3Q24 Investor Update

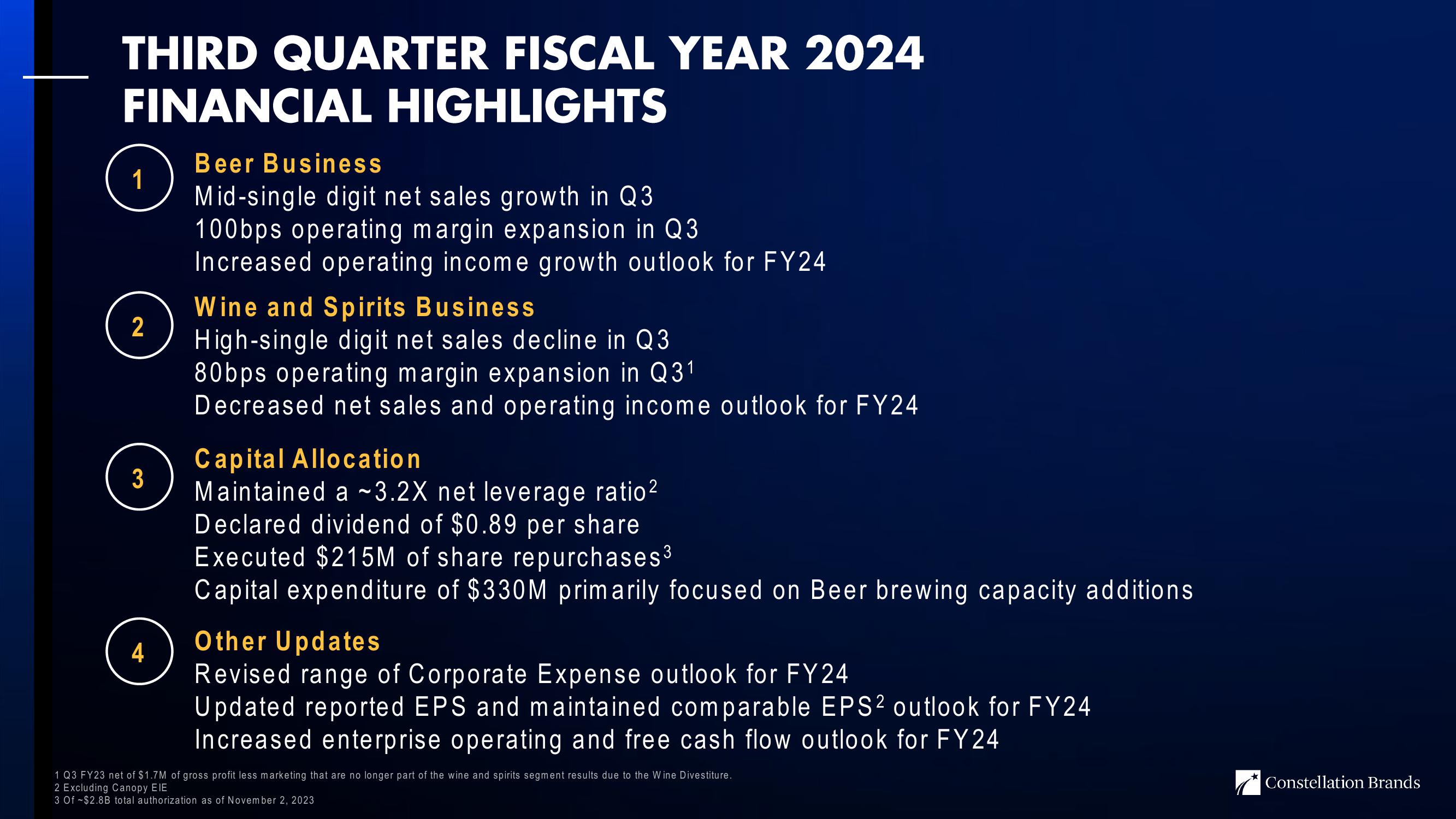

THIRD QUARTER FISCAL YEAR 2024

FINANCIAL HIGHLIGHTS

Beer Business

Mid-single digit net sales growth in Q3

100bps operating margin expansion in Q3

Increased operating income growth outlook for FY24

1

2

3

4

Wine and Spirits Business

High-single digit net sales decline in Q3

80bps operating margin expansion in Q31

Decreased net sales and operating income outlook for FY24

Capital Allocation

Maintained a ~3.2X net leverage ratio²

Declared dividend of $0.89 per share

Executed $215M of share repurchases ³

Capital expenditure of $330M primarily focused on Beer brewing capacity additions

Other Updates

Revised range of Corporate Expense outlook for FY24

Updated reported EPS and maintained comparable EPS² outlook for FY24

Increased enterprise operating and free cash flow outlook for FY24

1 Q3 FY23 net of $1.7M of gross profit less marketing that are no longer part of the wine and spirits segment results due to the Wine Divestiture.

2 Excluding Canopy EIE

3 Of $2.8B total authorization as of November 2, 2023

Constellation BrandsView entire presentation