Tudor, Pickering, Holt & Co Investment Banking

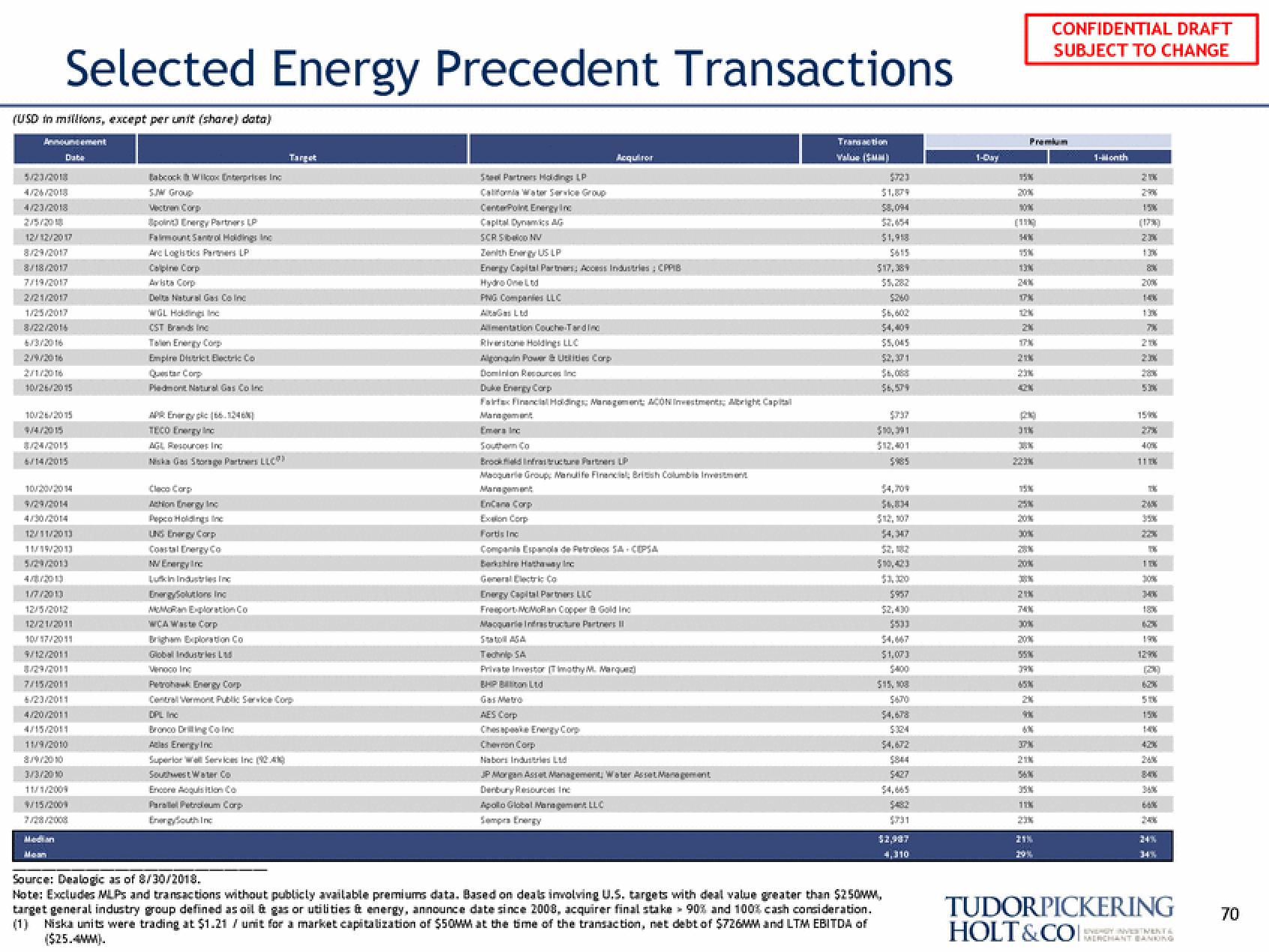

Selected Energy Precedent Transactions

(USD in millions, except per unit (share) data)

Announcement

Data

5/23/2018

4/26/2018

4/23/2018

2/5/2018

12/12/2017

8/29/2017

8/18/2017

7/19/2017

1/25/2017

6/3/2016

2/9/2016

2/1/2016

10/26/2015

9/4/2015

6/14/2015

10/20/2014

9/29/2014

4/30/2014

12/11/2013

11/19/2013

5/2-1/2013

4/8/2013

1/7/2013

12/5/2012

12/21/2011

10/17/2011

9/12/2011

7/15/2011

4/20/2011

11/9/2010

3/3/2010

9/15/2009

7/28/2008

Median

Babcock Wilcox Enterprises Inc

5W Group

point Energy Partners LP

Are Logistics Partners LP

Calpine Corp

Avista Corp

De Natural Gas Conc

WGL Holdings inc

CST Brands Inc

Tan Energy Corp

Empire District Electric Co

Piedmont Natural Gas Conc

APR Energy (6.12468)

TECO Energy Inc

AGL Resources Inc

Niska Gas Storage Partners LLC)

Claco Corp

Action Energy Inc

Pepco Holdings Inc

UNS Energy Corp

Coastal Energy Co

NV Energy Inc

Luin Industries Inc

EnergySolutions Inc

McMan Exploration Co

WCA Waste Corp

Brigham Exploration Co

Global Industries Ltd

Target

Perak Energy Corp

Central Vermont Public Service Corp

DPL Inc

Bronco Driting Conc

Atlas Energy Inc

Superior wall Services Inc (240)

Southwest Water Co

Encone Acquisition Co

Parallel Petroleum Corp

Steel Partners Holdings LP

CenterPoint Energy In

Capital Dynamics AG

SCR SNV

Zenith Energy US LP

Energy Capital Partners: Access Industries; CPPB

Hydro One Ltd

PMG Companies LLC

AG Ltd

Alimentation Couche-Tardin

Riverstone Holdings LLC

Algonquin Power & Utilities Corp

Dominion Resources Inc

Duke Energy Corp

Fairtex Financial Holdings: Management ACONInstments Abright Capital

Management

Emers Inc

Acquiror

Brookfield Infrastructure Partners LP

Macquarie Group: Manulife Financial, British Columbia Investment

Management

EnCane Corp

Exion Corp

Fortis Inc

Compania Espanola de Petroles SACEPSA

Berkshire Hathaway Inc

General Electric Co

Energy Capital Partners LLC

Freeport-McMoran Copper & Gold Inc

Macquarie Infrastructure Partners I

Tech SA

Private Investor (Timothy M. Marque

BHP Billiton Ltd

Gas Metro

AES Corp

Chesapeake Energy Corp

Chevron Corp

Nabor Industries Ltd

Denbury Resources Inc

Apollo Global Management LLC

Sempra Energy

Transaction

Value (MM)

$323

$17,389

$260

$6,602

$2,371

$10,391

53,182

$10,423

$1,073

$15,00

34,678

Source: Dealogic as of 8/30/2018.

Note: Excludes MLPs and transactions without publicly available premiums data. Based on deals involving U.S. targets with deal value greater than $250MM,

target general industry group defined as oil & gas or utilities & energy, announce date since 2008, acquirer final stake 90% and 100% cash consideration.

(1) Niska units were trading at $1.21 / unit for a market capitalization of $50MM at the time of the transaction, net debt of $726MM and LTM EBITDA of

($25.4MM).

5427

$731

4,310

1-Day

95%

TON

54%

TON

24%

17M

20

17%

21

23%

42%

20

31%

338%

15%

25%

20%

30%

20%

21%

30%

55%

DAN

204

*

ME

37N

21

SAN

11%

23%

21%

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

1-Month

(1790)

20%

80

140

73

15/8%

278

40%

11

TERG

24%

35%

220

116

30%

340

626

1290

5TK

15%

42%

B4%

64%

24%

34%

TUDORPICKERING

HOLT&CO:

EVEAGY INVESTMENTS

MERCHANT BANKING

70View entire presentation