2.6

$4.9

$1.6

$3.0

NA

50.5

LARGEST

TRANSACTION TRANSACTION TOTAL EQUITY

IN PORTFOLIO SIZE($BN) CHECK (SBN)

$1.5

50.5

$1.6

$1.1

NA

NA

$1.6

$1.1

Fomica Corp.

NA

Saturn fund size is $3.68N Largest transaction is UGS ($2.18N transaction size

$1.0BN equity check)

Approximate size of most recently raised fund. Source: Capital 10

Debt Funding

The current market indicates that it has the

ability to raise over $3BN of new high yield

issuance

► The new issue market is extremely active with

$6.9 billion in new issuance for the week ended

December 10, 2004

• Year to date 636 deals have priced raising

$165 billion in proceeds

▪ November and the first two weeks of

December have shown a resurgence in new

issue activity

▪ The forward calendar continues to build and

currently stands at $5.5 billion

▸ AMG reported $111 million of outflows from

High Yield Mutual Funds this past week;

however, this is the first week of outflows in the

last sixteen weeks

11View entire presentation