Tesla Results Presentation Deck

HIGHLIGHTS

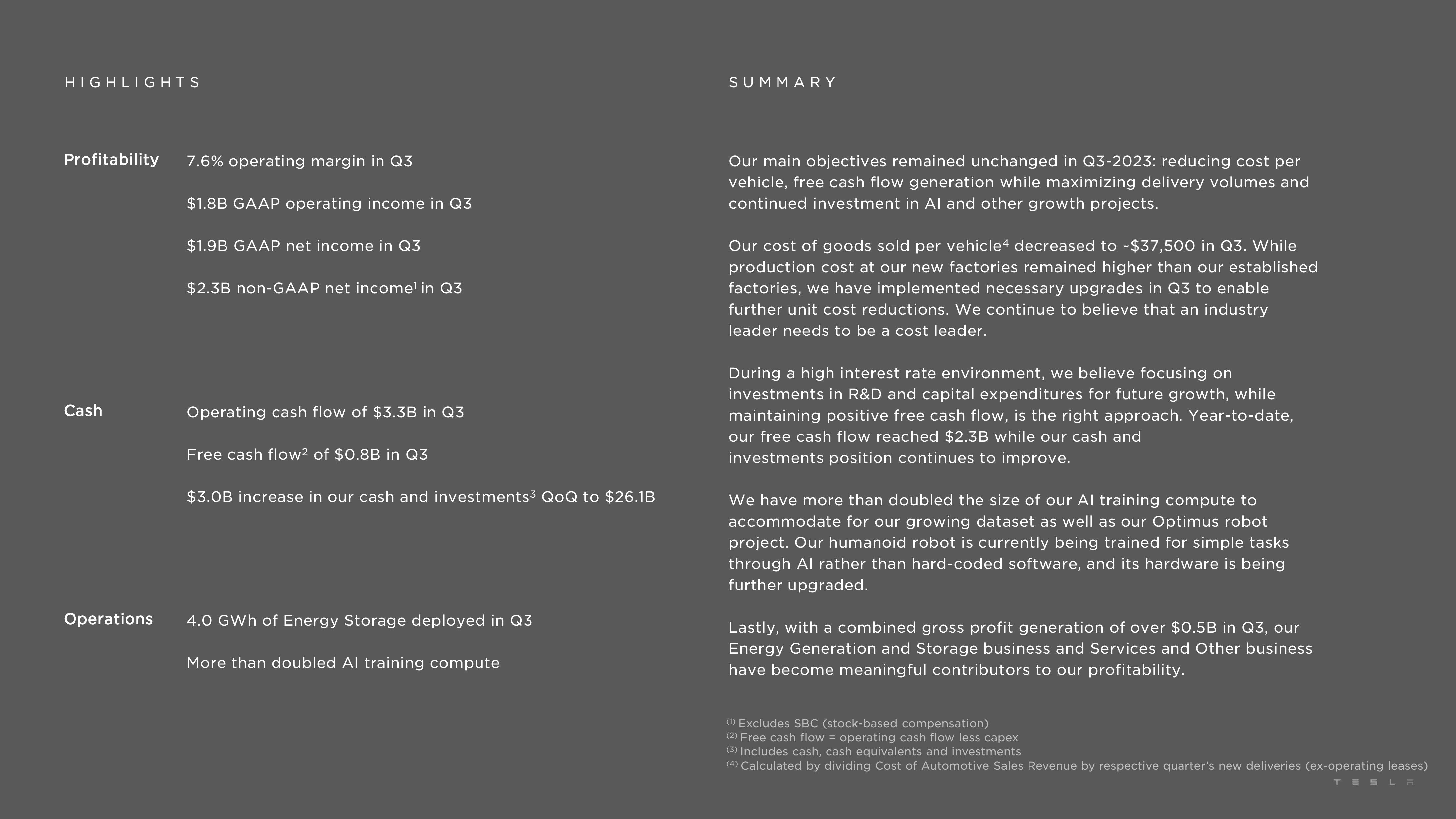

Profitability 7.6% operating margin in Q3

Cash

Operations

$1.8B GAAP operating income in Q3

$1.9B GAAP net income in Q3

$2.3B non-GAAP net income¹ in Q3

Operating cash flow of $3.3B in Q3

Free cash flow² of $0.8B in Q3

$3.0B increase in our cash and investments3 QoQ to $26.1B

4.0 GWh of Energy Storage deployed in Q3

More than doubled Al training compute

SUMMARY

Our main objectives remained unchanged in Q3-2023: reducing cost per

vehicle, free cash flow generation while maximizing delivery volumes and

continued investment in Al and other growth projects.

Our cost of goods sold per vehicle4 decreased to -$37,500 in Q3. While

production cost at our new factories remained higher than our established

factories, we have implemented necessary upgrades in Q3 to enable

further unit cost reductions. We continue to believe that an industry

leader needs to be a cost leader.

During a high interest rate environment, we believe focusing on

investments in R&D and capital expenditures for future growth, while

maintaining positive free cash flow, is the right approach. Year-to-date,

our free cash flow reached $2.3B while our cash and

investments position continues to improve.

We have more than doubled the size of our Al training compute to

accommodate for our growing dataset as well as our Optimus robot

project. Our humanoid robot is currently being trained for simple tasks

through Al rather than hard-coded software, and its hardware is being

further upgraded.

Lastly, with a combined gross profit generation of over $0.5B in Q3, our

Energy Generation and Storage business and Services and Other business

have become meaningful contributors to our profitability.

(1) Excludes SBC (stock-based compensation)

(2) Free cash flow = operating cash flow less capex

(3) Includes cash, cash equivalents and investments

(4) Calculated by dividing Cost of Automotive Sales Revenue by respective quarter's new deliveries (ex-operating leases)

TESLAView entire presentation