OSP Value Fund IV LP Q4 2022

OSP

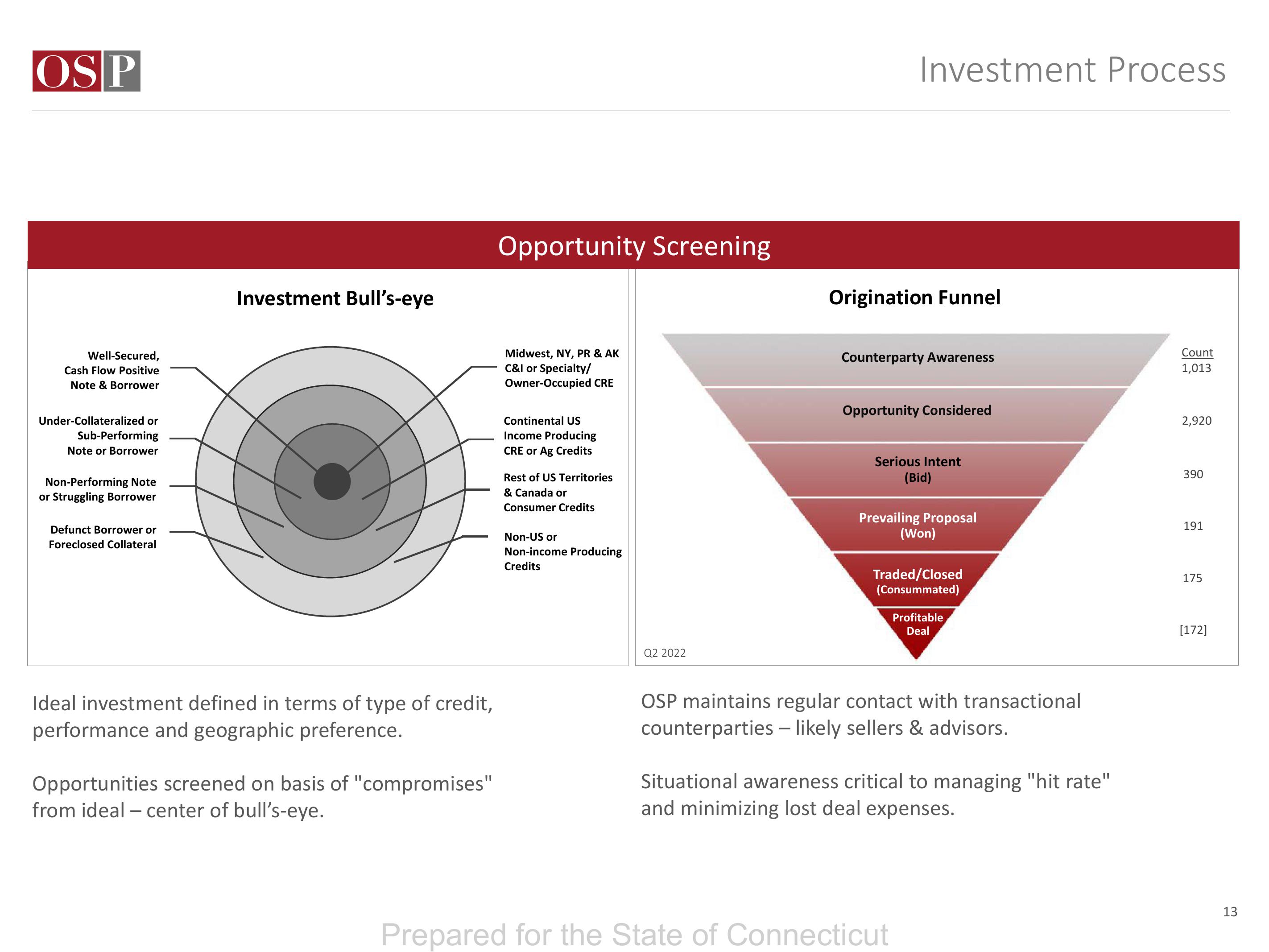

Well-Secured,

Cash Flow Positive

Note & Borrower

Under-Collateralized or

Sub-Performing

Note or Borrower

Non-Performing Note

or Struggling Borrower

Defunct Borrower or

Foreclosed Collateral

Investment Bull's-eye

Ideal investment defined in terms of type of credit,

performance and geographic preference.

Opportunities screened on basis of "compromises"

from ideal - center of bull's-eye.

Opportunity Screening

Midwest, NY, PR & AK

C&I or Specialty/

Owner-Occupied CRE

Continental US

Income Producing

CRE or Ag Credits

Rest of US Territories

& Canada or

Consumer Credits

Non-US or

Non-income Producing

Credits

Q2 2022

Investment Process

Origination Funnel

Counterparty Awareness

Opportunity Considered

Serious Intent

(Bid)

Prevailing Proposal

(Won)

Traded/Closed

(Consummated)

Profitable

Deal

OSP maintains regular contact with transactional

counterparties - likely sellers & advisors.

Prepared for the State of Connecticut

Situational awareness critical to managing "hit rate"

and minimizing lost deal expenses.

Count

1,013

2,920

390

191

175

[172]

13View entire presentation