Bed Bath & Beyond Results Presentation Deck

Q3 PERFORMANCE HIGHLIGHTS & TRANSFORMATION UPDATE

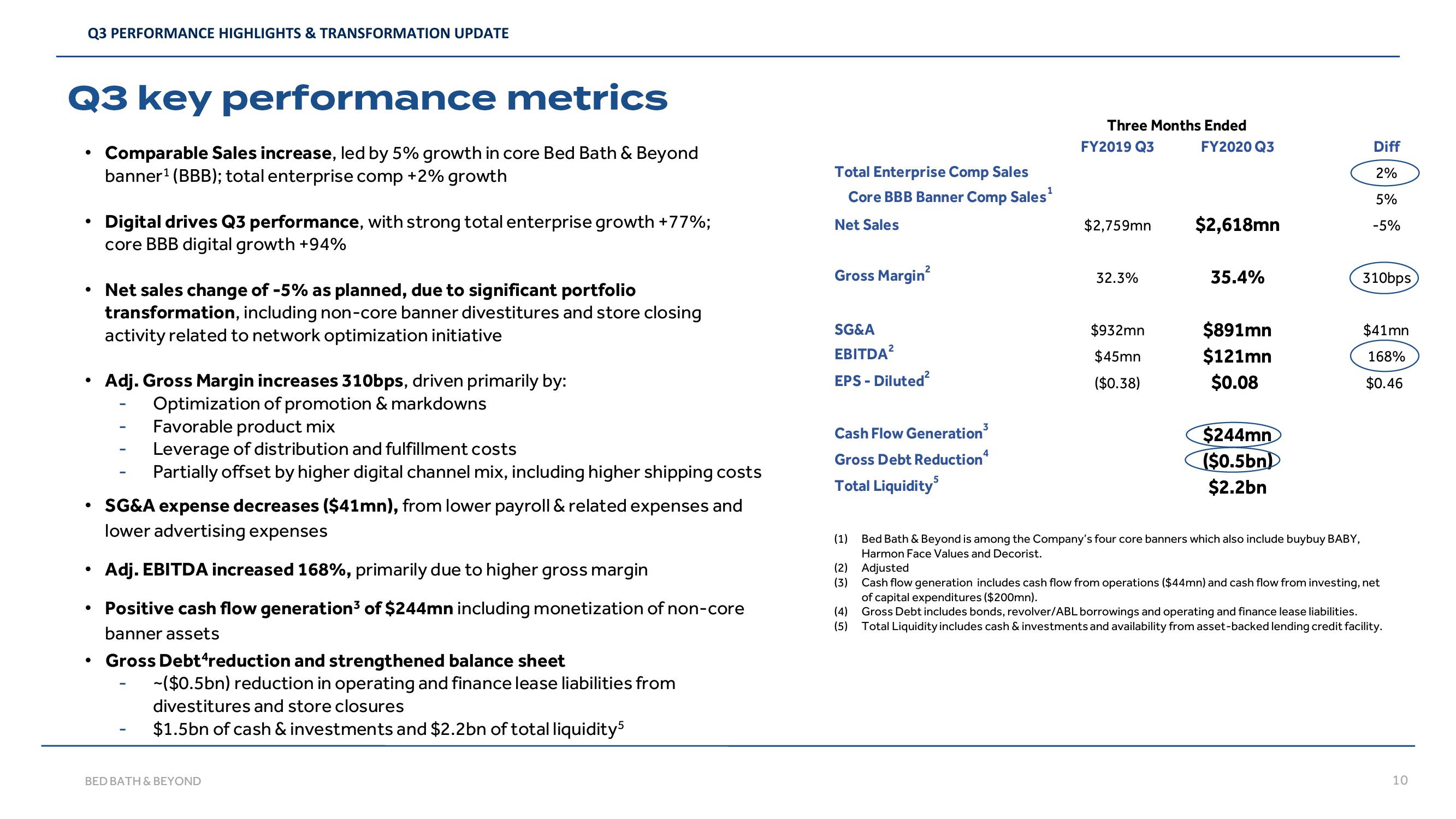

Q3 key performance metrics

Comparable Sales increase, led by 5% growth in core Bed Bath & Beyond

banner¹ (BBB); total enterprise comp +2% growth

●

●

• Net sales change of -5% as planned, due to significant portfolio

transformation, including non-core banner divestitures and store closing

activity related to network optimization initiative

●

●

●

Digital drives Q3 performance, with strong total enterprise growth +77%;

core BBB digital growth +94%

●

Adj. Gross Margin increases 310bps, driven primarily by:

Optimization of promotion & markdowns

Favorable product mix

Leverage of distribution and fulfillment costs

Partially offset by higher digital channel mix, including higher shipping costs

SG&A expense decreases ($41mn), from lower payroll & related expenses and

lower advertising expenses

Adj. EBITDA increased 168%, primarily due to higher gross margin

Positive cash flow generation³ of $244mn including monetization of non-core

banner assets

Gross Debt reduction and strengthened balance sheet

-($0.5bn) reduction in operating and finance lease liabilities from

divestitures and store closures

$1.5bn of cash & investments and $2.2bn of total liquidity5

BED BATH & BEYOND

Total Enterprise Comp Sales

Core BBB Banner Comp Sales¹

Net Sales

Gross Margin²

SG&A

EBITDA²

EPS - Diluted²

Cash Flow Generation³

Gross Debt Reduction

Total Liquidity5

(1)

(2)

(3)

(4)

(5)

Three Months Ended

FY2019 Q3

FY2020 Q3

$2,759mn

32.3%

$932mn

$45mn

($0.38)

$2,618mn

35.4%

$891mn

$121mn

$0.08

$244mn

($0.5bn)

$2.2bn

Bed Bath & Beyond is among the Company's four core banners which also include buybuy BABY,

Harmon Face Values and Decorist.

Adjusted

Diff

2%

5%

-5%

310bps

$41mn

168%

$0.46

Cash flow generation includes cash flow from operations ($44mn) and cash flow from investing, net

of capital expenditures ($200mn).

Gross Debt includes bonds, revolver/ABL borrowings and operating and finance lease liabilities.

Total Liquidity includes cash & investments and availability from asset-backed lending credit facility.

10View entire presentation