Boxed SPAC Presentation Deck

Transaction Overview

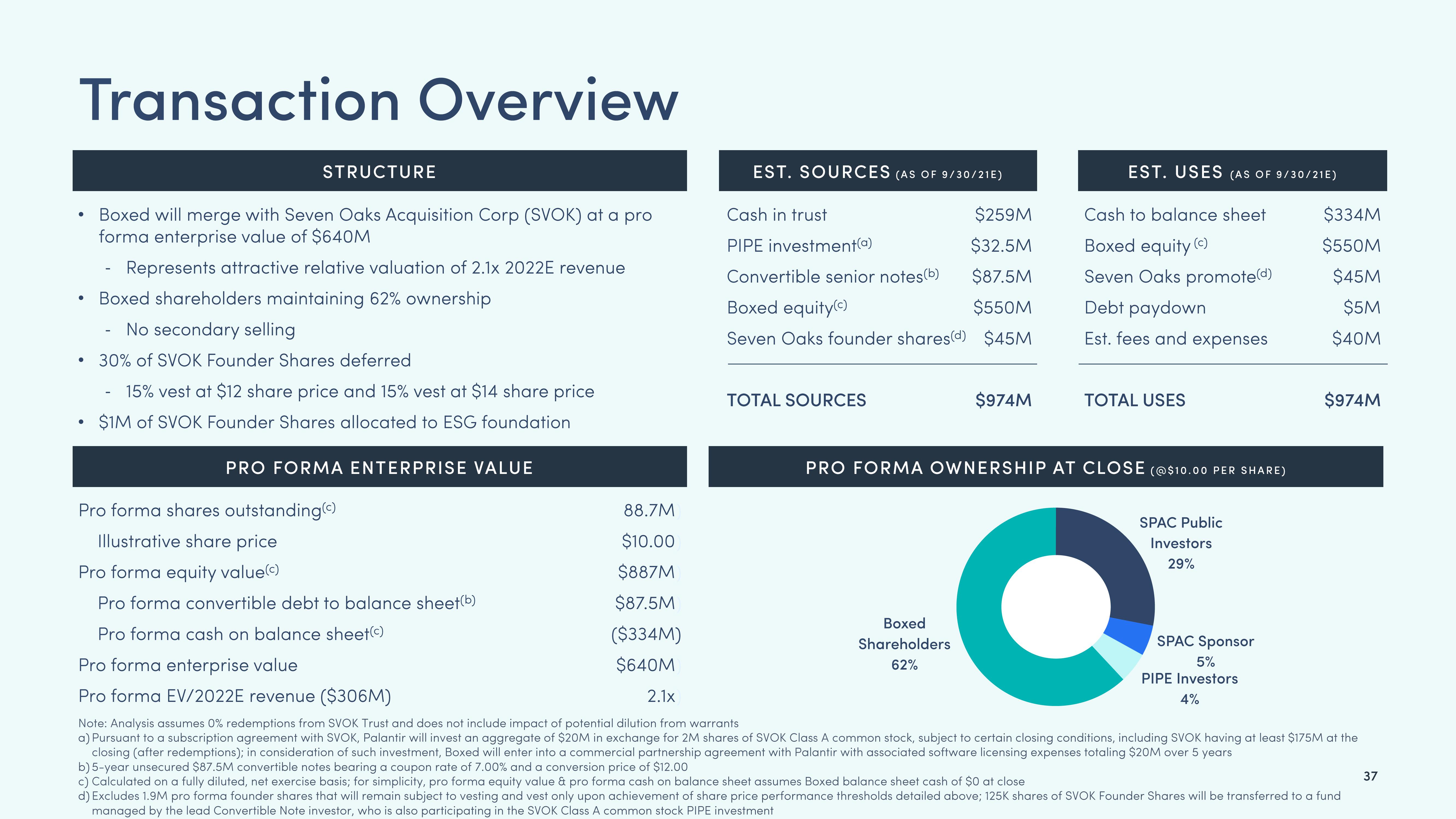

STRUCTURE

Boxed will merge with Seven Oaks Acquisition Corp (SVOK) at a pro

forma enterprise value of $640M

Represents attractive relative valuation of 2.1x 2022E revenue

Boxed shareholders maintaining 62% ownership

No secondary selling

30% of SVOK Founder Shares deferred

15% vest at $12 share price and 15% vest at $14 share price

$1M of SVOK Founder Shares allocated to ESG foundation

PRO FORMA ENTERPRISE VALUE

Pro forma shares outstanding (c)

Illustrative share price

Pro forma equity value(c)

Pro forma convertible debt to balance sheet(b)

Pro forma cash on balance sheet(c)

Pro forma enterprise value

Pro forma EV/2022E revenue ($306M)

88.7M

$10.00

$887M

$87.5M

($334M)

$640M

2.1x

EST. SOURCES (AS OF 9/30/21E)

$259M

$32.5M

$87.5M

Convertible senior notes (b)

Boxed equity(c)

$550M

Seven Oaks founder shares(d) $45M

Cash in trust

PIPE investment(a)

TOTAL SOURCES

$974M

EST. USES (AS OF 9/30/21E)

Boxed

Shareholders

62%

Cash to balance sheet

Boxed equity (c)

Seven Oaks promote(d)

Debt paydown

Est. fees and expenses

TOTAL USES

PRO FORMA OWNERSHIP AT CLOSE (@$10.00 PER SHARE)

Q

SPAC Public

Investors

29%

SPAC Sponsor

5%

PIPE Investors

4%

$334M

$550M

$45M

$5M

$40M

$974M

Note: Analysis assumes 0% redemptions from SVOK Trust and does not include impact of potential dilution from warrants

a) Pursuant to a subscription agreement with SVOK, Palantir will invest an aggregate of $20M in exchange for 2M shares of SVOK Class A common stock, subject to certain closing conditions, including SVOK having at least $175M at the

closing (after redemptions); in consideration of such investment, Boxed will enter into a commercial partnership agreement with Palantir with associated software licensing expenses totaling $20M over 5 years

b) 5-year unsecured $87.5M convertible notes bearing a coupon rate of 7.00% and a conversion price of $12.00

c) Calculated on a fully diluted, net exercise basis; for simplicity, pro forma equity value & pro forma cash on balance sheet assumes Boxed balance sheet cash of $0 at close

d) Excludes 1.9M pro forma founder shares that will remain subject to vesting and vest only upon achievement of share price performance thresholds detailed above; 125K shares of SVOK Founder Shares will be transferred to a fund

managed by the lead Convertible Note investor, who is also participating in the SVOK Class A common stock PIPE investment

37View entire presentation