WeWork Restructuring Presentation Deck

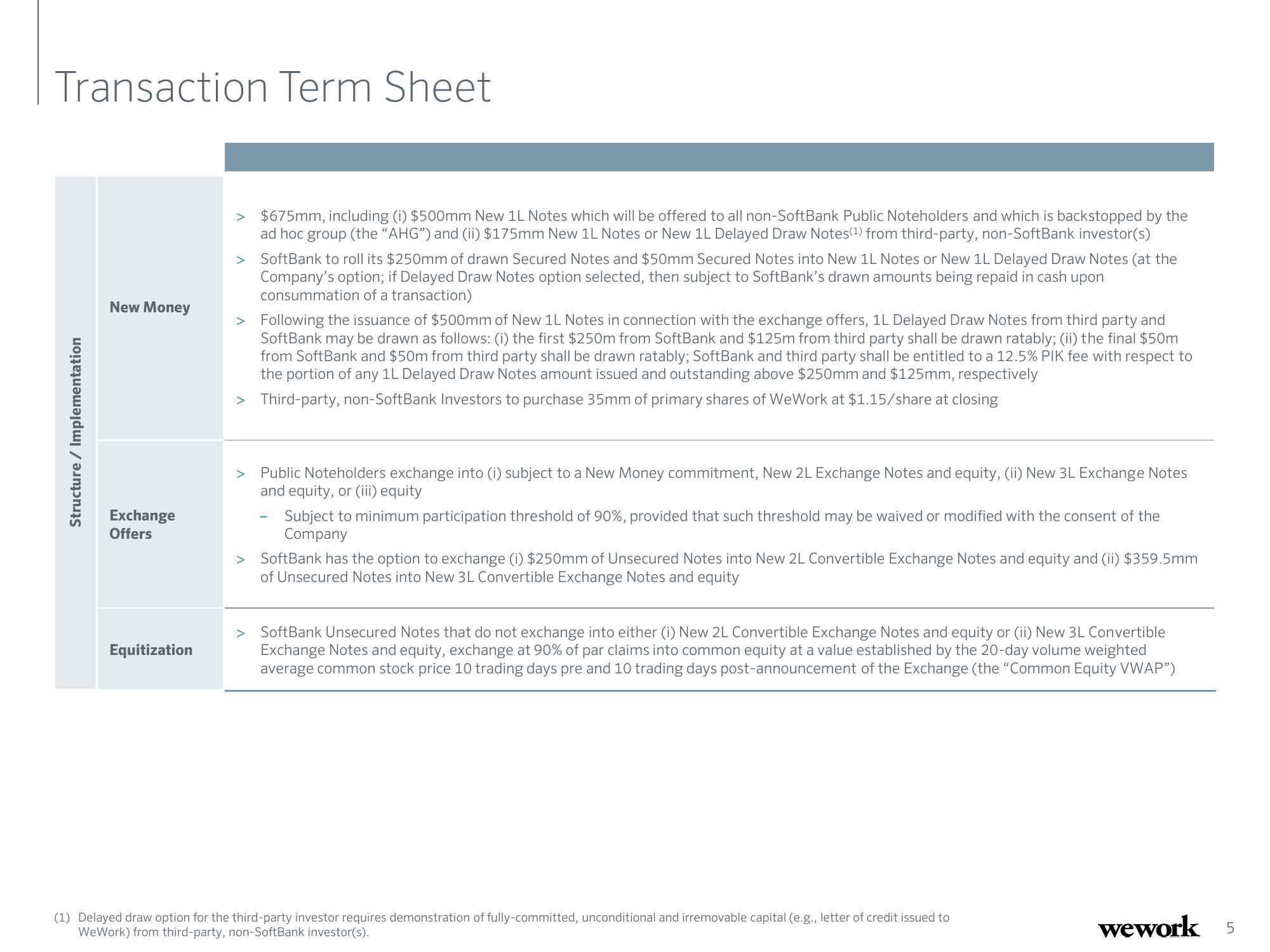

Transaction Term Sheet

Structure / Implementation

New Money

Exchange

Offers

Equitization

> $675mm, including (i) $500mm New 1L Notes which will be offered to all non-SoftBank Public Noteholders and which is backstopped by the

ad hoc group (the "AHG") and (ii) $175mm New 1L Notes or New 1L Delayed Draw Notes(¹) from third-party, non-SoftBank investor(s)

SoftBank to roll its $250mm of drawn Secured Notes and $50mm Secured Notes into New 1L Notes or New 1L Delayed Draw Notes (at the

Company's option; if Delayed Draw Notes option selected, then subject to SoftBank's drawn amounts being repaid in cash upon

consummation of a transaction)

> Following the issuance of $500mm of New 1L Notes in connection with the exchange offers, 1L Delayed Draw Notes from third party and

SoftBank may be drawn as follows: (i) the first $250m from SoftBank and $125m from third party shall be drawn ratably; (ii) the final $50m

from SoftBank and $50m from third party shall be drawn ratably; SoftBank and third party shall be entitled to a 12.5% PIK fee with respect to

the portion of any 1L Delayed Draw Notes amount issued and outstanding above $250mm and $125mm, respectively

> Third-party, non-SoftBank Investors to purchase 35mm of primary shares of WeWork at $1.15/share at closing

Public Noteholders exchange into (i) subject to a New Money commitment, New 2L Exchange Notes and equity, (ii) New 3L Exchange Notes

and equity, or (iii) equity

Subject to minimum participation threshold of 90%, provided that such threshold may be waived or modified with the consent of the

Company

SoftBank has the option to exchange (i) $250mm of Unsecured Notes into New 2L Convertible Exchange Notes and equity and (ii) $359.5mm

of Unsecured Notes into New 3L Convertible Exchange Notes and equity

SoftBank Unsecured Notes that do not exchange into either (i) New 2L Convertible Exchange Notes and equity or (ii) New 3L Convertible

Exchange Notes and equity, exchange at 90% of par claims into common equity at a value established by the 20-day volume weighted

average common stock price 10 trading days pre and 10 trading days post-announcement of the Exchange (the "Common Equity VWAP")

(1) Delayed draw option for the third-party investor requires demonstration of fully-committed, unconditional and irremovable capital (e.g., letter of credit issued to

WeWork) from third-party, non-SoftBank investor(s).

wework 5View entire presentation