HSBC Investor Day Presentation Deck

2021 performance

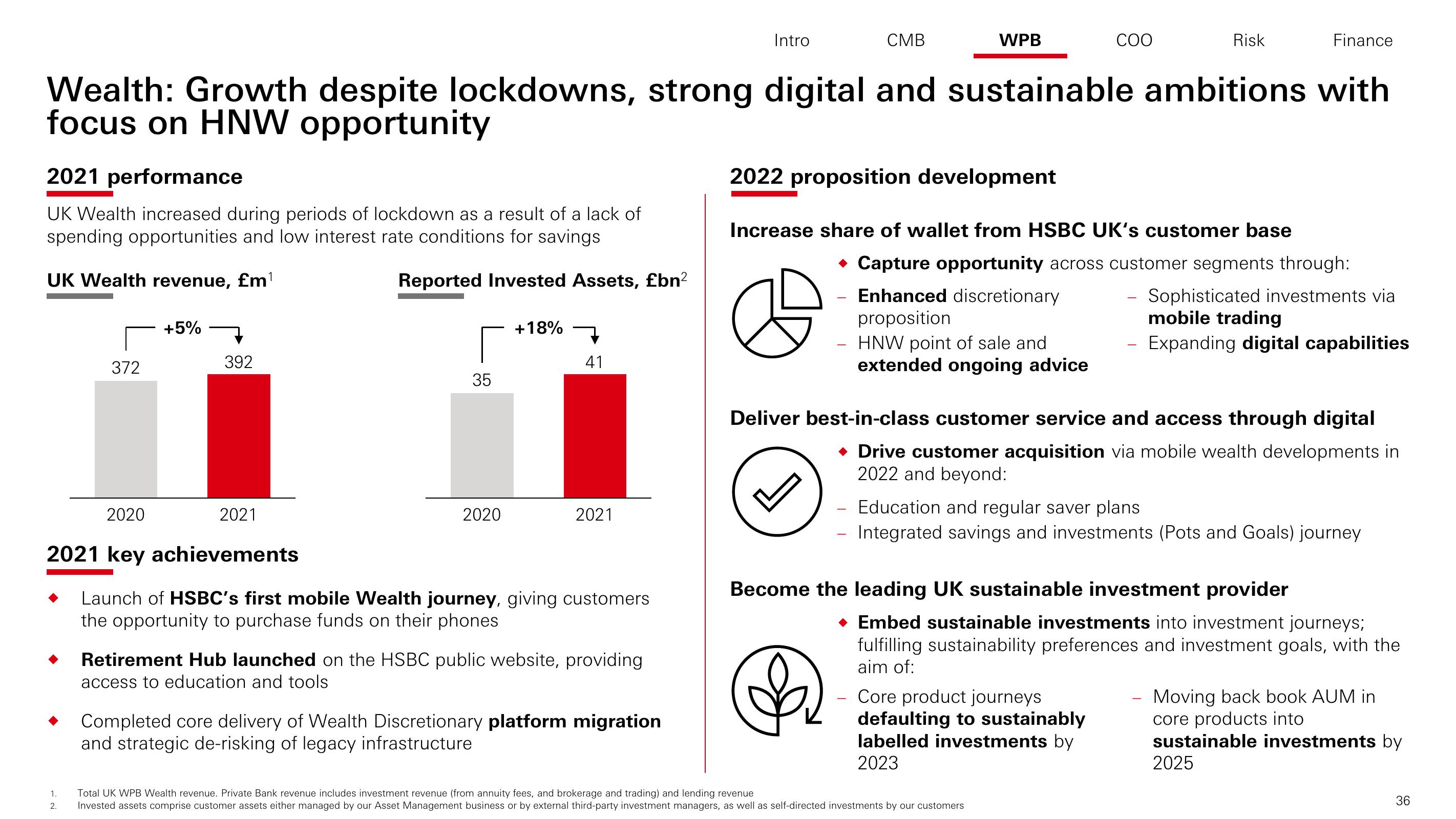

UK Wealth increased during periods of lockdown as a result of a lack of

spending opportunities and low interest rate conditions for savings

UK Wealth revenue, £m¹

Reported Invested Assets, £bn²

372

1.

2.

2020

+5%

Wealth: Growth despite lockdowns, strong digital and sustainable ambitions with

focus on HNW opportunity

392

2021

2021 key achievements

୮

35

2020

+18%

41

2021

Launch of HSBC's first mobile Wealth journey, giving customers

the opportunity to purchase funds on their phones

Retirement Hub launched on the HSBC public website, providing

access to education and tools

Intro

Completed core delivery of Wealth Discretionary platform migration

and strategic de-risking of legacy infrastructure

CMB

2022 proposition development

B

WPB

Increase share of wallet from HSBC UK's customer base

p.

Enhanced discretionary

proposition

COO

HNW point of sale and

extended ongoing advice

Risk

◆ Capture opportunity across customer segments through:

Sophisticated investments via

mobile trading

- Expanding digital capabilities

Deliver best-in-class customer service and access through digital

◆ Drive customer acquisition via mobile wealth developments in

2022 and beyond:

Finance

Become the leading UK sustainable investment provider

Education and regular saver plans

Integrated savings and investments (Pots and Goals) journey

defaulting to sustainably

labelled investments by

2023

Total UK WPB Wealth revenue. Private Bank revenue includes investment revenue (from annuity fees, and brokerage and trading) and lending revenue

Invested assets comprise customer assets either managed by our Asset Management business or by external third-party investment managers, as well as self-directed investments by our customers

◆ Embed sustainable investments into investment journeys;

fulfilling sustainability preferences and investment goals, with the

aim of:

Core product journeys

Moving back book AUM in

core products into

sustainable investments by

2025

36View entire presentation