Kinnevik Results Presentation Deck

WE CONTINUED TO EXECUTE ON OUR 2023 PRIORITIES IN Q2,

ACCRETING OWNERSHIP IN SPRING HEALTH AND TRAVELPERK

Spring Health

Note:

TravelPerk

babylon

CHARM

Key Events of The Quarter

Q2 2023

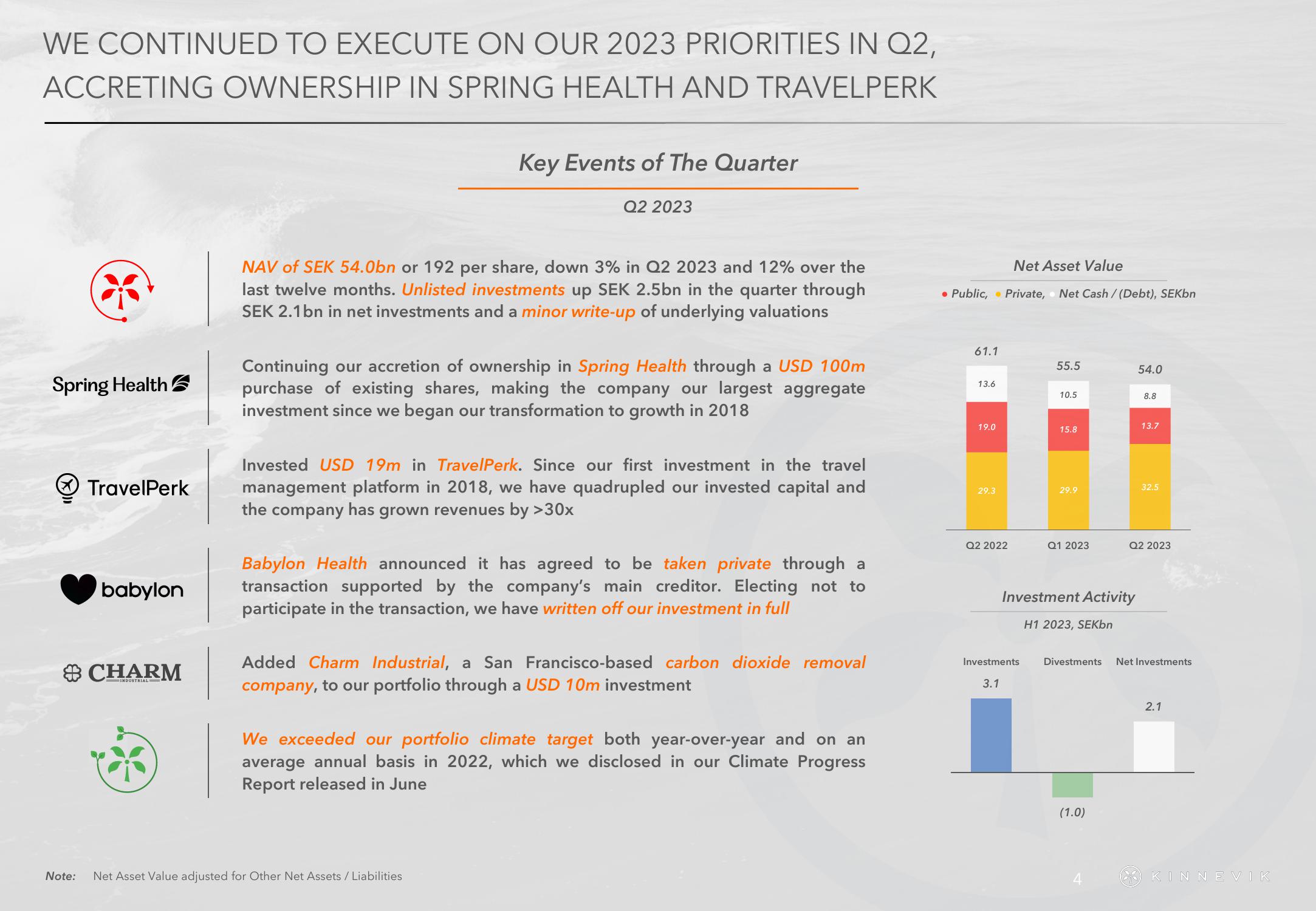

NAV of SEK 54.0bn or 192 per share, down 3% in Q2 2023 and 12% over the

last twelve months. Unlisted investments up SEK 2.5bn in the quarter through

SEK 2.1bn in net investments and a minor write-up of underlying valuations

Continuing our accretion of ownership in Spring Health through a USD 100m

purchase of existing shares, making the company our largest aggregate

investment since we began our transformation to growth in 2018

Invested USD 19m in TravelPerk. Since our first investment in the travel

management platform in 2018, we have quadrupled our invested capital and

the company has grown revenues by >30x

Babylon Health announced it has agreed to be taken private through a

transaction supported by the company's main creditor. Electing not to

participate in the transaction, we have written off our investment in full

Added Charm Industrial, a San Francisco-based carbon dioxide removal

company, to our portfolio through a USD 10m investment

Net Asset Value adjusted for Other Net Assets / Liabilities

We exceeded our portfolio climate target both year-over-year and on an

average annual basis in 2022, which we disclosed in our Climate Progress

Report released in June

Net Asset Value

• Public, Private, Net Cash/ (Debt), SEKbn

61.1

13.6

19.0

29.3

Q2 2022

55.5

Investments

3.1

10.5.

15.8

29.9

Q1 2023

Investment Activity

H1 2023, SEKbn

Divestments

(1.0)

54.0

8.8

13.7

32.5

Q2 2023

Net Investments

2.1

KINNEVIKView entire presentation