GMS Investor Conference Presentation Deck

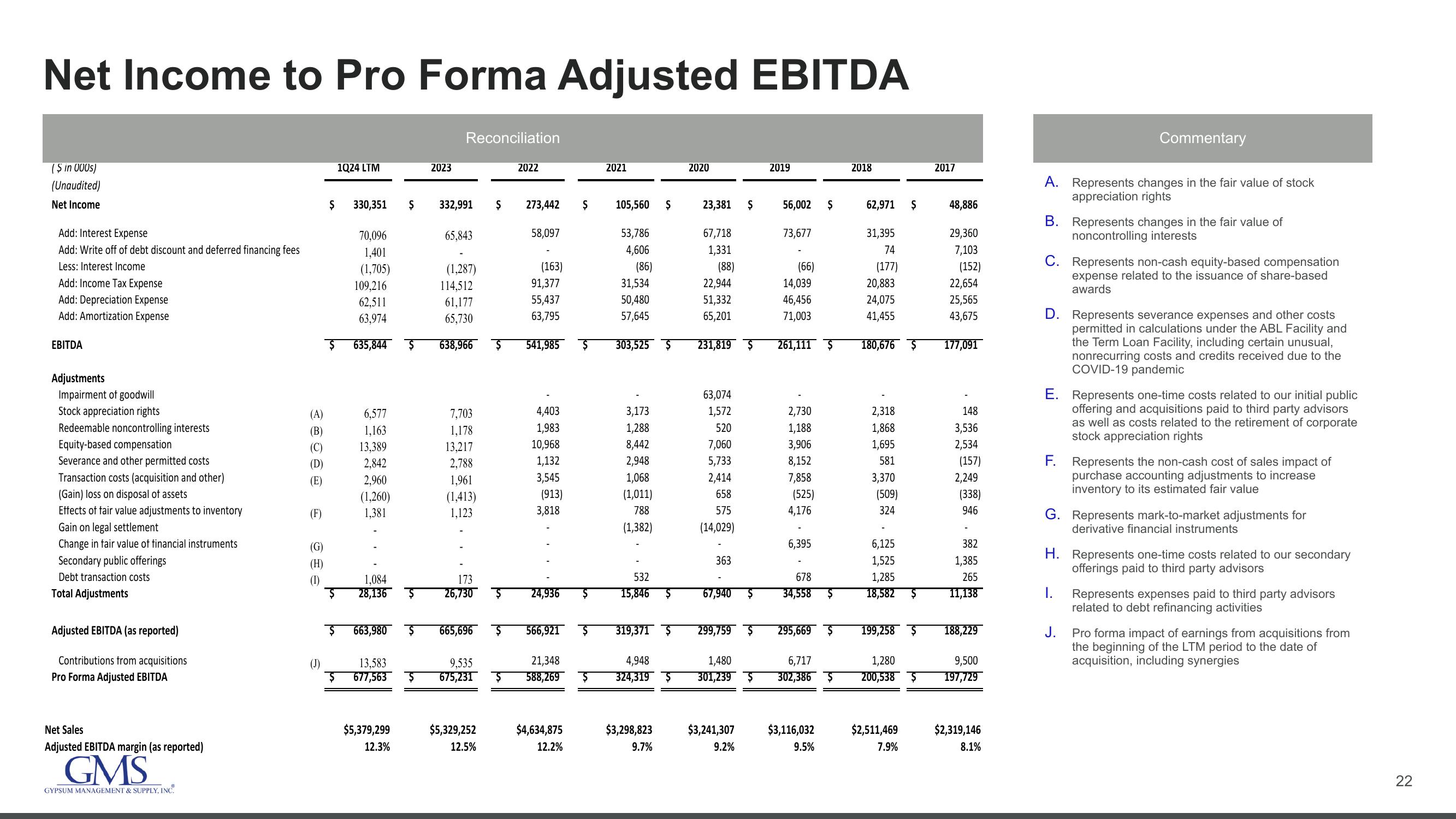

Net Income to Pro Forma Adjusted EBITDA

($ in 000s)

(Unaudited)

Net Income

Add: Interest Expense

Add: Write off of debt discount and deferred financing fees

Less: Interest Income

Add: Income Tax Expense

Add: Depreciation Expense

Add: Amortization Expense

EBITDA

Adjustments

Impairment of goodwill

Stock appreciation rights

Redeemable noncontrolling interests

Equity-based compensation

Severance and other permitted costs

costs (acquisition and other)

(Gain) loss on disposal of assets

Effects of fair value adjustments to inventory

Gain on legal settlement

Change in fair value of financial instruments

Secondary public offerings

Debt transaction costs

Total Adjustments

Adjusted EBITDA (as reported)

Contributions from acquisitions

Pro Forma Adjusted EBITDA

Net Sales

Adjusted EBITDA margin (as reported)

GMS

GYPSUM MANAGEMENT & SUPPLY, INC.

(A)

(B)

(C)

(D

(E)

(F)

(1)

(J)

1Q24 LTM

$ 330,351

$

70,096

1,401

(1,705)

109,216

62,511

63,974

635,844

6,577

1,163

13,389

2,842

2,960

(1,260)

1,381

1,084

28,136

$

$

$5,379,299

12.3%

2023

Reconciliation

332,991

65,843

(1,287)

114,512

61,177

65,730

638,966

7,703

1,178

13,217

2,788

1,961

(1,413)

1,123

173

26,730

$ 663,980 $ 665,696

$

$5,329,252

12.5%

$

9,535

13,583

677,563 $ 675,231 $

2022

273,442

58,097

(163)

91,377

55,437

63,795

541,985

4,403

1,983

10,968

1,132

3,545

(913)

3,818

24,936

$ 566,921 $

21,348

588,269 $

$4,634,875

12.2%

2021

Ş 105,560 S

53,786

4,606

(86)

31,534

50,480

57,645

$ 303,525 $

3,173

1,288

8,442

2,948

1,068

(1,011)

788

(1,382)

532

15,846 $

319,371 $

4,948

324,319 $

$3,298,823

9.7%

2020

63,074

1,572

520

7,060

5,733

2,414

658

575

(14,029)

23,381 Ş

67,718

1,331

(88)

22,944

51,332

65,201

231,819 $ 261,111 $

363

67,940

299,759 $

1,480

301,239 $

2019

$3,241,307

9.2%

56,002

73,677

(66)

14,039

46,456

71,003

2,730

1,188

3,906

8,152

7,858

(525)

4,176

6,395

$

678

34,558 $

295,669 $

6,717

302,386 $

$3,116,032

9.5%

2018

62,971 $

31,395

74

(177)

20,883

24,075

41,455

180,676 $

2,318

1,868

1,695

581

3,370

(509)

324

6,125

1,525

1,285

18,582 $

199,258 $

1,280

200,538 $

$2,511,469

7.9%

2017

48,886

29,360

7,103

(152)

22,654

25,565

43,675

177,091

148

3,536

2,534

(157)

2,249

(338)

946

382

1,385

265

11,138

188,229

9,500

197,729

$2,319,146

8.1%

Commentary

A. Represents changes in the fair value of stock

appreciation rights

B. Represents changes in the fair value of

noncontrolling interests

C. Represents non-cash equity-based compensation

expense related to the issuance of share-based

awards

D. Represents severance expenses and other costs

permitted in calculations under the ABL Facility and

the Term Loan Facility, including certain unusual,

nonrecurring costs and credits received due to the

COVID-19 pandemic

E. Represents one-time costs related to our initial public

offering and acquisitions paid to third party advisors

as well as costs related to the retirement of corporate

stock appreciation rights

F. Represents the non-cash cost of sales impact of

purchase accounting adjustments to increase

inventory to its estimated fair value

G. Represents mark-to-market adjustments for

derivative financial instruments

H. Represents one-time costs related to our secondary

offerings paid to third party advisors

Represents expenses paid to third party advisors

related to debt refinancing activities

J.

Pro forma impact of earnings from acquisitions from

the beginning of the LTM period to the date of

acquisition, including synergies

22View entire presentation