Membership Collective Group Results Presentation Deck

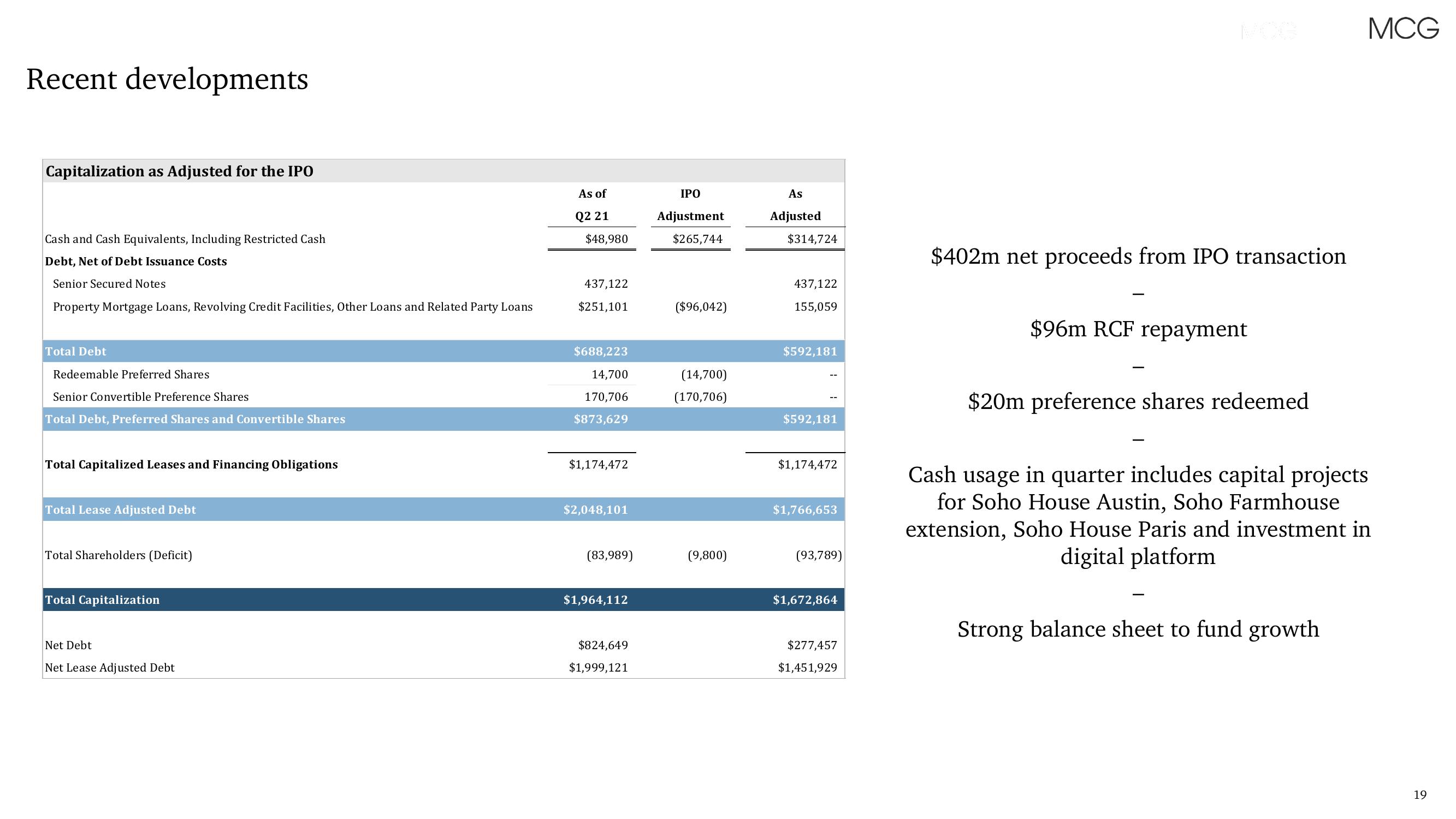

Recent developments

Capitalization as Adjusted for the IPO

Cash and Cash Equivalents, Including Restricted Cash

Debt, Net of Debt Issuance Costs

Senior Secured Notes

Property Mortgage Loans, Revolving Credit Facilities, Other Loans and Related Party Loans

Total Debt

Redeemable Preferred Shares

Senior Convertible Preference Shares

Total Debt, Preferred Shares and Convertible Shares

Total Capitalized Leases and Financing Obligations

Total Lease Adjusted Debt

Total Shareholders (Deficit)

Total Capitalization

Net Debt

Net Lease Adjusted Debt

As of

Q2 21

$48,980

437,122

$251,101

$688,223

14,700

170,706

$873,629

$1,174,472

$2,048,101

(83,989)

$1,964,112

$824,649

$1,999,121

IPO

Adjustment

$265,744

($96,042)

(14,700)

(170,706)

(9,800)

As

Adjusted

$314,724

437,122

155,059

$592,181

$592,181

$1,174,472

$1,766,653

(93,789)

$1,672,864

$277,457

$1,451,929

$402m net proceeds from IPO transaction

$96m RCF repayment

$20m preference shares redeemed

MCG

Cash usage in quarter includes capital projects

for Soho House Austin, Soho Farmhouse

extension, Soho House Paris and investment in

digital platform

Strong balance sheet to fund growth

19View entire presentation