Presentation to Vermont Pension Investment Committee

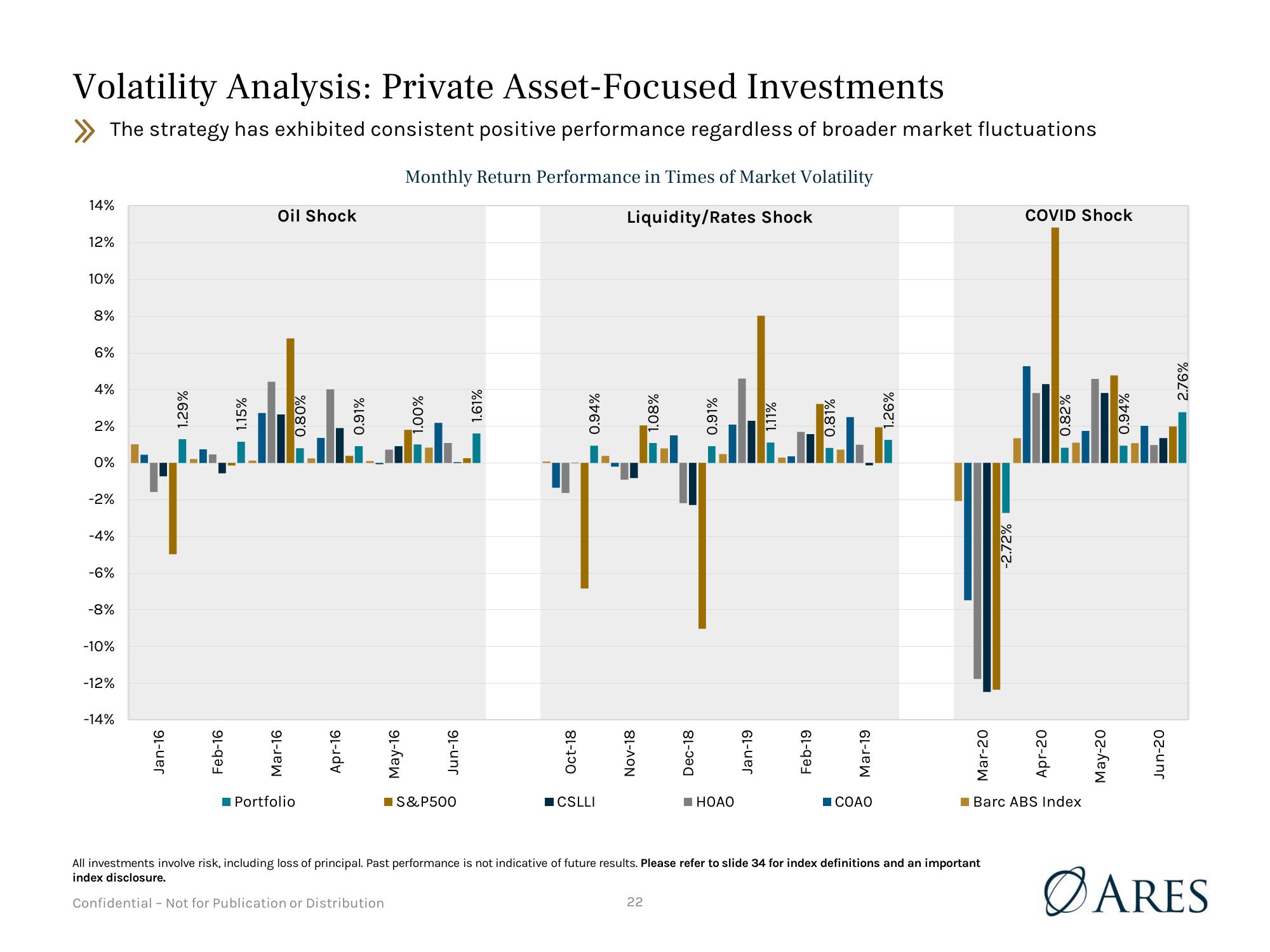

Volatility Analysis: Private Asset-Focused Investments

The strategy has exhibited consistent positive performance regardless of broader market fluctuations

14%

12%

10%

8%

6%

4%

2%

0%

-2%

-4%

-6%

-8%

-10%

-12%

-14%

Jan-16

1.29%

Lake and

Feb-16

Oil Shock

1.15%

Mar-16

Portfolio

0.80%

Apr-16

0.91%

Monthly Return Performance in Times of Market Volatility

Liquidity/Rates Shock

May-16

Confidential - Not for Publication or Distribution

1.00%

Jun-16

S&P500

1.61%

of paytadanes

Oct-18

0.94%

CSLLI

Nov-18

➡ 1.08%

22

Dec-18

➡0.91%

■HOAO

Jan-19

1.11%

Feb-19

☐ 0.81%

Mar-19

■COAO

1.26%

Mar-20

All investments involve risk, including loss of principal. Past performance is not indicative of future results. Please refer to slide 34 for index definitions and an important

index disclosure.

-2.72%

COVID Shock

JUL

Apr-20

0.82%

Barc ABS Index

May-20

0.94%

Jun-20

2.76%

ØARESView entire presentation