Inovalon Investor Conference Presentation Deck

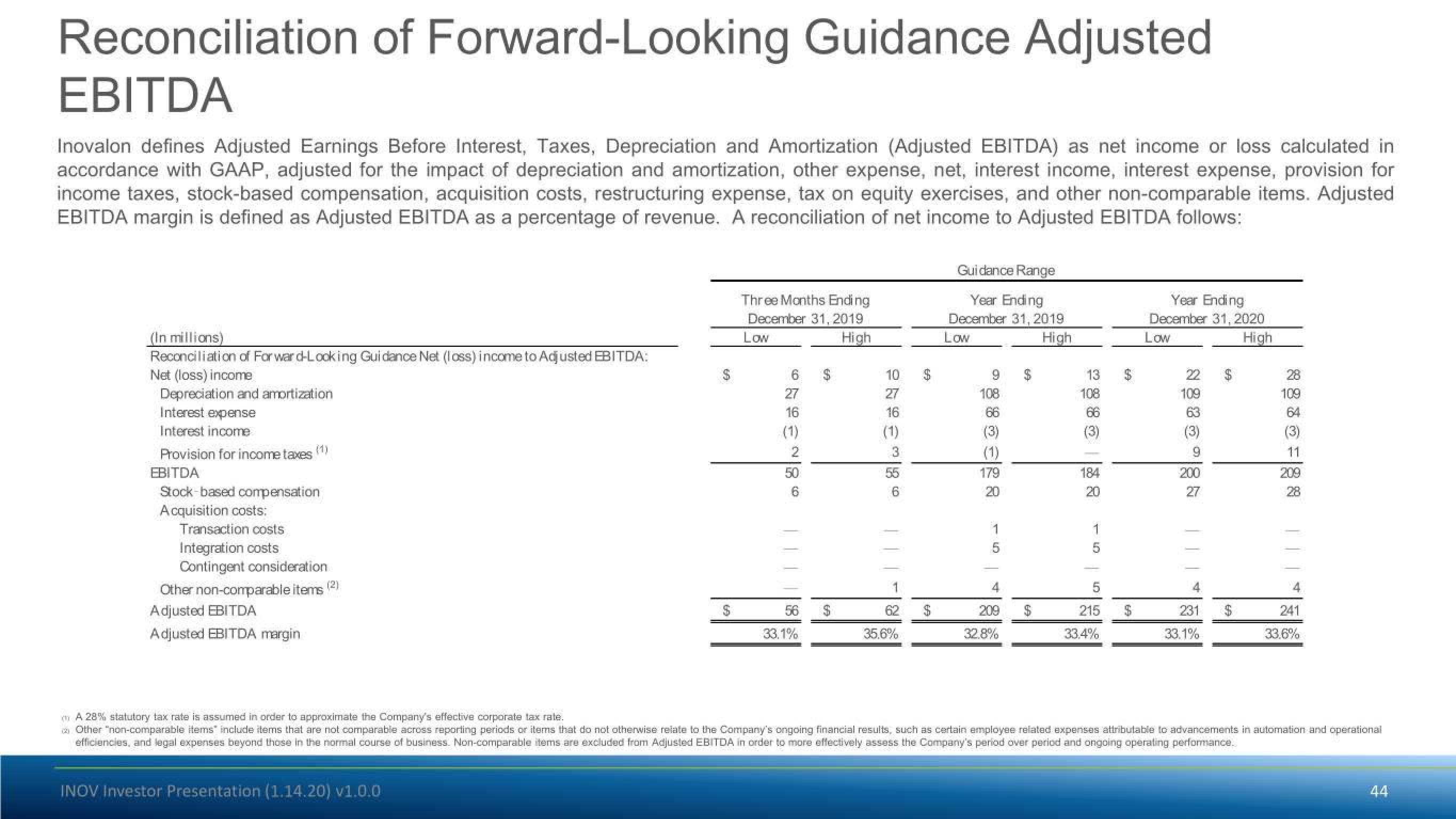

Reconciliation of Forward-Looking Guidance Adjusted

EBITDA

Inovalon defines Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA) as net income or loss calculated in

accordance with GAAP, adjusted for the impact of depreciation and amortization, other expense, net, interest income, interest expense, provision for

income taxes, stock-based compensation, acquisition costs, restructuring expense, tax on equity exercises, and other non-comparable items. Adjusted

EBITDA margin is defined as Adjusted EBITDA as a percentage of revenue. A reconciliation of net income to Adjusted EBITDA follows:

(In millions)

Reconciliation of Forward-Looking Guidance Net (loss) income to Adjusted EBITDA:

Net (loss) income

Depreciation and amortization

Interest expense

Interest income

Provision for income taxes (1)

EBITDA

Stock-based compensation

Acquisition costs:

Transaction costs

Integration costs

Contingent consideration

Other non-comparable items (2)

Adjusted EBITDA

Adjusted EBITDA margin

69

INOV Investor Presentation (1.14.20) v1.0.0

Three Months Ending

December 31, 2019

Low

High

6

27

16

(1)

2

50

6

56

33,1%

69

$

10

27

16

(1)

3

6

35,6%

69

Guidance Range

Year Ending

December 31, 2019

Low

High

9

108

66

(3)

179

20

5

4

209

32.8%

69

13

108

66

184

20

1

5

5

215

33.4%

+A

Year Ending

December 31, 2020

Low

High

22

109

63

(3)

200

27

231

33.1%

$

109

64

(3)

11

209

241

33.6%

A 28% statutory tax rate is assumed in order to approximate the Company's effective corporate tax rate.

Other "non-comparable items include items that are not comparable across reporting periods or items that do not otherwise relate to the Company's ongoing financial results, such as certain employee related expenses attributable to advancements in automation and operational

efficiencies, and legal expenses beyond those in the normal course of business. Non-comparable items are excluded from Adjusted EBITDA in order to more effectively assess the Company's period over period and ongoing operating performance.

44View entire presentation